US Earnings Preview: JP Morgan, Citi and Wells Fargo

Before the US market opens later today, JP Morgan, Citigroup and Wells Fargo will report their Q2 results.

After last year’s post-election rally, these stocks and others in the financial sector have been trading in wide ranges.

However, over the last few weeks, bank stocks have rallied after the results of the FED’s “stress tests”, a push higher in short-term rates and hopes of further government de-regulation.

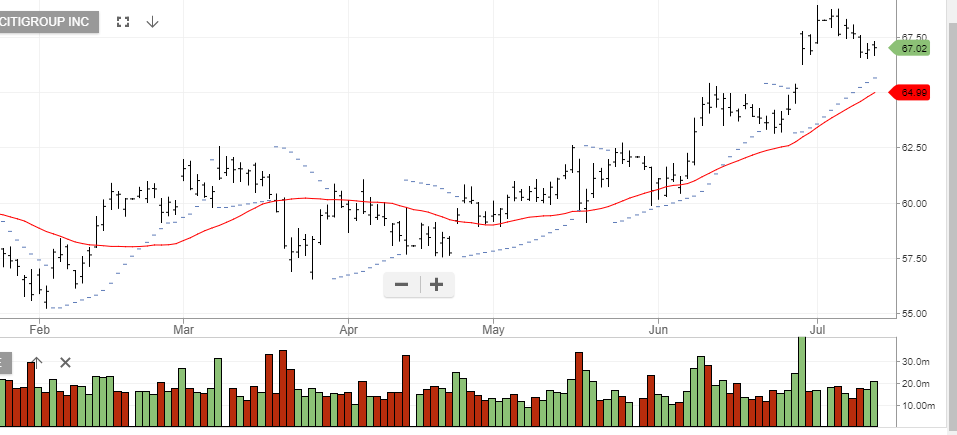

For Q2, JP Morgan is expected to report earnings of $1.57 per share, up 2 cents from last year on revenue of $24.8 billion. Wells Fargo is expected to report earnings of $1.02 per share, which is up 1 cent from last year on revenue of $22.3 billion. Citigroup is expected to report earnings of $1.21 per share, which is 3 cents below last year on lower revenue of $17.3 billion.

Our base case for the US banks is that trading revenues will be trending lower for the remainder of the year and the current levels look fully-valued with risk to the downside.

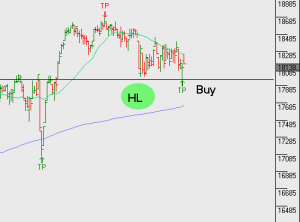

JP Morgan

Citigroup

Wells Fargo