Paypal

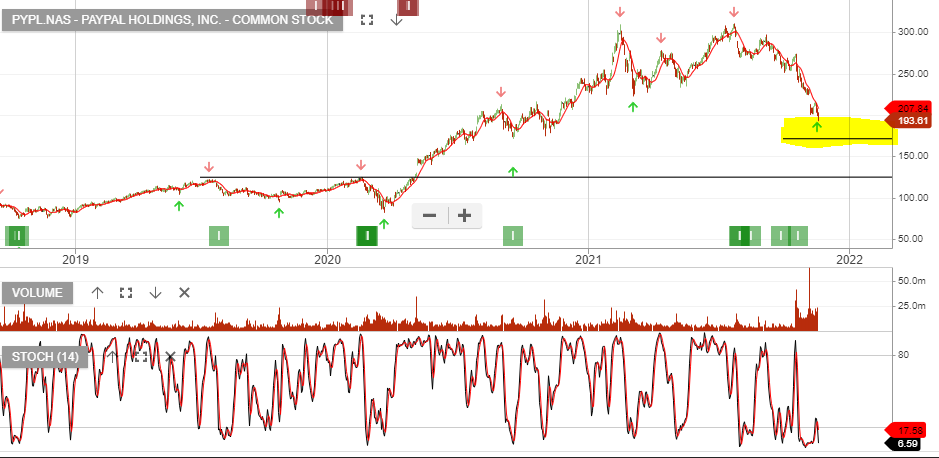

PayPal Holdings, Inc. – Common stop loss lifts to $68.55

PayPal Holdings, Inc. – Common stop loss lifts to $68.55

PayPal Holdings, Inc. – Common is a trade we intend to take once the price action exceeds the 10-day average.

PayPal Holdings, Inc. – Common is under Algo Engine buy conditions. PayPal generated $8.4B in revenue in Q4’24, operating income was $1.5B, +2% year-over-year.

PayPal reported strong Q4 earnings, showing growth in active accounts, free cash flow, and operating income margins, and the board approved a $15B stock buyback authorization.

PayPal is trading at 14x P/E.

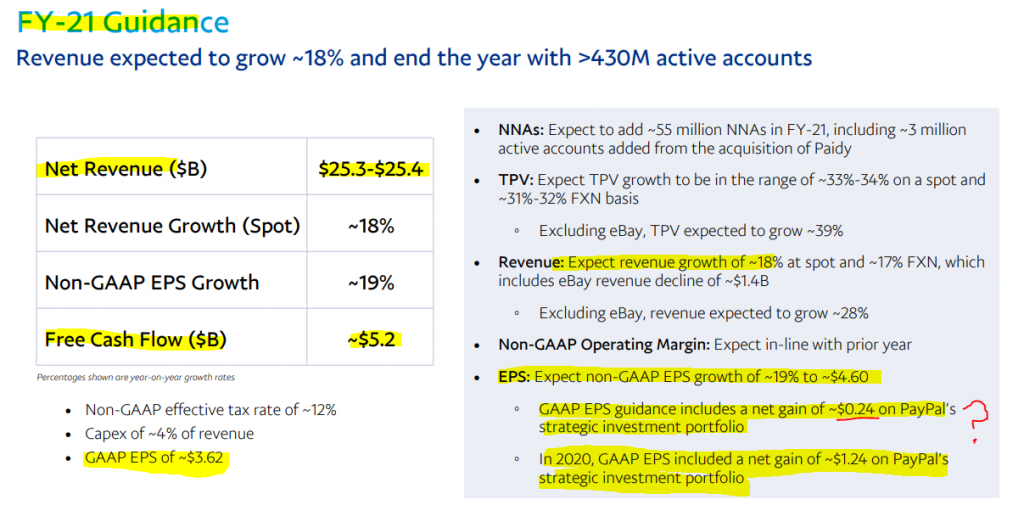

Guidance FY25: PayPal expects up to 10% year-over-year growth and an adjusted EPS range of $4.95-5.10 per-share.

PayPal Holdings, Inc. – Common first-quarter results show a 9% revenue increase and a 14% rise in Total Payment Volume, driven by enhanced features in Venmo and strategic market expansions.

The number of people using Venmo has gradually increased, from a low of 3 million in 2015 to a high of nearly 78 million as of the end of 2023.

FCF, which touched $1.763 billion in Q1 2024 alone. This resurgence can be attributed to, among other factors, robust management strategies, such as buying back shares aggressively in response to the stock’s depressed valuation, which suffered from a significant pullback of 80% in the last few years.

In 2023 alone, PayPal redirected $4.4 billion to buybacks,

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

PayPal Holdings, Inc. – Common is a current holding in our US model portfolio. The stock is up 10% since being added last year and the current sell-off provides another entry opportunity.

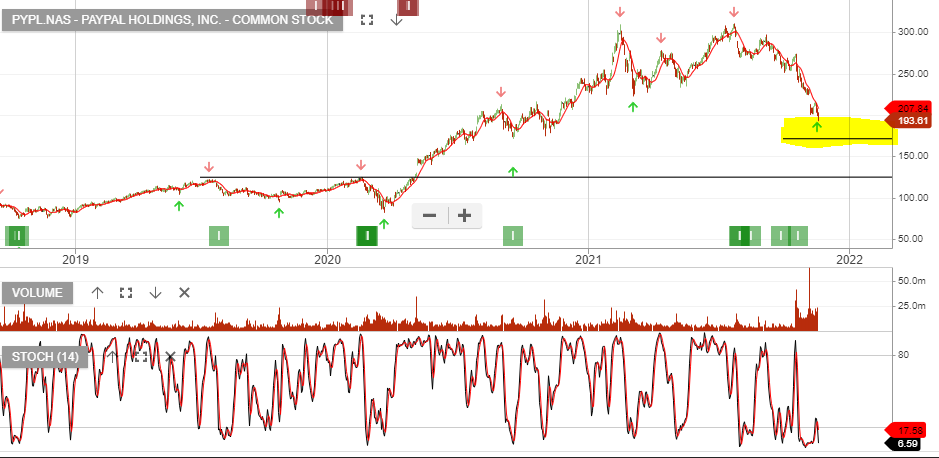

20/11 update: Paypal remains below the 10-day average and we encourage traders interested in US stocks to track the price action, as a powerful price reversal is likely.

26/11 update:

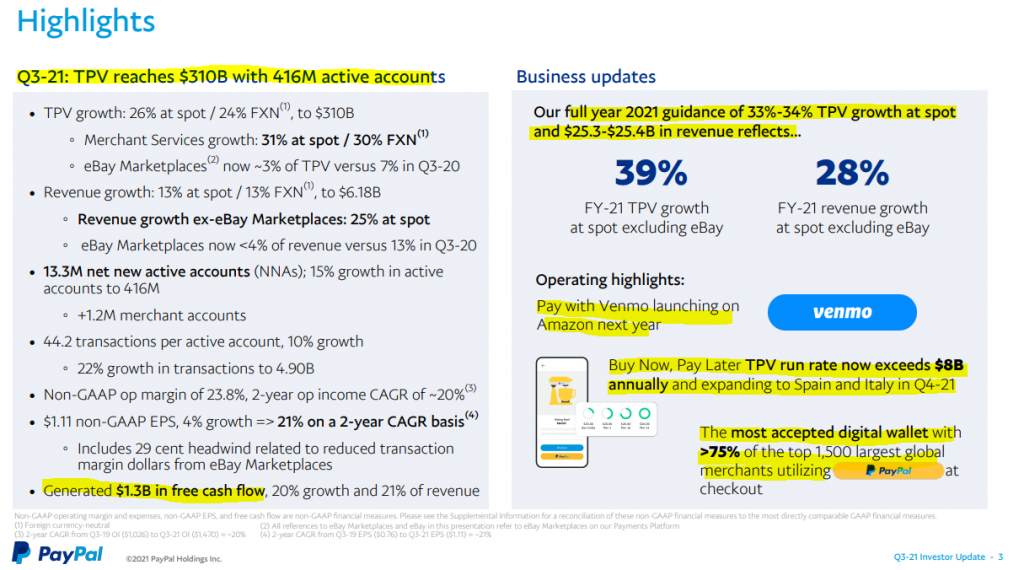

PayPal is an opportunity to accumulate within the $150 – $180 price range. The selloff reflects a correction in the PE ratio from 80x to 40x and the investment is a bet on continued growth and a responsive reaction from the company to increased competitive threats.

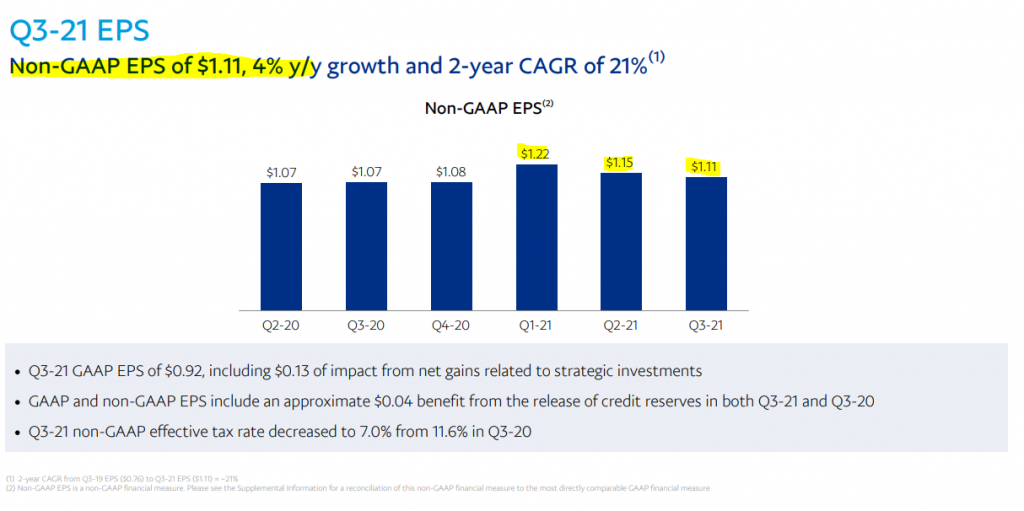

This explains the selloff: 4% EPS growth and the FY21 quarterly trend of lower EPS is a concern. However, we’re positioning on the basis the market is getting overly negative on the stock.

Wait for the price to cross back up through the 10-day average.

PayPal Holdings, Inc. – Common is a current holding in our US model portfolio. The stock is up 10% since being added last year and the current sell-off provides another entry opportunity.

20/11 update: Paypal remains below the 10-day average and we encourage traders interested in US stocks to track the price action, as a powerful price reversal is likely.

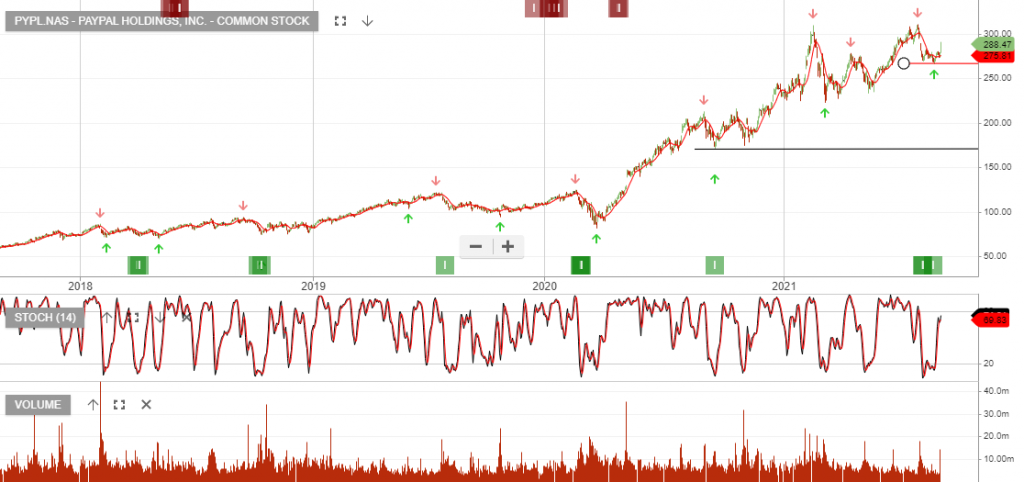

PayPal Holdings, Inc. – Common is under Algo Engine buy conditions and has been in our US S&P100 model portfolio since Sep 2020. The stock is up 63.80% after 347 days.

The low earlier this month at $266 triggered another buy signal which makes it the second cluster of buy signals since the original switch to buy in 2020.

PayPal Holdings is under Algo Engine buy conditions and is a current holding in our US S&P100 model portfolio.

We see price support developing near the $103 level.

Or start a free thirty day trial for our full service, which includes our ASX Research.