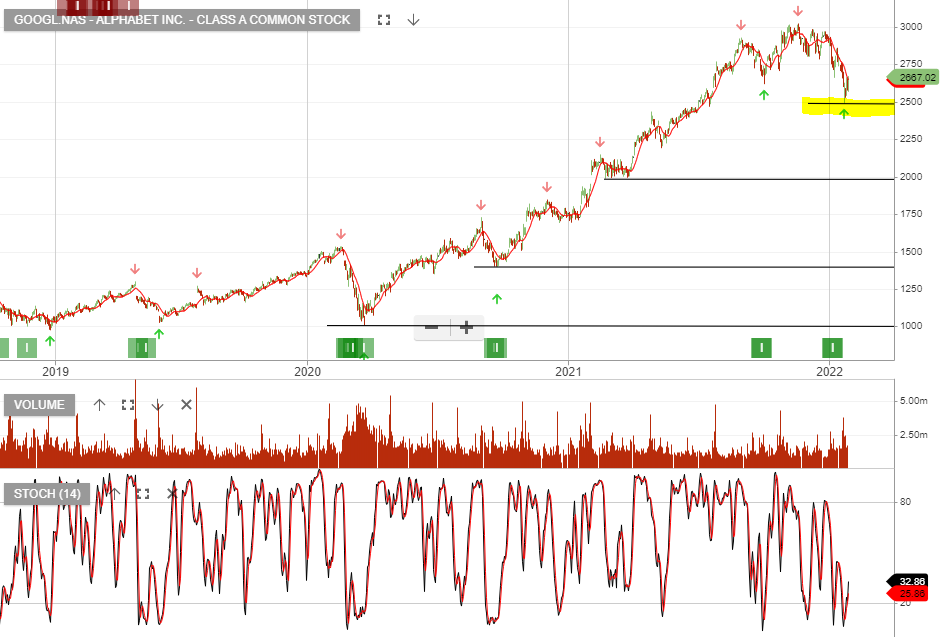

Alphabet

Alphabet Inc. – Class C Capital is under Algo Engine buy conditions.

Alphabet Inc. – Class C Capital is under Algo Engine buy conditions.

Alphabet Inc. – Class C Capital second-quarter revenue grew 14% to $84.74 billion, driven by a rise in digital advertising sales and healthy demand for its cloud computing services.

In Q4 2023, the group achieved a market-weighted average of 60% YoY operating profit expansion, while Apple contributed an underperforming 11%.

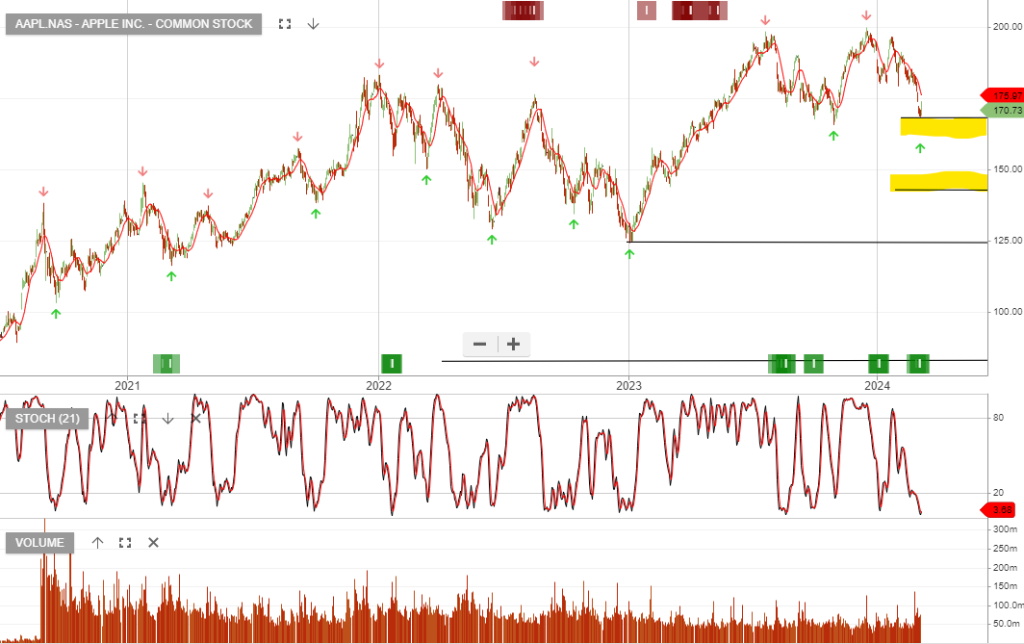

Apple and Google are under recent algo engine buy signals, and we’re now building exposure within the identified value ranges.

Oracle Corporation Common is under Algo Engine buy conditions and we expect buying support to build above the $80 support level.

.

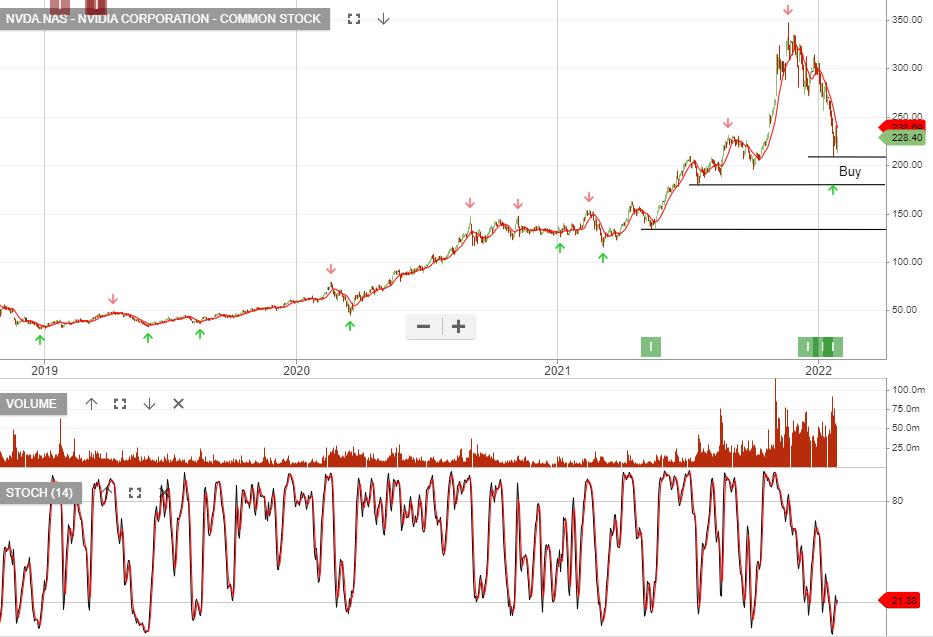

NVIDIA Corporation – Common is under Algo Engine buy conditions. The stock is up 67% since being added in May 2021 and is among the top performers in the US S&P100 model portfolio.

Apply a stop loss on a break below the $208 support.

.

Alphabet Inc. – Class C Capital is under Algo Engine buy conditions. The stock is up 129% since being added in May 2019 and is among the top performers in the US S&P100 model portfolio.

Apply a stop loss on a break below the $2492 support.

.

Alphabet is a current holding in our US S&P100 model portfolio.

Shares of Alphabet rose after its second-quarter earnings announcement with earnings and revenue beating market expectations.

The strong earnings came from higher ad sales and growth at its cloud unit. Google reported advertising revenue of $32.6 Bn for the second quarter, compared to $28.09 Bn during the second quarter last year.

Revenue came in at $38.94 Bn up 19% from last year and earnings per share were $14.21, up 21%.

Alphabet said its board of directors approved a re-purchase of up to an additional $25 Bn of its Class C capital stock.

Alphabet is on our high conviction buy list, underpinned by strong revenue growth and the large scale share buyback.

Or start a free thirty day trial for our full service, which includes our ASX Research.