US Banks Expand Share Buy-Back Plans

A week after the FED announced that 33 of 34 major US banks had passed their financial stress-tests, the banks have released their revised share buyback and dividend plans.

Analysts had estimated that positive stress-test results would open the way for banks to boost dividends and share buybacks by up to 25%, which could translate to about $30 billion back to shareholders through higher dividends and share prices.

Some of the specific plans include Citi-Group buying back up to $15 billion in shares and increasing their dividend to 32 cents per share, and JP Morgan buying back up to $19 billion in shares and lifting their dividend from 50 cents to 56 cents.

While these announcements were bullish for the share prices today, a longer-term valuation question is: How are the major US banks going to maintain these share and dividend levels?

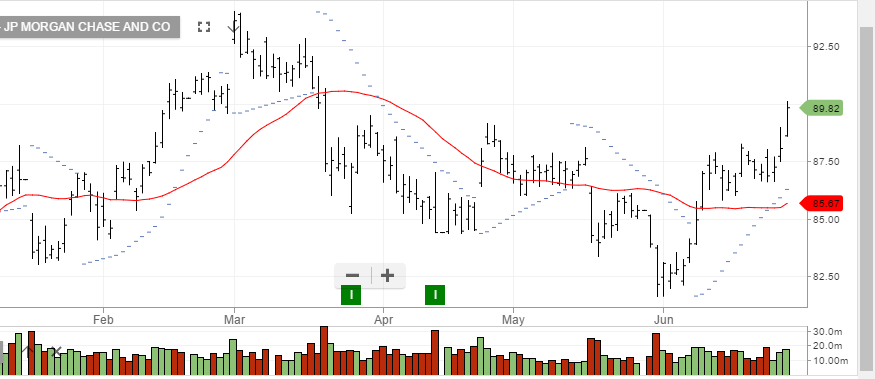

Against a back drop of lower loan creation, thinner margins and increased bad loan provisions, we’ll track the recent price action and see if the bounce from the recent lows will be sustainable.

JP Morgan