Facebook Falls On Lower Ad Revenue Growth

Shares of Facebook are down 2.4% in aftermarket trade to $148.00 after the social media giant released positive earnings, but fell short on expectations of future advertising revenue growth.

The company reported earnings of $1.04 per share on $8.03 billion in revenue versus 60 cents per share on $5.38 billion in revenue in the same period last year.

However, CFO David Wehner repeated his comments from last quarter that advertising revenue would come down “meaningfully”, while payments and other fees revenue fell 3% to $175 million on a year-on-year basis.

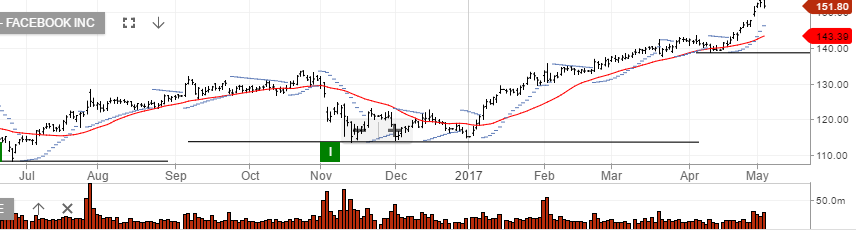

Considering the stock has gained over 20% since the beginning of the year, a move back into the $135.00 handle looks like a reasonable downside target.