BGA – Back on Support

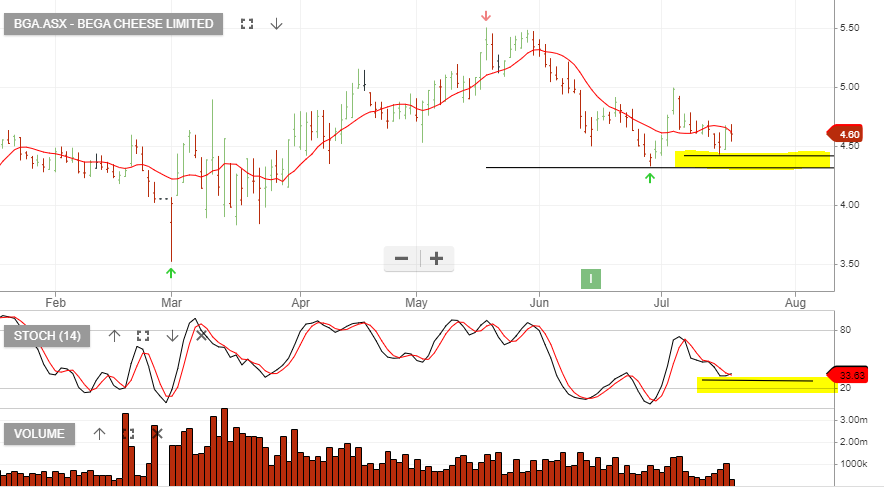

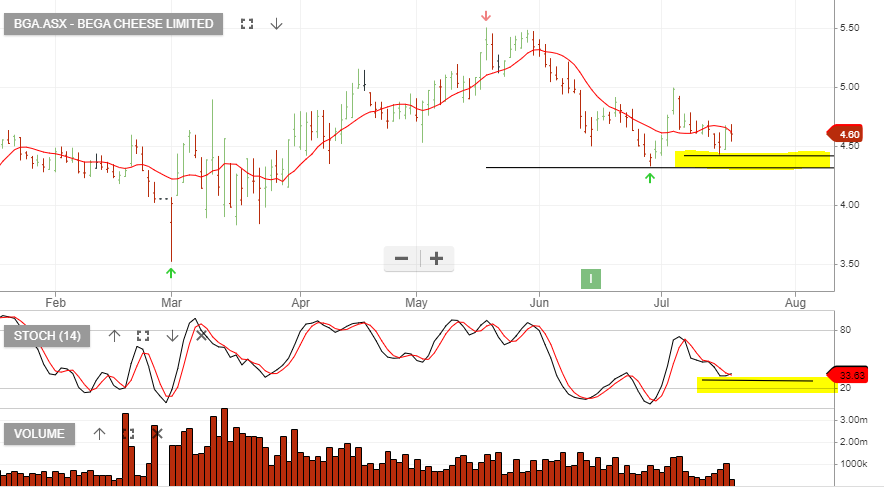

Bega Cheese is a recent Algo Engine buy signal and we revisit the opportunity as the price action builds support near $4.40.

Bega Cheese is a recent Algo Engine buy signal and we revisit the opportunity as the price action builds support near $4.40.

Bega Cheese switched to Algo Engine buy conditions back on the 15/6 at $4.50. Following a retest of the initial entry level this week, Bega then rallied 15%.

We’ve seen other food-related companies report strong earnings with an increase in stay at home cooking, supporting industry fundamentals. Despite this, we traded out of BGA in Friday’s session and locked-in the gain.

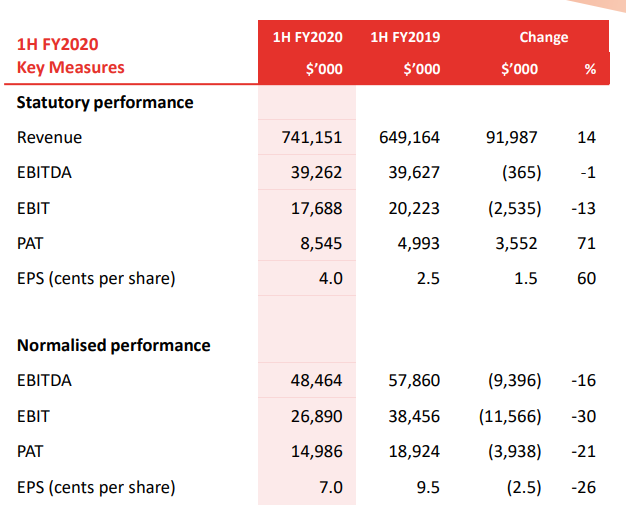

1H20 earnings showed mixed performance and we’ll be reviewing the full-year results when announced in August.

Bega Cheese comes onto our Radar following the price correction from $8.00 down to $4.51.

The PE valuation has corrected from lofty levels to now being 21x FY19 earnings and the stock trades on a 2.3% yield.

Our ALGO engine triggered a buy signal for Bega Cheese into yesterday’s ASX close at $6.85.

This “lower high” pattern is referenced to the intra-day low of $6.47 posted on April 18th.

Shares of BGA have dropped over 10% since the company announced an institutional share placement to raise $200 million to reduce its debt and initiate a share buyback plan.

The share price looks technically oversold at current levels and we see solid investor support in the $6.50 area.

Bega Cheese

Shares in Bega Cheese Ltd are up .75% at $6.75 after UBS released a positive market note on the company over the weekend.

BGA had dropped about 8% since the half-year results released last Wednesday, despite an improvement in all key financial metrics over the previous corresponding period.

However, it seems the market might have been too harsh on the dairy company. Bega’s first-half normalised EBITDA of $70 million exceeded the $64 million forecast by the street.

We see scope for BGA to reach $7.42 a share and find the stock attractive at the current price, based on 20X earnings.

Our ALGO engine triggered a buy signal in BGA at $6.81 on January 16th. BGA will go ex-dividend tomorrow paying 5.5 cents per share, fully franked.

Bega Cheese

Our ALGO engine triggered a buy signal in Bega Cheese at yesterday’s close at $6.80.

This signal is based on the “higher low” chart formation relative to the $6.55 low on October 5th.

BGA, who bought Vegemite a year ago, has continued its expansion plans buy acquiring the Peanut Company of Australia in December.

According to BGA management, the company’s strong balance sheet will allow it to look for other potential opportunities in the dairy and food sectors this year.

Shares of BGA gained more than 60% in 2016/17.

As many consumers steer away from diets with high sugars and carbohydrates, we believe BGA is a reasonable investment at current levels.

Initial technical price resistance will be found in the $7.50 area.

Bega Cheese

Or start a free thirty day trial for our full service, which includes our ASX Research.