Bega – Price Support

Bega Cheese has continued to see buying interest above the $5.00 support level.

Bega Cheese has continued to see buying interest above the $5.00 support level.

Bega Cheese has continued to see buying interest above the $5.00 support level.

Bega Cheese found buying support at the $5.00 support level.

Bega Cheese is under Algo Engine buy conditions since forming a support base at $4.30 back in Jul/Aug. The stock price has since rallied on better FY21 earnings forecasts and the $5.00 level provides another opportunity for investors to accumulate the stock.

Bega Cheese is under Algo Engine buy conditions since forming a support base at $4.30 back in Jul/Aug. The stock price has since rallied on better FY21 earnings forecasts and the $5.00 level provides another opportunity for investors to accumulate the stock.

Watch for the short-term momentum indicators to turn positive.

Bega Cheese is under Algo Engine buy conditions following the recent signal at $4.50.

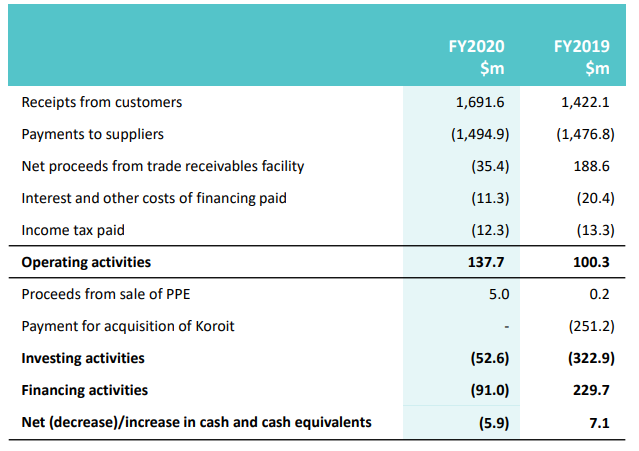

FY20 Full year earnings exceeded consensus and the key numbers are;

Revenue increased by 5% to $1.5 billion

Operating cash flow $138 million

Net debt reduction by $52 million to $236 million

Export sales increased 15% to $523 million

Inventory reduction by $15 million to $257 million

Normalised EBITDA decreased by 2% to $103.0 million

Bega Cheese reports earnings on 27 August. We like the idea of buying the dip ahead of the result.

Bega Cheese remains under Algo Engine buy conditions and we highlight the recent higher low formed at $4.40.

The stock price continues to trade higher heading into the 2H20 earnings result.

Bega Cheese remains under Algo Engine buy conditions and we highlight the recent higher low formed at $4.40.

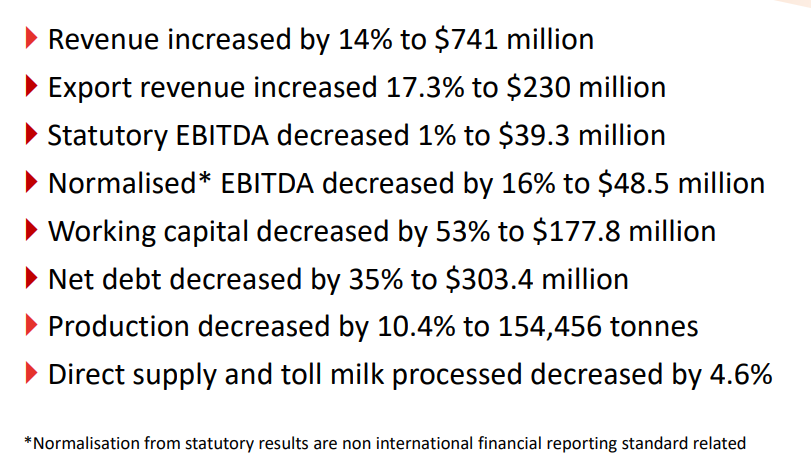

1H20 earnings are posted below and we’d expect to see improvement in the 2H20 numbers.

Or start a free thirty day trial for our full service, which includes our ASX Research.