Bendigo Bank: Reverting Higher

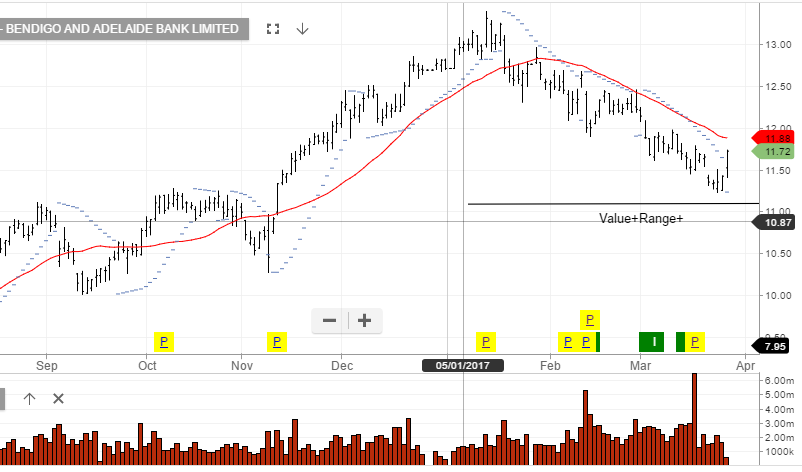

On March 16th, the ALGO engine flagged a buy sign for Bendigo Bank (BEN) at, or near, the $11.00 level.

BEN shares have reached $11.68 in early trade today.

Looking from a broader perspective, we believe the chart reflects a mean-reversion pattern, as opposed to the beginning a protracted trend higher.

On January 12th, BEN posted a high of $13.40 before reversing lower. On March 24th, BEN traded as low as $11.20 and then began to move higher.

Taking into account the high valuation of the domestic banking sector, we would expect the upside in the current move to be capped at or near $12.30, which is the 50% reversion level of the move from $13.40 to $11.20.

Prudent money management on this trade would be to work a sell stop at last week’s low of $11.20.