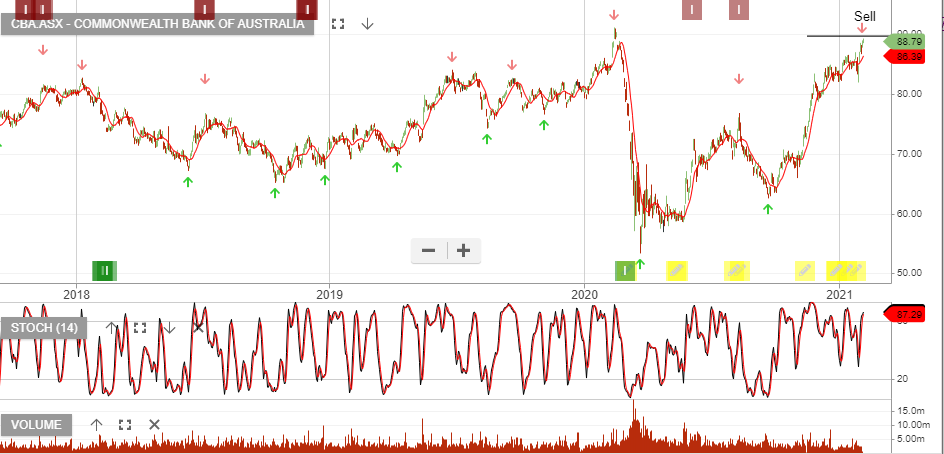

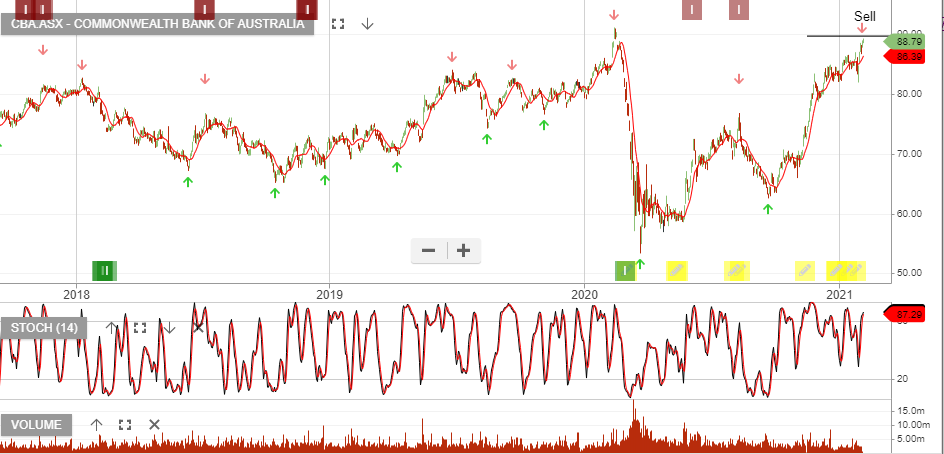

CBA – Sell

Commonwealth Bank of is under Algo Engine sell conditions and the company will report earnings on 10 Feb.

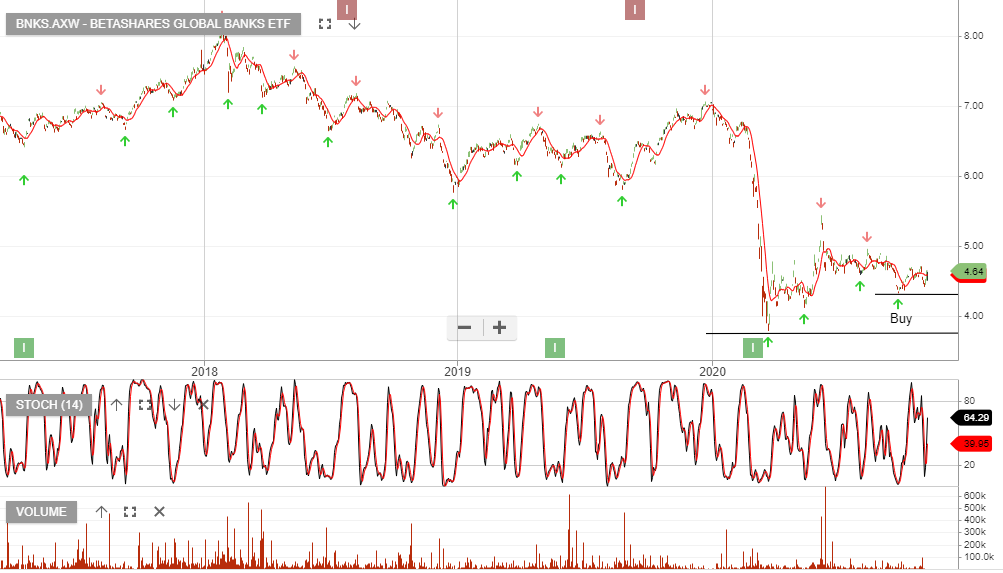

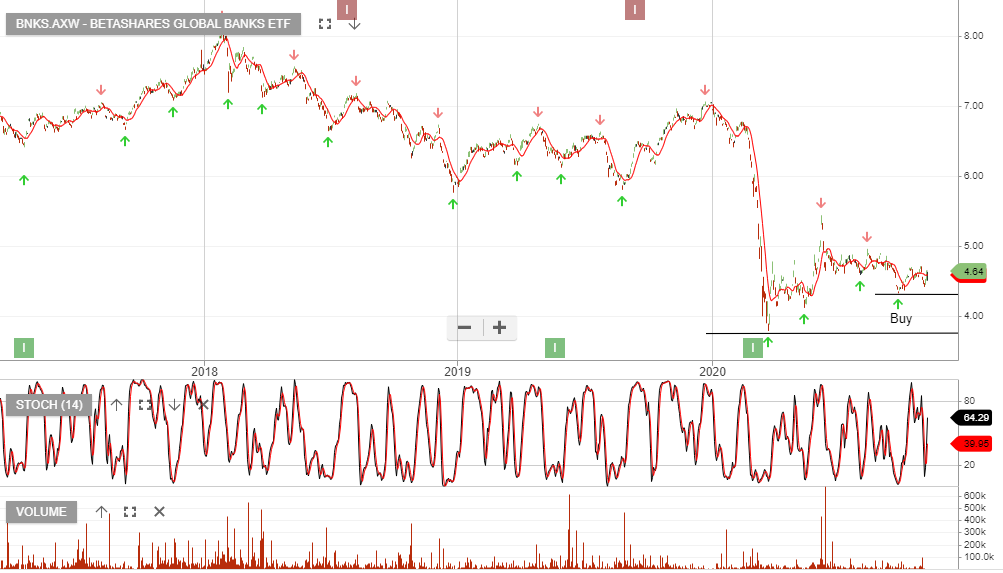

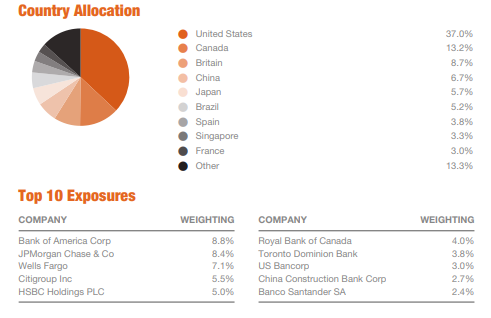

Our preference has been to be long the BetaShares Global Banks and the AXW:AXW fund.

Commonwealth Bank of is under Algo Engine sell conditions and the company will report earnings on 10 Feb.

Our preference has been to be long the BetaShares Global Banks and the AXW:AXW fund.

BetaShares Global Banks is our preferred bank exposure. Taking a global perspective and holding an overweight allocation to JP Morgan provides a low-risk profile and potentially greater upside.

Since writing the above post the BNKS ETF has rallied 20%

Commonwealth Bank of remains under Algo Engine sell conditions.

1Q21 earnings of $1.8bn were down 16% on the same time last year. CBA’s operational performance in 1Q21 does not justify the premium it is trading on versus peers.

Our preferred exposure to banks is through the BetaShares Global Banks

BetaShares Global Banks is our preferred bank exposure. Taking a global perspective and holding an overweight allocation to JP Morgan provides a low-risk profile and potentially greater upside.

BetaShares Global Banks remains our preferred instrument to gain broad exposure to a potential long-term recovery in the banking sector.

Risks remain extremely high for the sector, in the short-term.

Betashares Global Banks is under Algo Engine buy conditions and is a current holding in our ETF model portfolio.

We recently added to the position at $5.85 and the ETF is now trading at $6.25.

Global sector rotation is occurring and money is switching from momentum to value. This could be a repositioning ahead of this week’s ECB meeting and next month’s anticipated Fed Reserve rate cut.

The yield on the global bank ETF is 1.3%. We don’t consider this a core holding and will, therefore, look to take profit on the trade.

Or start a free thirty day trial for our full service, which includes our ASX Research.