RBA Meeting Highlights A Busy Data Week

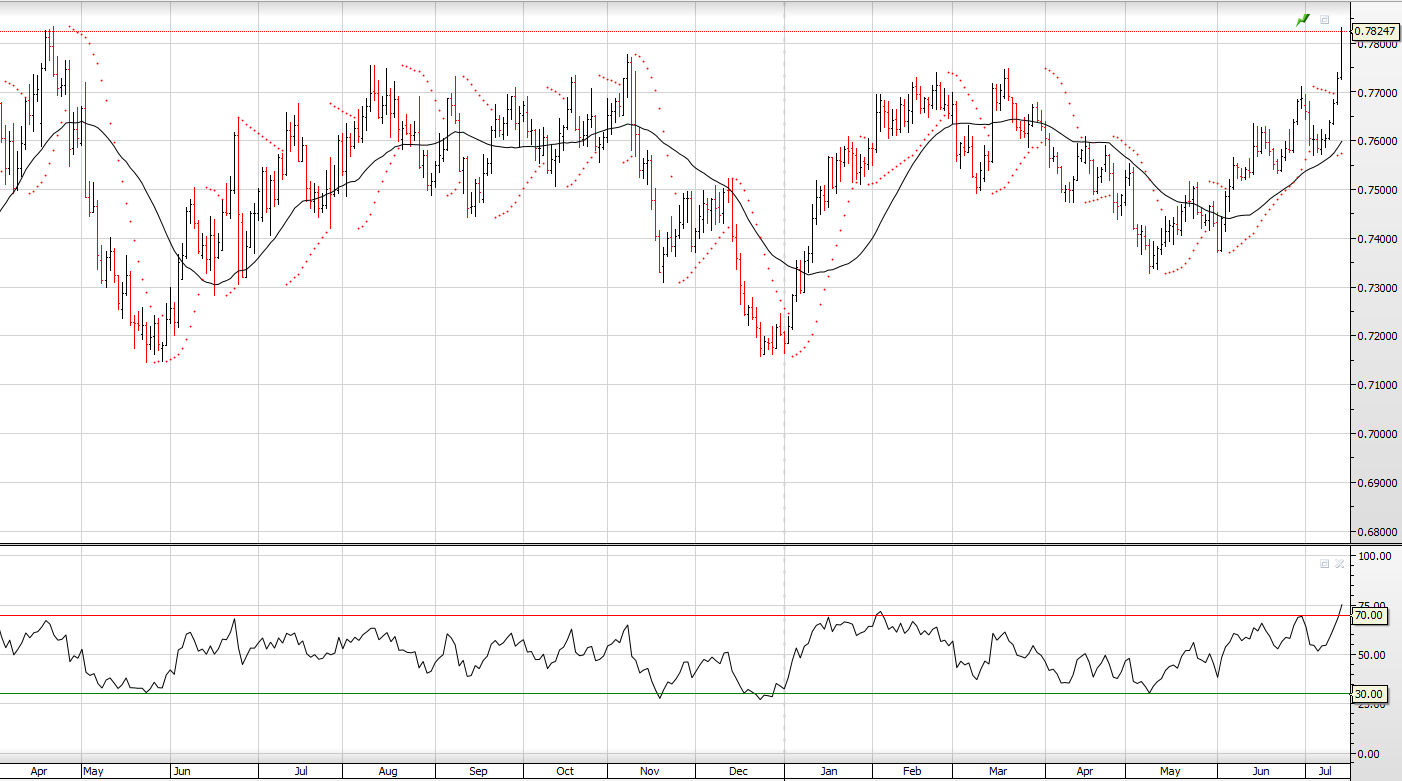

It’s going to be a busy data week for the Aussie Dollar, which could lead to some increased trade activity in the AUD/USD.

The schedule includes the RBA and Current Account data on Tuesday, followed by the quarterly GDP data on Wednesday, and then the Retail Sales and Trade Balance report on Thursday.

Any of these reports could put further downside pressure on the Aussie Dollar and return the pair below the .7800 level for the week

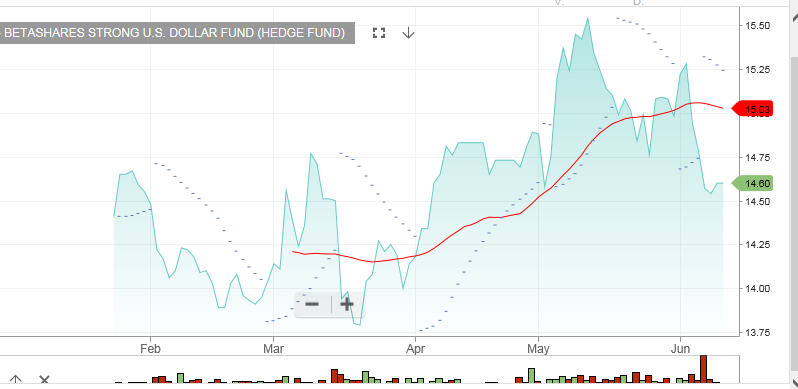

Investors looking to profit from the AUD/USD trading lower can look to buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the unit price increases as the price of the AUD/USD decreases.

YANK also has a 2.5% weighting, which means a 1% change in the AUD/USD will correspond to a 2.5% move in the unit price.

The current price of YANK is $12.70.

We calculate that when the AUD/USD trades back to the January low near .7300, the unit price will trade at $16.75.

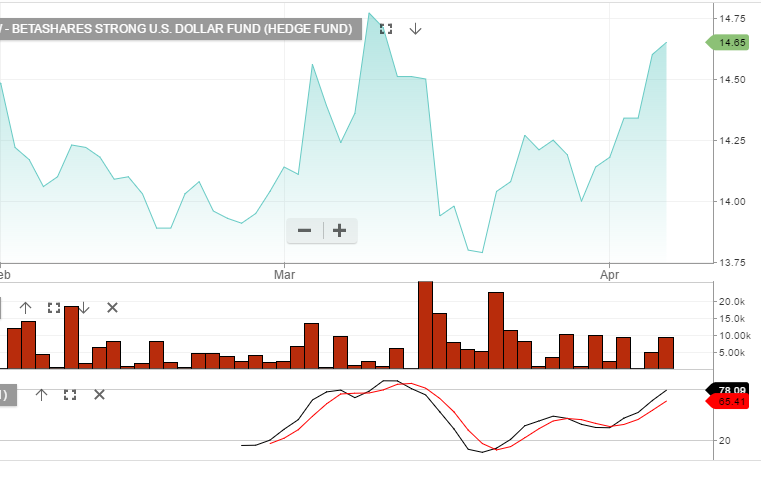

BetaShare ETF Yank

BetaShare ETF: YANK

BetaShare ETF: YANK