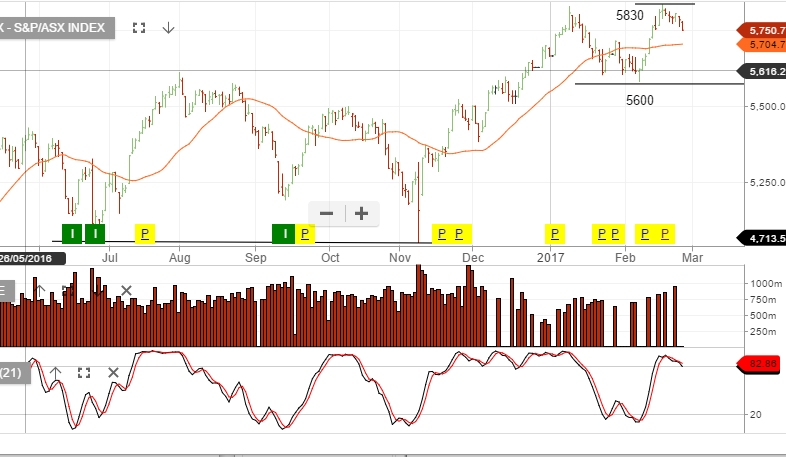

XJO – 5830 Support

The XJO has found support on the resistance level of 5830. If we see the price action turn-down through this support range, we recommend investors increase their hedging exposure.

The XJO has found support on the resistance level of 5830. If we see the price action turn-down through this support range, we recommend investors increase their hedging exposure.

The XJO continues to make higher low formations with 5830 providing buying support throughout the past week. If we see price action break below 5830 and then form resistance, we’ll view this as the beginning of structural weakness for the local market.

The XJO continues to push the upper range of the recent consolidation band. If the resource names can hold their current higher low formation, we may see further short-term strength in the index.

The following group of stocks have recently been flagged by our Algo Engine.

Algo buy signals include; BHP, RIO, FMG, S32 & QBE;

Algo sell signals include; NCM & OSH.

The XJO remains range bound with the most current level of support at 5640.

The XJO is creating a higher low formation with new support at 5640.

The XJO is now off 158 points from the 16/02/17 high of 5833. The resource sector has been the main drag, in particular, BHP and RIO.

Chart – BHP

We’ve been cautious of the resource names rolling over from the recent highs and the potential negative impact on the overall XJO index. It appears that the broader Australian market may be in the early stages of a price correction.

Also, the Australian banks appear fully valued given the low revenue and profit growth outlook across the next 12 to 18 months.

On the 7th of February the XJO index created a new higher low formation as buying support returned and the index rallied from the 5582 low, back to retest the trend high on Friday, when the index closed at 5805.

Currently, ASX 200 stocks which have reported, show an average revenue growth of 3.2% and underlying earnings per share growth of 6.5%. This is the first return to earnings growth in 3 years.

The XJO is holding support at 5600 points and maintaining a bullish short-term price structure.

We’re cautious due to stretched equity valuations, political risks in the Euro zone, debt stability in China and low revenue growth in many industry sectors.

To mange these concerns we’ve tilted portfolios to defensive assets and become aggressive with our covered call overlay. The bulk of our portfolio returns will come through dividends and option premium over the next short while.

Furthermore, we’re just not convinced the reflation trade the market has positioned around, will actually materielize in FY17.

Or start a free thirty day trial for our full service, which includes our ASX Research.