XJO – Under Price Resistance

The XJO is trading into a weak price structure following a series of lower high formations.

XJO

The XJO is trading into a weak price structure following a series of lower high formations.

XJO

The S&P/ASX 200 Index finished the week down 1.2%.

The best performer was the Property Trust sector, up 0.3% and the worst performer was the Telecoms sector, down 4.8%.

The market found resistance at 6083, the top end of the range we forecast.

The ASX 200 finished the week up 1.1% with the Health Care sector up 5.2% .

Telecoms lost 1.8% and were the worst performing sector, .

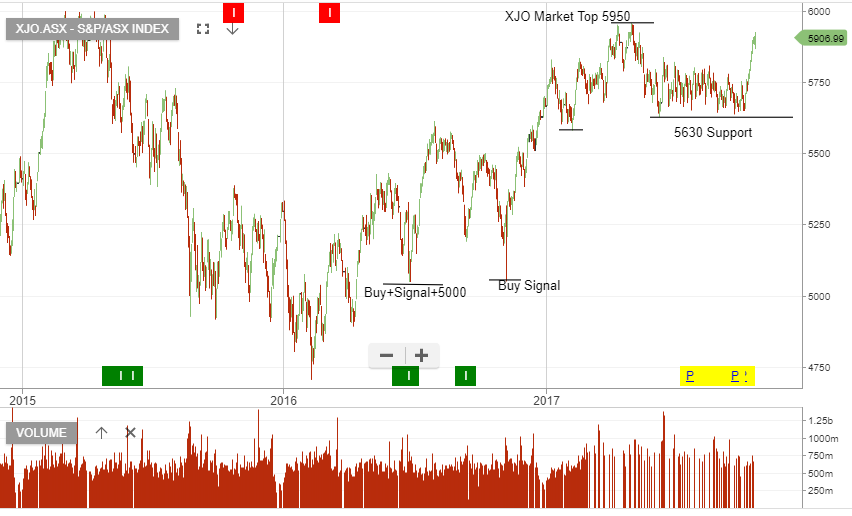

The XJO is likely to find resistance within the 5950 to 6000 range displayed below.

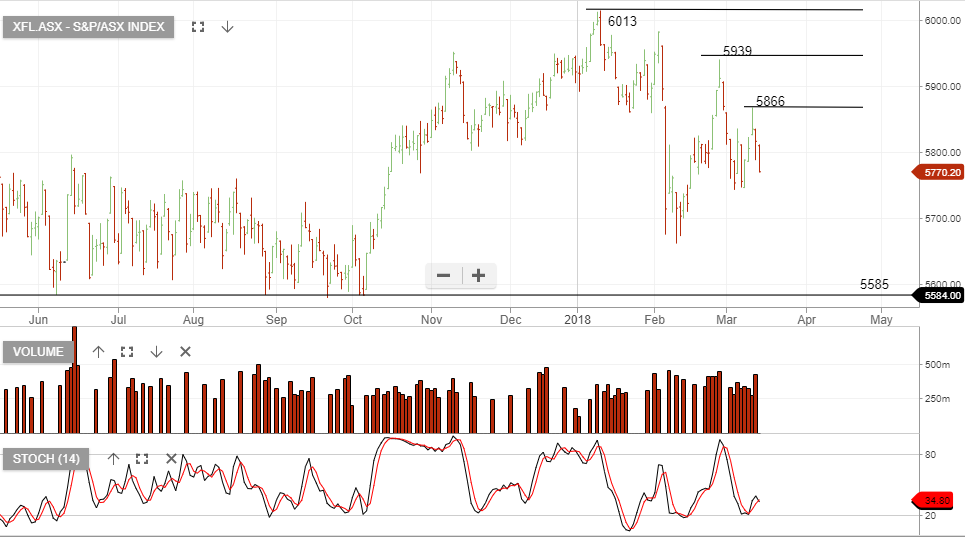

The ASX XJO Index fell 1.1% for the week and traded below the 6000 level for the first time this year.

Mining stocks and the major banks led the downside following weakness in commodity prices.

The ASX Gold index dropped four sessions in a row and lost 1.3% on Friday to close at 4874.60.

Iron Ore prices posted their first weekly loss in over a month, which pressured shares of mining giants BHP and RIO Tinto lower for the week.

Shares of RIO fell 4.6% to $78.00 while BHP slipped 3.7% to end the week at $30.70

Internal momentum indicators are looking fairly neutral on the daily charts, which suggest the index could see range trading next week between 6070 and 5985.

XJO Index

XJO Index

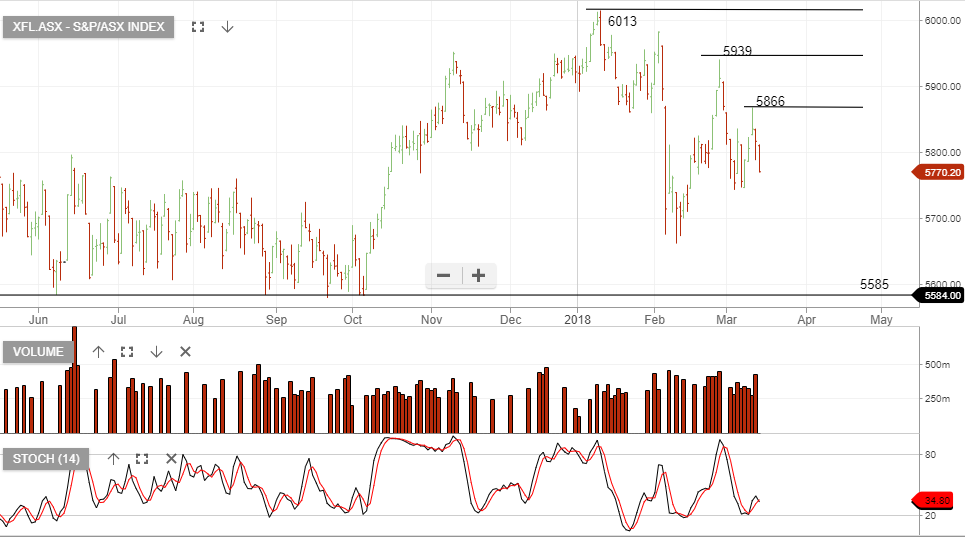

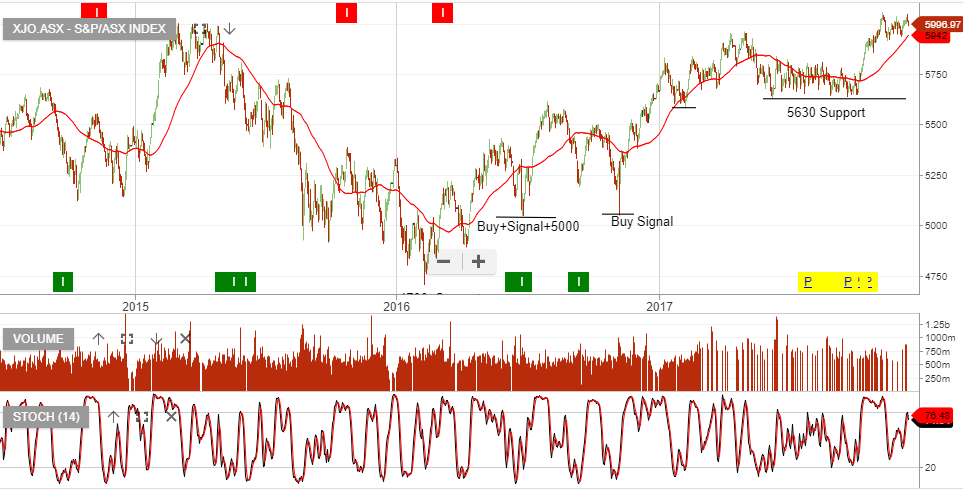

The last time our ALGO engine gave a signal in the XJO Index was on September 8th, 2016; this was a buy signal at 5227.

It isn’t surprising that there hasn’t been a more current signal considering that the index has traded in a wide, sideways trading range between 5650 and 5960 during 2017.

However, the recent break above 5960 has the technical structure of a “price exhaustion pattern” and could signal a correction lower into the new year.

Looking at the internal momentum indicators on the daily chart, the November high of 6052 had a corresponding RSI reading of 80.00.

Interestingly, the higher print from December 20th at 6083, had a lower RSI reading of 63.00.

This divergence in momentum suggests the index is nearing a medium-term high and could offer a shorting opportunity. The next key support level is the November 16th low at 5916.

The XJO Index is available to trade on our SAXO Go platform as both a CFD and a futures contract.

XJO Index

XJO Index

The S&P/ASX 200 Index finished the week up 0.04%.

The best performer was the Property Trusts sector, up 1.8% and the the worst performer was the Utilities sector, down 3.8%.

The S&P/ASX 200 Index finished the week to Friday up 1.6%, the best performing sector was the Utilities sector, up 3.9%. AGL Energy Ltd led the performance rising by 5.0% and the worst performing sector was the Telecoms sector, up only 0.7%.

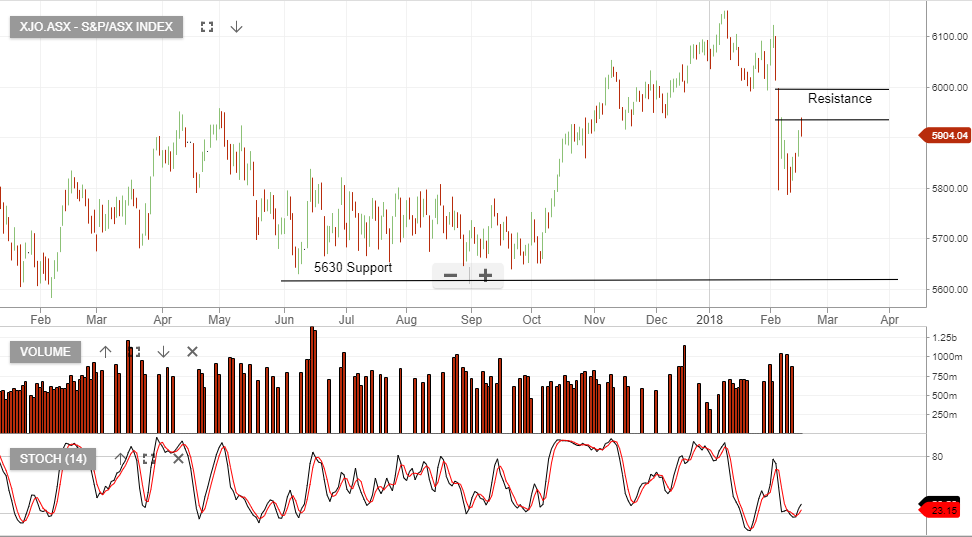

The XJO index found support at 5640 early this month and has since rallied to the top end of the trading range, making a high in Friday’s session of 5925.

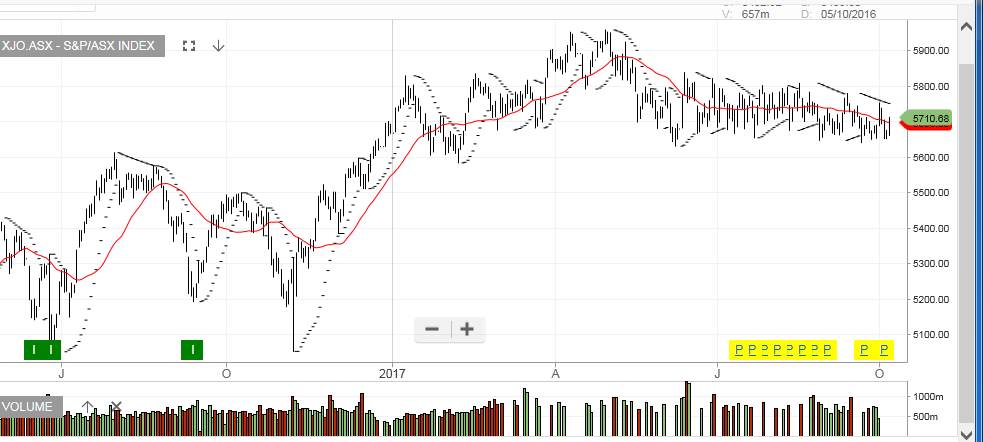

Trading in the XJO 200 Index posted another week within the sideways “Flag” pattern bounded by the June 15th high of 5834 and the June 8th low of 5637.

It’s worth noting that 4 of the 5 trading sessions last week saw intra-day net changes of almost 1% from open to close (2 days higher, 2 days lower).

This increase in daily price volatility suggests a resolution to this 4-month indecision pattern may occur sooner, as opposed to later.

With the series of “lower highs” since the August high of 5810 still the dominant technical component, we believe the break will point to the downside with the next support level near 5570.

XJO 200 Index

XJO 200 Index

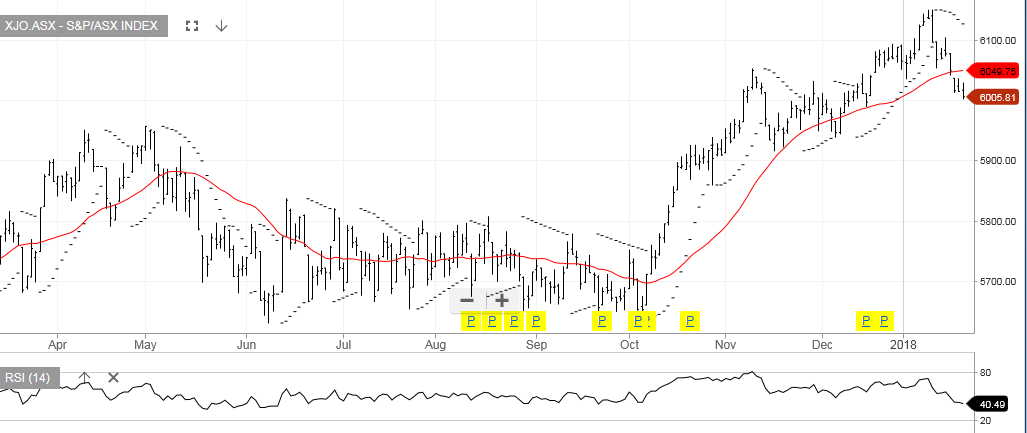

The XJO 200 Index continues to trade within a broad, sideways “Flag” pattern bound by the June 8th low of 5624 and the June 15th high of 5834.

The index is currently trading at 5666, which puts the key support level of 5624 within reach. A break of this level would open up range extension to the downside and find the next key target at 5578.

Investors looking to profit from a move lower in the XJO can buy the BetaShare ETF with the symbol: BBOZ.

BBOZ is an inverse ETF which means the unit price increases as the XJO Index trades lower.

BBOZ also has a 2.5% weighting, which means a 1% move in the XJO will have a 2.5% impact on the unit price of BBOZ.

The current price of BBOZ is $17.80.

We estimate that unit price of BBOZ will be $19.50 when the XJO trades down to 5578.

ASX XJO Index

BetaShare Inverse ETF: BBOZ

The XJO 200 Index continues to trade within a broad, sideways “Flag” pattern bound by the June 8th low of 5624 and the June 15th high of 5834.

The low price for the week at 5637 was the result of weakness in the banking names, as well as, a drop in major miners BHP and RIO; which lost 2% and 1.5% for the week, respectively.

The continuation of the “lower high” price pattern suggests a downward bias with the next key support level near the February low of 5578.

ASX XJO Index

ASX XJO Index

Or start a free thirty day trial for our full service, which includes our ASX Research.