Strong Buy Signals

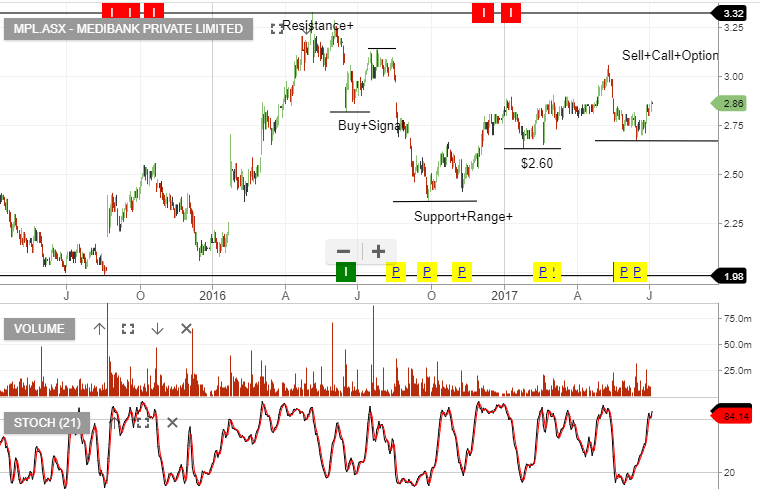

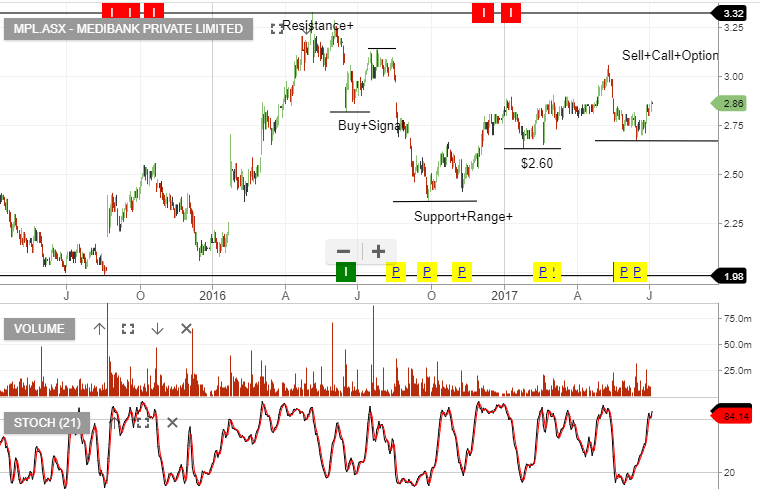

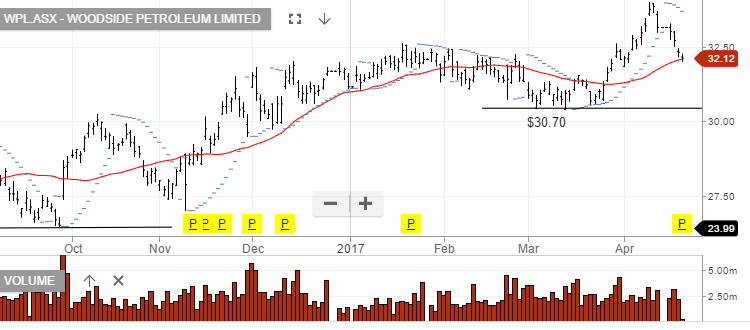

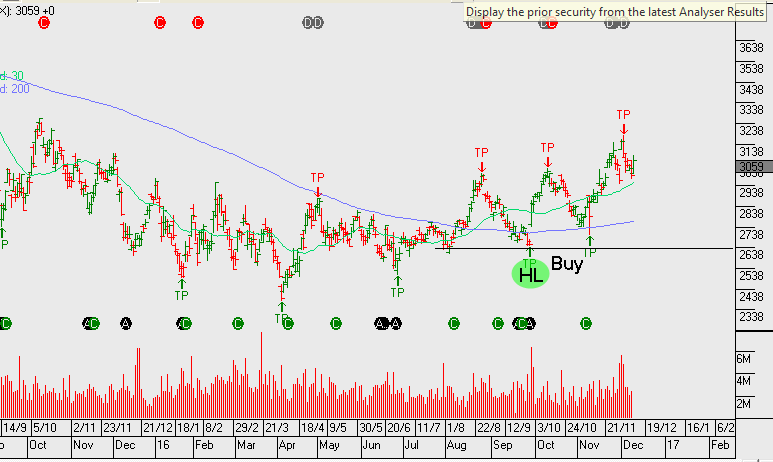

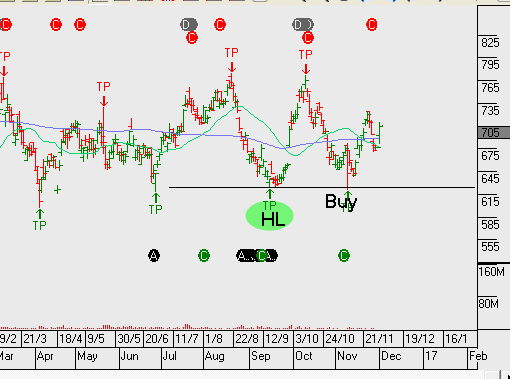

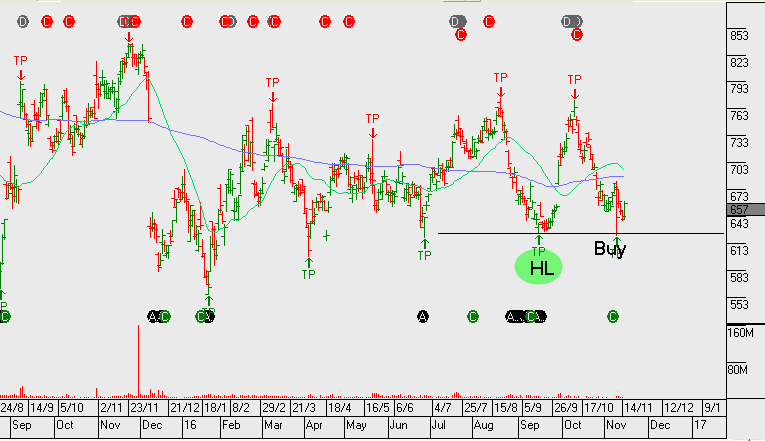

Woolworths, Woodside, Medibank & Origin look like they’re setting-up as strong buy signals.

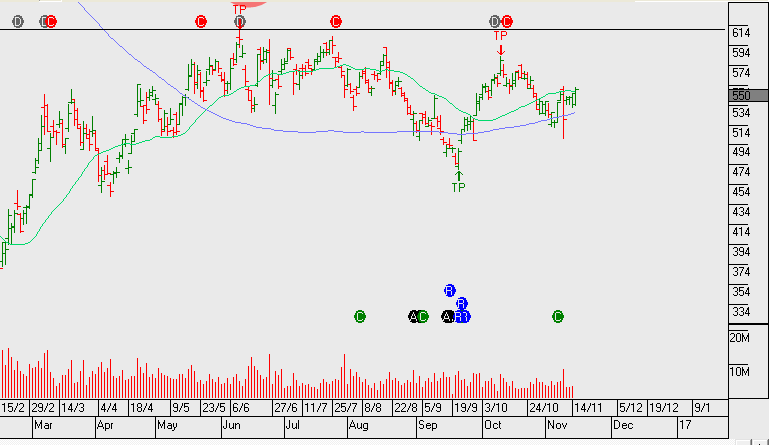

Other names which we view favourably from recent ALGO alerts include, SYD, TCL & GPT.

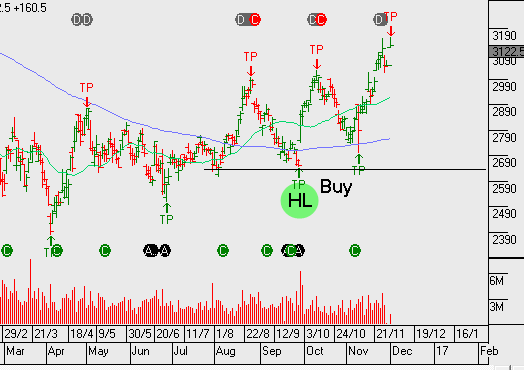

Woolworths, Woodside, Medibank & Origin look like they’re setting-up as strong buy signals.

Other names which we view favourably from recent ALGO alerts include, SYD, TCL & GPT.

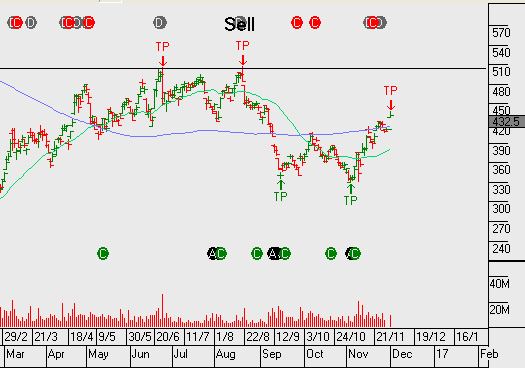

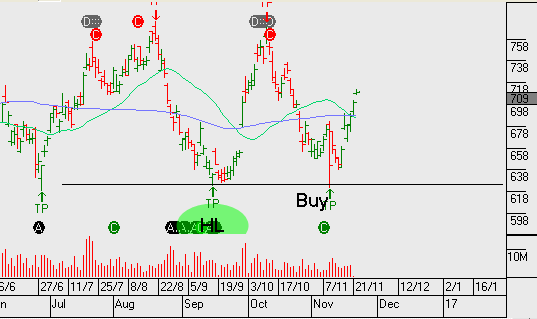

The sell-off in oil back to US$45 per barrel has seen WPL, OSH, STO, and ORG all come under selling pressure.

Origin remains one of our preferred exposures among the energy names and after taking profit recently at $8.00, we’ve been buyers again on last weeks pullback to $7.30.

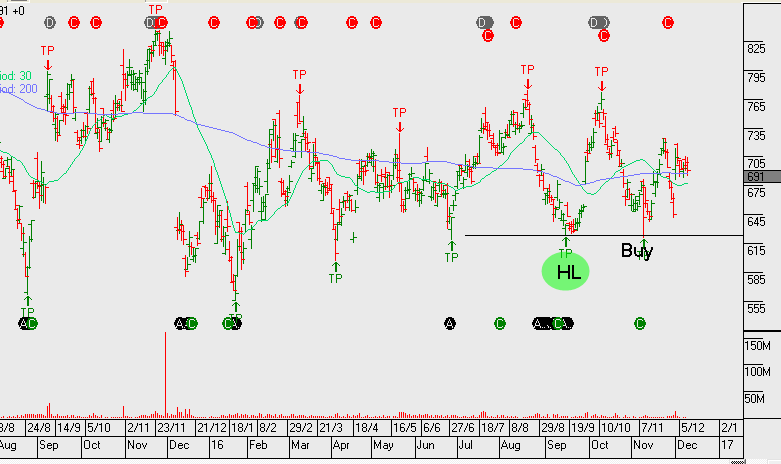

We now add WPL to our buy-list; we believe it’s back within a price range where buying interest is likely to start picking up.

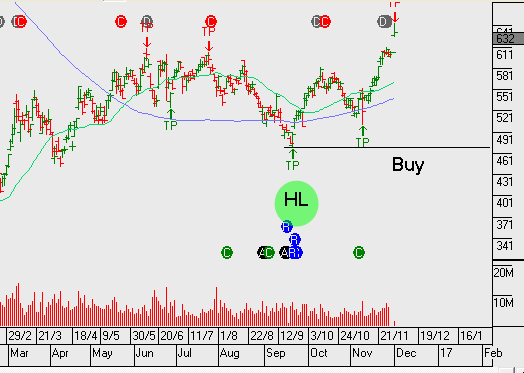

The Algo Engine triggered a buy signal on Friday in WPL, at or near $30.00

Woodside’s 1Q-17 quarterly production was impacted by weather, with sales revenue down to US$895 vs US$1b in the December quarter of 2016.

Woodside is working on advancing Scarborough & Browse LNG projects. With the market assigning a minimal current value to these projects, they could provide longer term material upside to Woodside should it be successful in demonstrating the viability of the projects.

FY18 forecast EPS is likely to be similar to FY17 placing the stock on a forward yield of 4%.

Woodside reported DecQ16 Production above market estimates on stronger LNG production. The result was driven by a stronger-than-expected performance from North-West Shelf & Pluto LNG.

The production beat helped DecQ16 revenue which increased to US$1 billion

CY17 production guidance will see volumes down 5- 10%. This is mainly due to the reduction in Woodside’s share of the NWS Joint venture.

2017 forecast revenue US$3.9b (flat on previous year), EBIT of US$1.5b, net profit of US$1b, EPS of US$1.30 places the stock on a forward yield of 4%.

We suggested going long oil names ahead of the OPEC meting, our preferred buy ideas were WPL, ORG, OSH and BHP. We see further upside ahead!

On November 30th, leaders of the Organization of Petroleum Exporting Nations (OPEC) agreed to their first production cut in eight years by collectively deciding to curtail crude oil production by 1.2 million barrels per day. Since then, West Texas Intermediate (WTI) Oil futures have gained over 6% from $45.20 to $51.50 at Friday’s NYMEX close.

The OPEC agreement got a shot in the arm on Saturday as 11 Non-OPEC oil producing countries agreed to cut their output by 558,000 barrels per day. This is the first time in over 15 years that a global agreement to cut production has been struck and adds fundamental support to the current rally in Crude Oil.

Technical indicators suggest the January WTI contract can move higher this week. The recent high in the $52.70 area is the next logical target, but there’s scope for a move back above $54.00 after this weekend’s Non-OPEC agreement. Near-term support is seen in the $49.60 area.

Although investors may be rightfully sceptical about the longevity of the OPEC and Non-OPEC productions cuts, our reading of the charts suggests being patient in trying to pick a near-term top in crude oil prices.

Crude Oil prices surged as much as 10%, almost reaching the $50.00 mark, as the Organization of Petroleum Exporting Countries (OPEC) agreed to curb oil production for the first time since 2008 in an effort to reduce oversupply and support prices.

The 14 nation cartel, led by Saudi Arabia, agreed to cut production to 32.5 million barrels per day, which pencils out to a 1.2 million barrel per day reduction from current levels. Saudi Arabia agreed to take the lion’s share of the cut; lowering their daily production by 486,000 barrels per day to get the deal done.

Russia, the world’s largest Non-OPEC producer, had long resisted cutting output but has tentatively agreed to join the effort by reducing production by 300,000 barrels per day. OPEC will meet with Non-OPEC producers on December 9th.

If history is an accurate gauge, the bullish market response to this deal may be short lived. OPEC members haven’t shown a strong track record of compliance to previous production agreements. As such, the recent price action in Crude Oil could reverse over the near term as more details are released.

Crude Oil prices rallied over 4% to a three week high today, as the market perceived a growing conviction that major oil producing countries would agree to limit output at the OPEC meeting in Vienna on November 30th.

West Texas Intermediate crude oil traded as high as $48.50, up over 10% in five days, since Saudi Arabia, the de facto leader of OPEC, increased pressure on the group’s more reluctant members to join its proposed reduction of output plan. In recent days, OPEC members including Iran, along with non-OPEC member Russia, have suggested that they were leaning toward a deal to limit production.

Both Iran and Russia have been the main hurdles facing any output curtailment by OPEC, as both nations want exemptions to try to recapture market share lost by years of Western sanctions. Analysts have been clear participation by Iran, Nigeria and Libya are integral in any agreement to cut production and shore up crude oil prices.

Oil prices surged overnight as investors speculate that OPEC members will push toward securing a deal to cut output. West Texas Intermediate Crude oil rose 5.8%.

As an introduction to our ETF Watch commentary, we’re looking at the BetaShares Oil ETF listed on the ASX under the code OOO.AXW. The ETF provides investors with a “pure play” to take a view on oil prices. It aims to track the performance of an index (before fees and expenses), that provides exposure directly to crude oil futures.

In addition, as oil is priced in USD the fund hedges its USD exposure back to AUD, which reduces currency risk for Australian investors.

At a company specific level, we continue to like OSH, ORG and note the recent positive momentum in STO following China’s Hony Capital increasing its share holding.

The following group of stocks are in either established uptrends or, in recent months they’ve broken downtrends to begin building the early stages of a bullish “higher low” formation.

Many of these names have been mentioned previously in the blog and/or the monthly strategy video report. It’s worth loading these codes into your watch list and considering rebalancing your portfolio to include allocations towards some, or all of these names:

JHX, LLC, MQG, SHL, TWE, ANN, ANZ, ASX, CCL, CIM, COH, QUB, TAH, WOW & WPL.

With the lower growth names within the above basket, such as WOW & CCL, we compliment the position now with tight covered calls to enhance the yield to 10%+ per annum. With some of the other names, we give a little more breathing space as we expect 5 to 10% price appreciation before selling the call option overlay.

WPL.ASX 1H16 underlying profit of $340m was down 50% on 1H15. IH16 EPS $0.41 and DPS (down 50%) to $0.34

Fy17 outlook is for full year EPS of $1.30 and DPS of $0.90 placing the stock on a forward yield of 4.5%.

The stock appears to be in the early stage of a break higher and for the time being, we leave this name uncapped from a call option perspective.

Or start a free thirty day trial for our full service, which includes our ASX Research.