Energy Names – Best Buy-Side Opportunities

Within the ASX 50, OSH, STO, WPL, ORG & BHP are the names investors consider when looking for exposure to Oil and LNG.

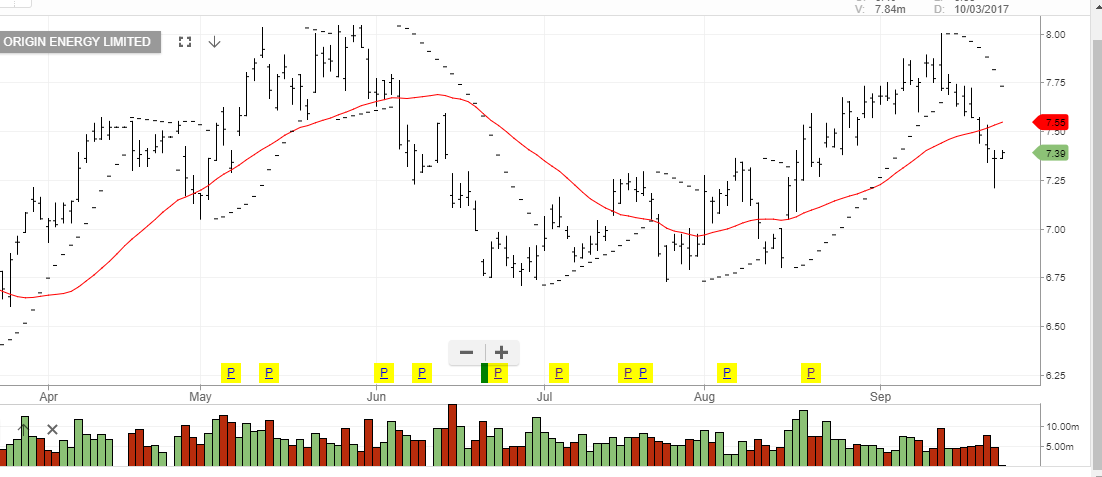

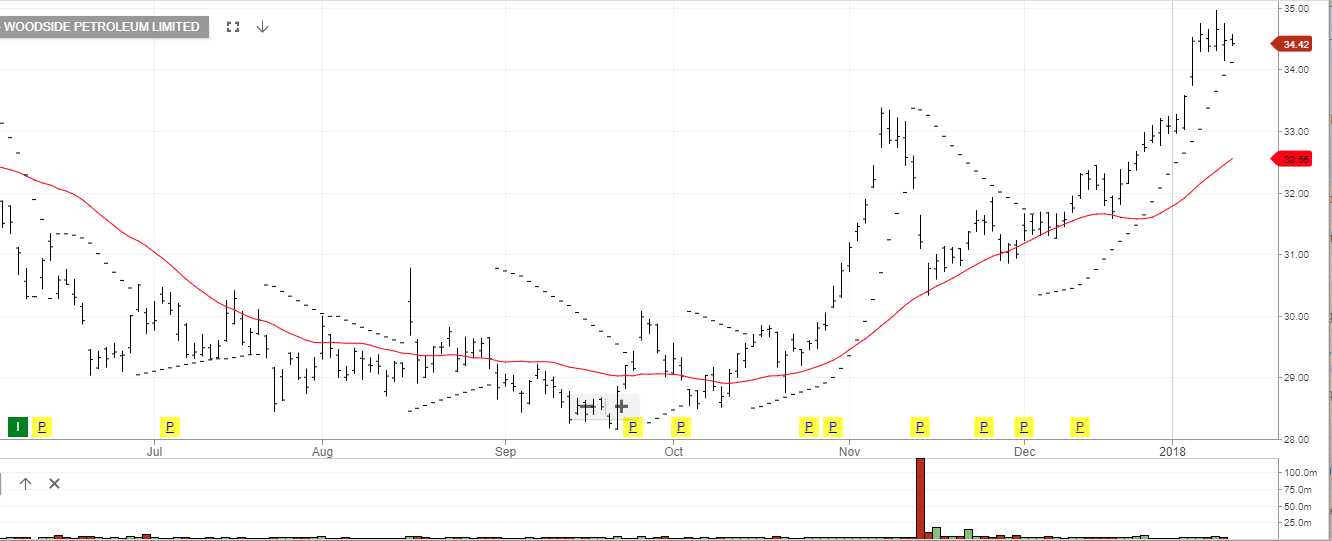

Currently WPL, ORG and BHP remain in our ASX50 model following a series of structural “higher low” formations.

OSH is not currently in our model portfolio.

The negative we see in the stock relates to market concerns surrounding their stretched balance sheet.

Oil Search has committed to substantial projects in PNG and Alaska and should oil prices fail to hold $60 – $80 per barrel, Oil Search may need to raise capital.

This week, Oil Search reported solid 4Q17 production at the upper end of their guidance range, with revenue of US$389mn.

Our preference remains adding long exposure on any pullback in BHP, WPL & ORG.

We are also watching for the next Algo Engine buy signal in the oil ETF OOO.AXW.

Woodside Petroleum

Woodside Petroleum