Woolworths – Valuation Review

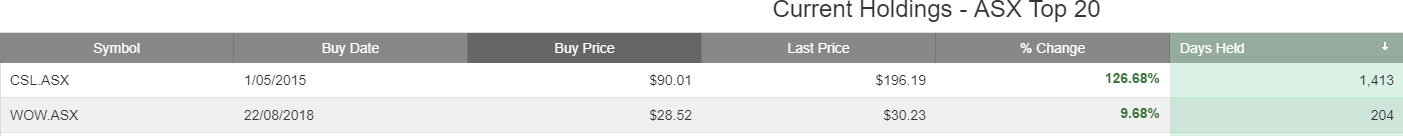

Woolworths Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The company is conducting a $1.7 billion off-market buyback which is 7 to 8% earnings accretive on an after-tax basis. Australian superannuation funds on a 15% tax rate are set to benefit from the off-market buyback.

Woolworths is trading on 23x FY20 earnings, which partly reflects the value of the off-market share buyback. If we assume the buyback is creating up to $2.00 of added value, fair value post the buyback, is sub $30.

Even at $29 – $30, it places WOW on 21x FY20 earnings and 3.1% dividend yield.

This places the stock at a very high valuation relative to the long-term average.

.

.