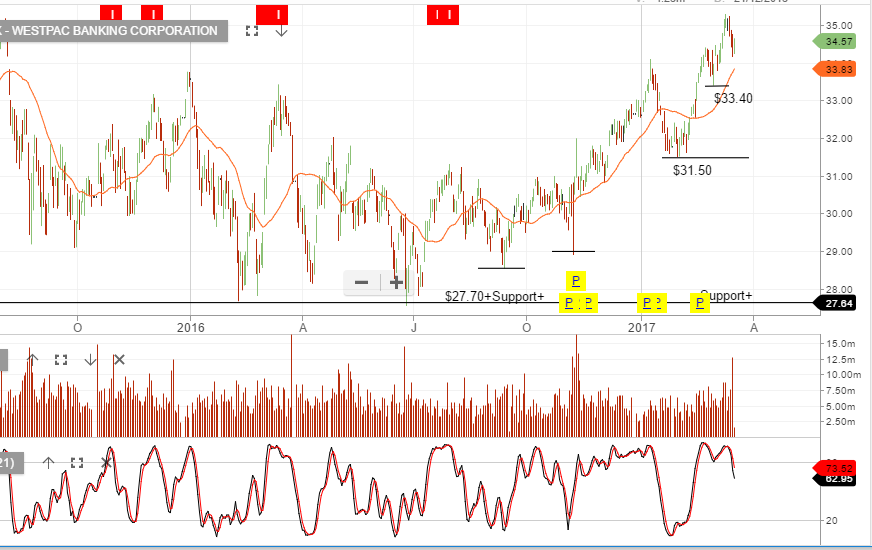

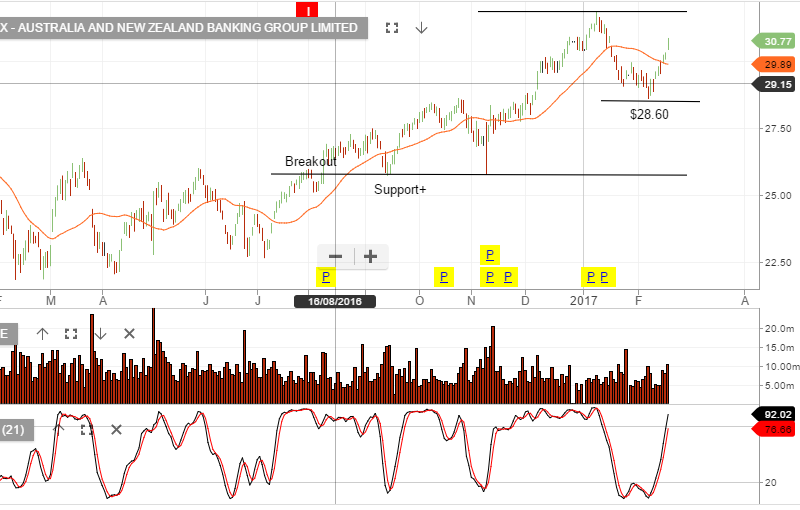

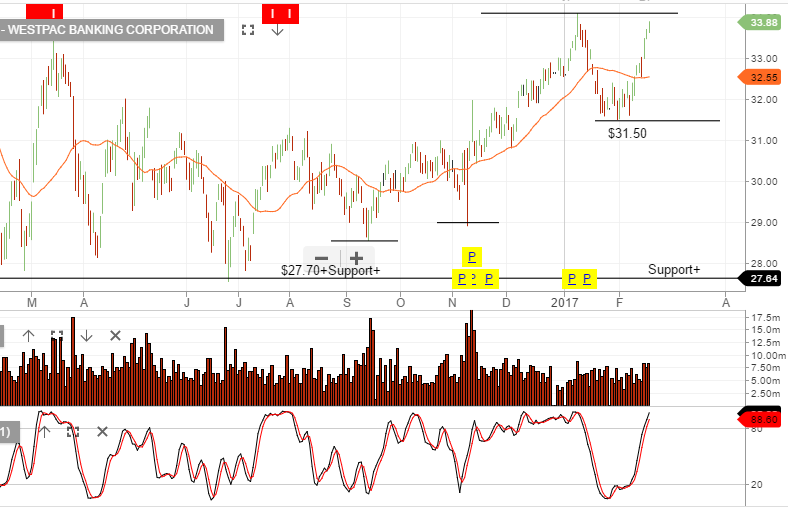

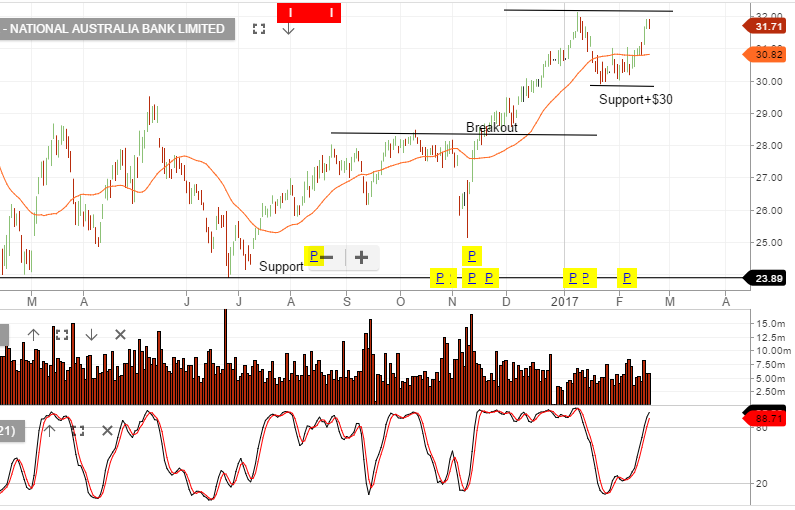

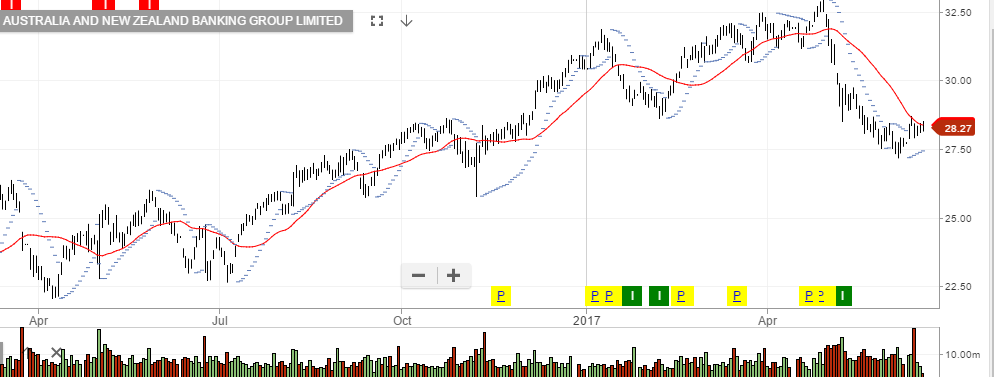

Algo Buy Signal – ANZ, NAB & WBC

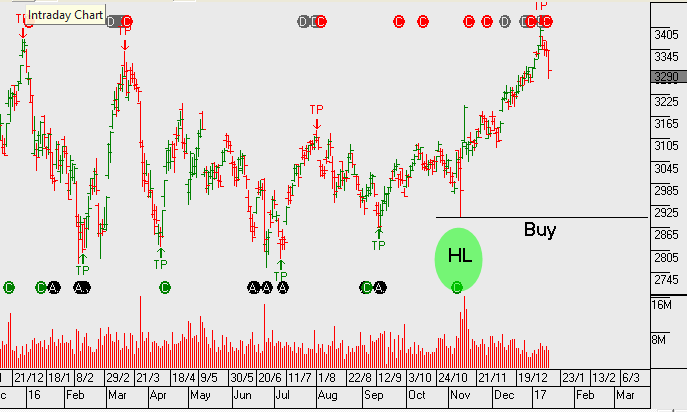

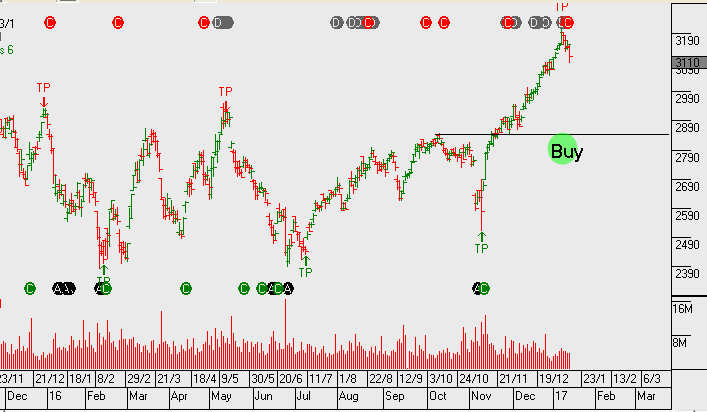

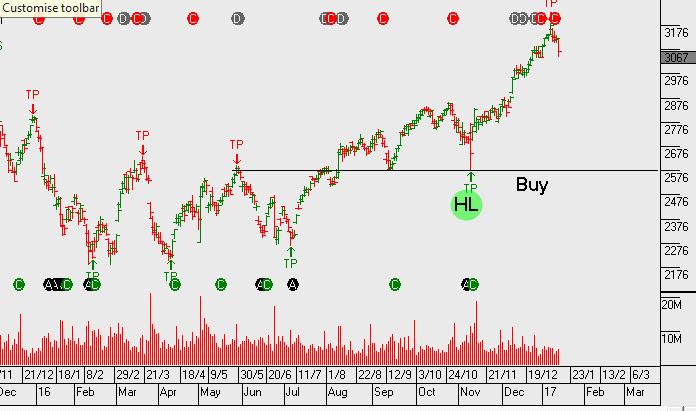

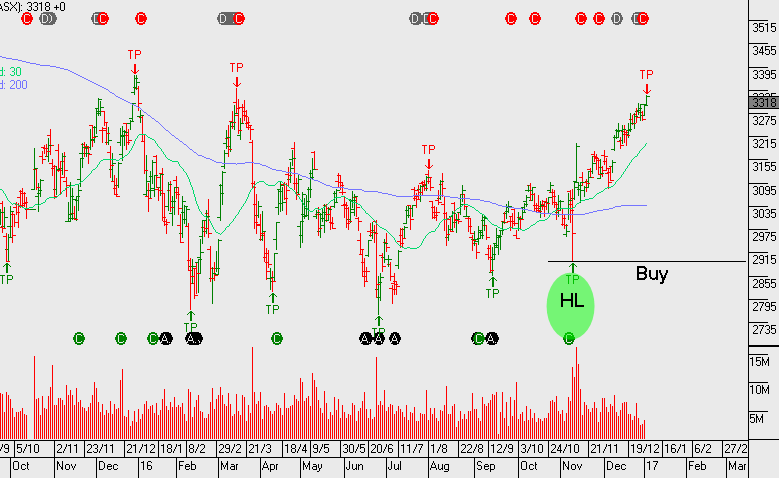

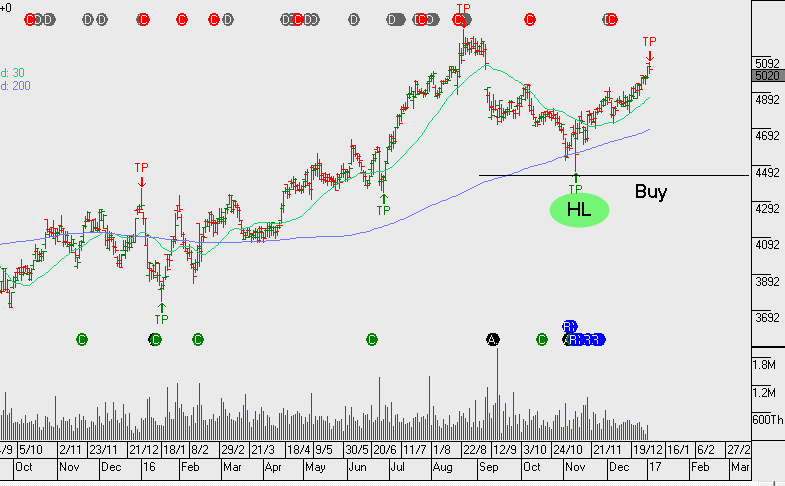

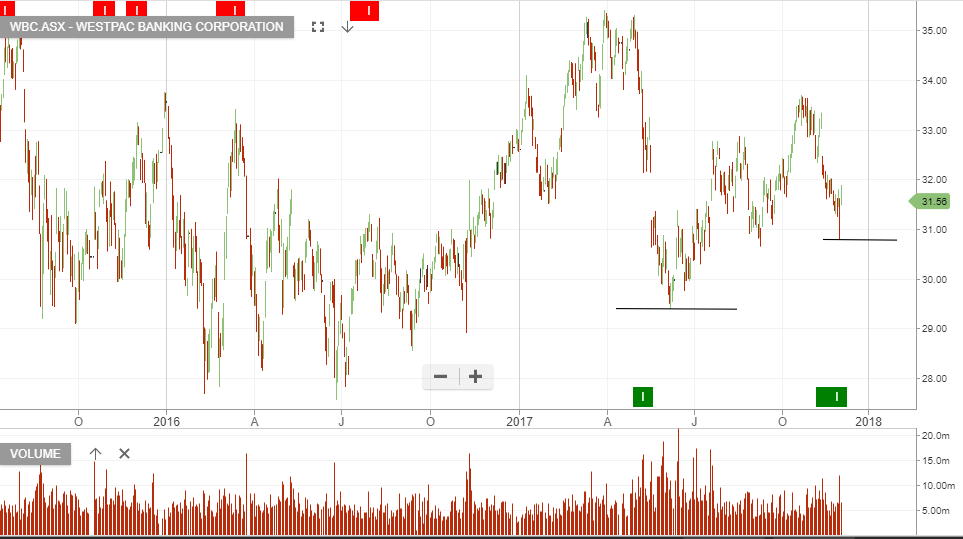

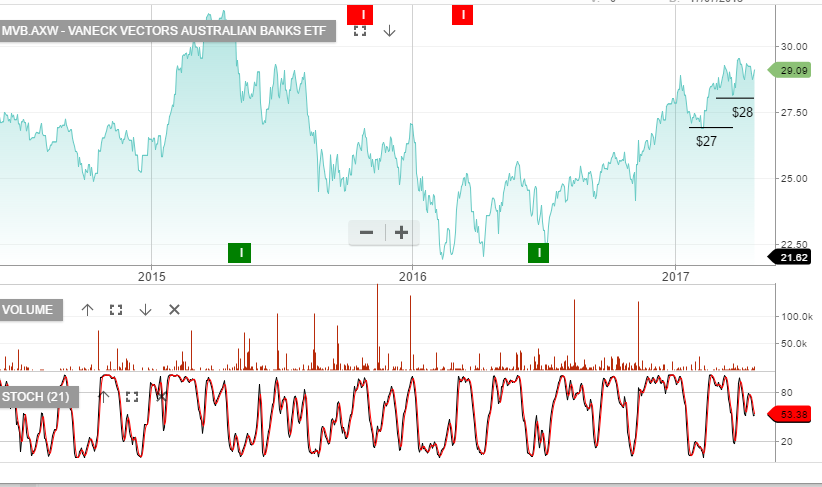

Following the recent sell-off in the major banks, we’re now seeing the Algo Engine flag the short-term “higher low” formation.

We’re cautious about entering these positions on the long-side due to the regulatory risks the banks face & the limited top-line revenue growth outlook for the sector. However, the search for yield may support another push higher in prices.

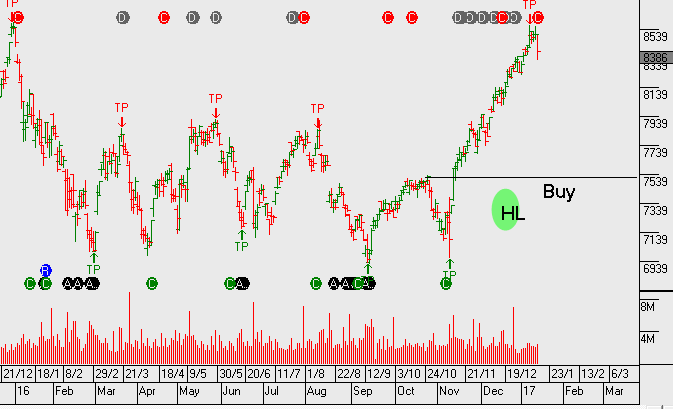

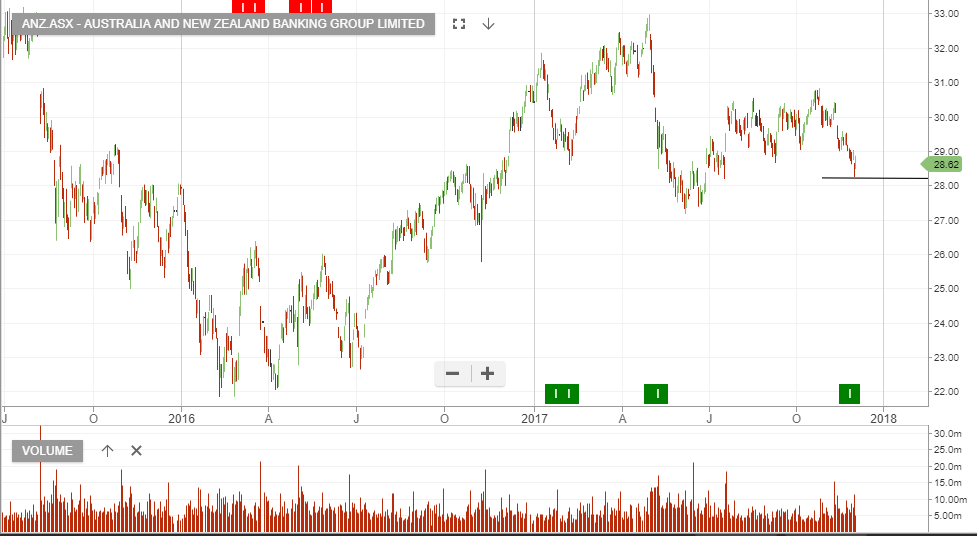

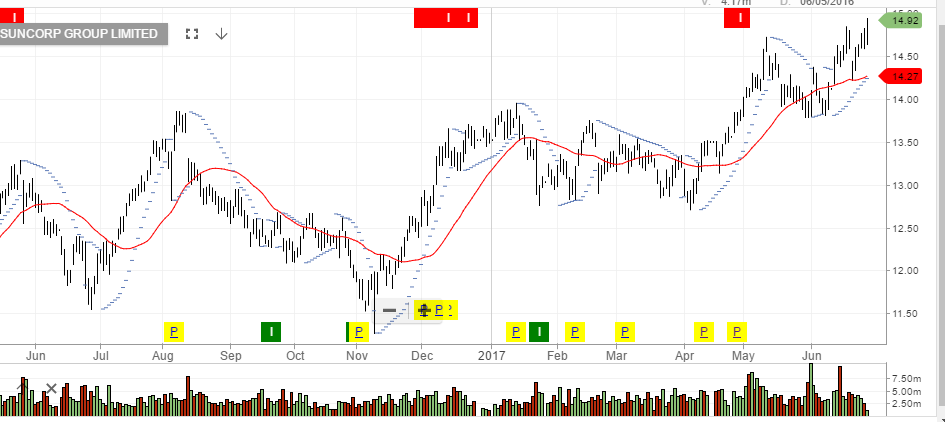

ANZ, NAB & WBC are buy signals, (place stop loss below signal low), CBA & SUN are showing sell signals.

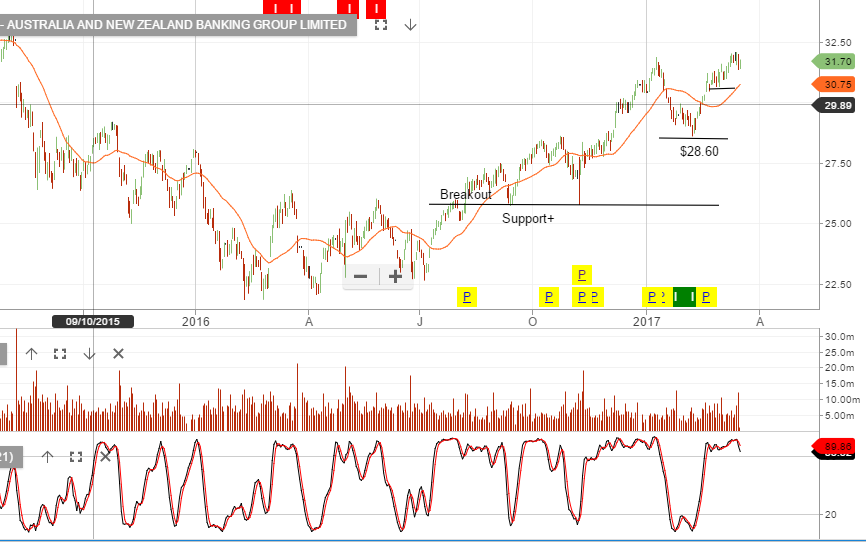

Chart – ANZ

Chart – ANZ