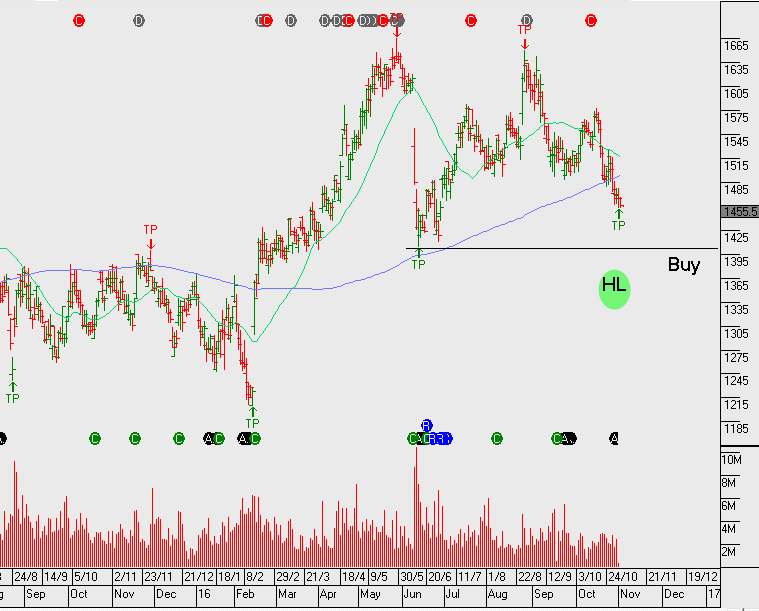

TWE – Treasury Wines (Trading on Price Support)

The algo engine triggered a buy signal on TWE and we note the price action on the chart is looking supportive.

FY17 EPS growth of 20% generates a price target of $11.50

The algo engine triggered a buy signal on TWE and we note the price action on the chart is looking supportive.

FY17 EPS growth of 20% generates a price target of $11.50

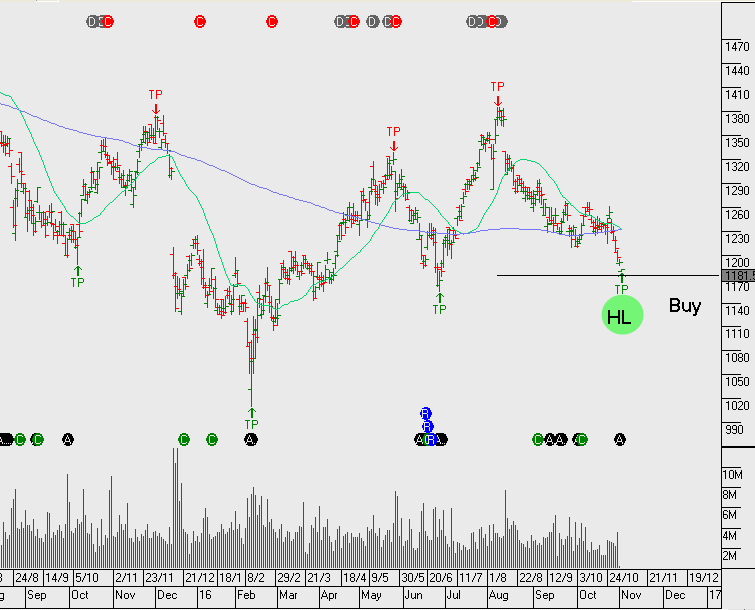

The following group of stocks are in either established uptrends or, in recent months they’ve broken downtrends to begin building the early stages of a bullish “higher low” formation.

Many of these names have been mentioned previously in the blog and/or the monthly strategy video report. It’s worth loading these codes into your watch list and considering rebalancing your portfolio to include allocations towards some, or all of these names:

JHX, LLC, MQG, SHL, TWE, ANN, ANZ, ASX, CCL, CIM, COH, QUB, TAH, WOW & WPL.

With the lower growth names within the above basket, such as WOW & CCL, we compliment the position now with tight covered calls to enhance the yield to 10%+ per annum. With some of the other names, we give a little more breathing space as we expect 5 to 10% price appreciation before selling the call option overlay.

The following group of stocks offer above average earnings growth, structural uptrends and are currently trading back on support levels that warrant closer attention.

ASX, AMC, BXB, JHX RHC, SEK, SHL, SUN and TWE.

More detail on the Investor Signals portfolio allocations and derivative overlay strategy will be provided in the October ASX top 50 Video Market Report.

After our buy signal on TWE.ASX at $9.20 we’ve started locking in the gains (PE now 27x). The stock rallied 15% during the last week following better than expected earnings result.

FY17 and FY18 should see EPS growth in the mid teens. Fy17 EPS forecast $0.37 and 2.5% yield on revenue of $2.6b and EBITDA of $550m

TWE.ASX is a buy at $9.30 and we’re building an exposure coming into the upcoming earnings result on Thursday. Looking for numbers that equal or exceed NPAT $230m and anticipating a dividend of $0.13

Or start a free thirty day trial for our full service, which includes our ASX Research.