TWE – Buy

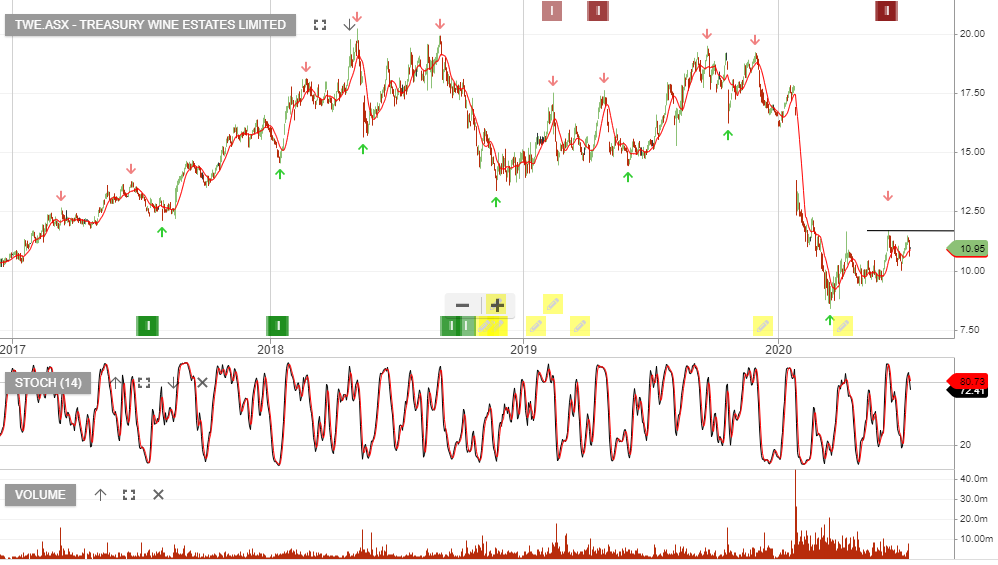

Treasury Wine Estates is under Algo Engine buy conditions.

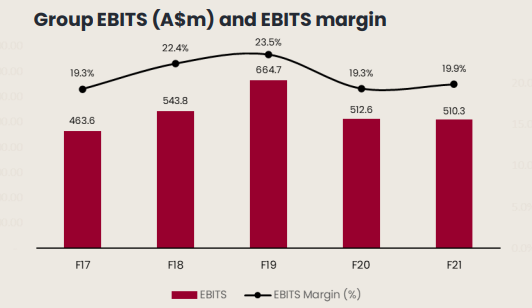

TWE continues to adjust to a post pandemic/post Chinese tariff environment. FY21 EBIT of $510 exceeded market expectations. After a number of years of disappointment for TWE in this region, we see America’s division accelerating growth into FY22.

FY22 EBIT growth is forecast to be in the mid to high single-digit range.

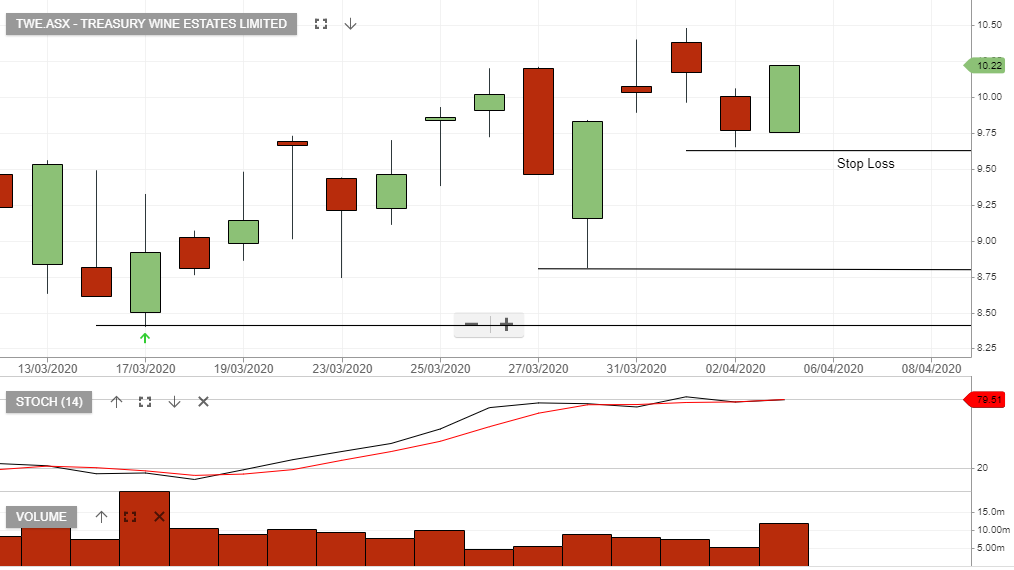

8/11 update: Buy above the $11.50 support range and place the stop loss below the recent pivot low of $11.48.