Telstra – Algo Buy Signal

Telstra Corporation is under Algo Engine buy conditions and has now been added into the ASX 100 model portfolio.

We see price support developing near the $3.50 price level.

Telstra Corporation is under Algo Engine buy conditions and has now been added into the ASX 100 model portfolio.

We see price support developing near the $3.50 price level.

Telstra’s 1H19 earnings were in line with consensus and mobile did better-than-expected. The ongoing progress on cost-out initiatives will be supportive for stable future dividends.

Assuming 16 cents as the base dividend, Telstra needs to deliver around $7.5bn in EBITDA. We view this as achievable and place TLS on a 5.9% forward yield.

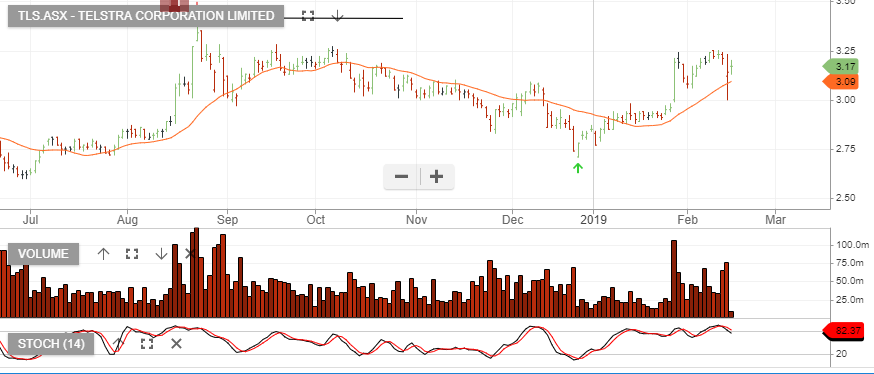

Since posting an intraday low of $2.60 on June 29th, shares of TLS have rebounded smartly and reached $3.40 in late August.

Last week’s market volatility has dampened investors interest in the stock over the last few days but, at $3.10, the share price is still 20% above the June low.

Tomorrow’s AGM will be a big test for bullish investors.

In focus will be the Telco giant’s “quantitative based” executive salary and bonus plan, as well as earnings updates across the company’s spectrum.

Given TLS’s target of 45% digital sales growth by 2021, we like the long side of the stock with a near-term target of $3.60.

Telstra

Telstra

Shares of TLS continue to trade with a positive bias as market commentators remain largely split on how the NBN roll out will impact the Telco giant’ s bottom line.

We believe investors will get a clearer picture after the AGM, scheduled for October 16th.

From a technical perspective, TLS has been building upside momentum with the next resistance level at $3.30 and solid support in the $3.05 area.

Telstra

Since slumping to a 7-year low of $2.60 on June 28th, shares of Telstra have risen over 20% during the last two months and reached $3.26 earlier today.

Part of the improvement in the domestic Telecom sector has stemmed from the merger of TPG and HTA, and the increase in scale for all the local providers.

In addition, we see TLS having a distinct advantage over its rivals with the 5-G network expanding revenue streams beyond traditional voice and data services.

As such, we believe the share price will continue to trend higher and the current dividend ratio is sustainable. The next technical chart level is just above $3.60.

Telstra

The S&P/ASX 200 Index finished the week to Friday up 1.3%.

The best performer was the Telecoms sector, up 6.1%. Telstra Corporation led the performance rising by 6.9%.

The worst performer was the Materials sector, down 1.2%.

Stay long the XJO index with a stop loss below 6174.

Shares of Telstra have started the new financial year off with a firmer tone rising 3% over the last three days.

Some of the positive sentiment has been driven by the news that TLS has sold 20% of its ventures arm to US private equity firm HarbourVest for $75 million.

The move is part of a broader plan for TLS to become a more technology-focused company and is consistent with the “Telstra2022” strategy announced last week.

HarbourVest has more than $50 billion in assets and the venture fund with TLS is expected to be valued at about $675 million.

After the $500 million loss from the Ooyala fiasco last year, the market may need some convincing that further investment in emerging 5G and next generation businesses will truly add to shareholder value.

It’s reasonable to expect that joining forces with the more experienced HarbourVest validates TLS’s commitment to the venture revenue stream and will see better results.

We believe that at current levels, TLS represents good value for investors with a medium to longer-term investment time horizon, with an initial target of around $3.90.

At $2.71, TLS is trading at a 9.7 PE and is on a 7.6% yield.

Telstra

Since posting an intra-day low of $2.74 on Wednesday, shares of Telstra have risen over 8% and are pushing against $3.00 in early trade today.

We cite two fundamental catalysts for the renewed buying interest in the telco giant.

First, the acquisition of Time Warner by ATT in the US has supported the idea of global telecommunication firms increasing revenue by diversifying into media and entertainment.

Second, TLS will be hosting its highly anticipated investor day next Wednesday, June 20th.

Since breaking down through the $3.00 mark on May 15th, shares of TLS have range traded between $2.70 and $2.90.

Much of the negative commentary about the Telco giant has revolved around its ability to hold on to its 47% market share, increase its profit margins via 5-G technology and maintain its dividend.

We feel that these questions will be answered in the affirmative during their business update call on June 20th.

At current prices, TLS has a dividend yield of 7.9% and a P/E ratio of 9.30, which we feel is good value for investors.

Telstra

Shares of TLS have been in a basing pattern above the $3.00 level and there are solid fundamental reasons for accumulating shares in this current range.

Since the share price has slipped over 17% over the last 12 months, the current yield is now close to 10%, including the franking credits.

Mobile is the company’s biggest earner and its most important revenue stream. TLS added 235,00 net new retail customers in H1 compared to 200,000 a year ago and only 18,000 in the June half of 2017.

A recent analyst research letter forecasts the continued dominance in the Telco space, as well as diversification into other data streams will lift the share price into the $4.60 area over the medium-term.

As such, we continue to favor the long side of TLS for value investors looking for growth and a solid dividend.

Telstra

Or start a free thirty day trial for our full service, which includes our ASX Research.