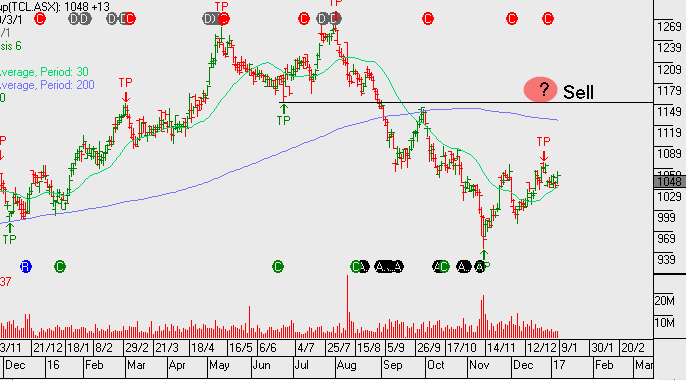

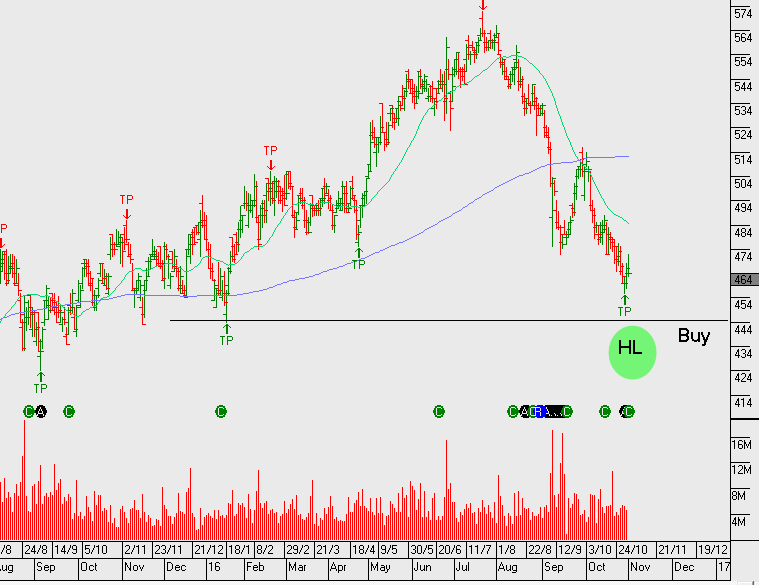

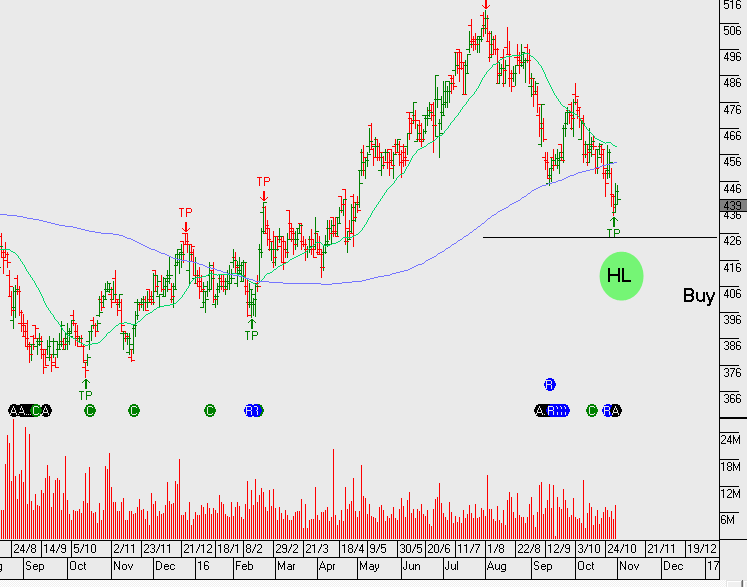

Transurban Lifts H1 profit

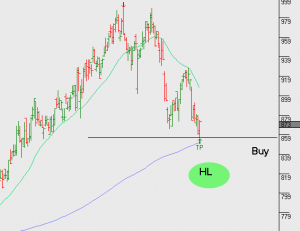

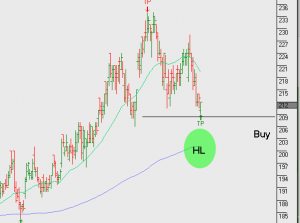

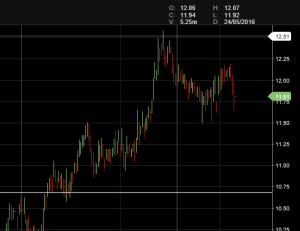

Shares of Transurban are up over 3.5% in early trade as the toll road developer increased H1 net profit 41.9% to $88 million on the back of strong traffic flows and operational performance.

The company also lifted revenue by 26.3% to $1.3 billion in the six months to December 31st.

As a result, Transurban will pay a partially franked interim dividend of 25 cents per share, up from 22.5 cents from the year ago period.

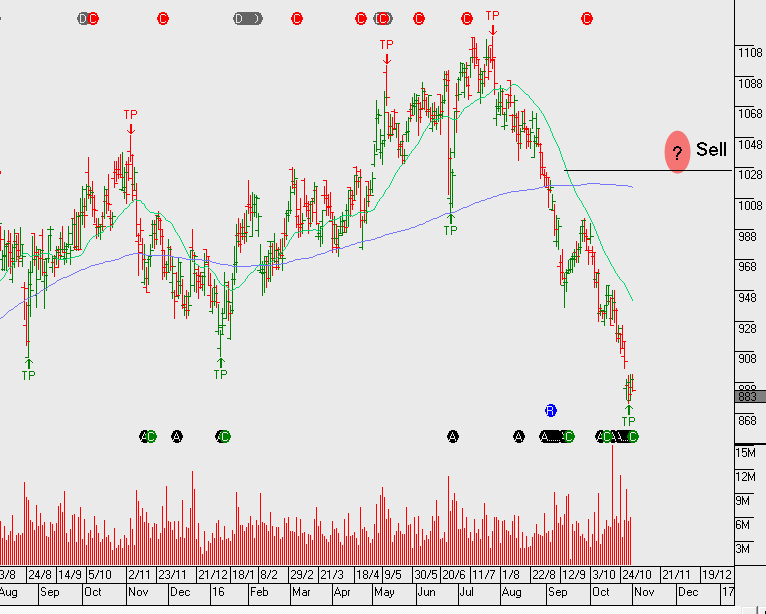

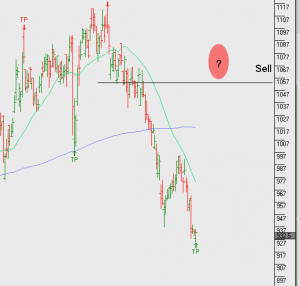

At $10.75 per share, we consider TCL a defensive income play. With limited scope on the upside, we suggest selling covered calls in the $11.25 area for an annual return in the 10 to 12 % range.