Over the last three weeks, shares in local infrastructure and property trusts have really taken a beating.

Some of the yield-sensitive names have lost between 5 and 10% as Australian interest rates in the 2yr to 5yr tenors have followed global interest rates higher.

One of the major aspects of the recent rise in rates has been the consensus amongst G-7 central bankers that the era of low rates and financial stimulus will be coming to an end.

It’s our base case that the market has gotten ahead of itself with the prospects of sustainable higher yields.

With global equity markets still at elevated levels, a material repricing, or “risk-off” period, in the market would increase the demand for “safe haven” government bonds, which would ease rates lower.

The specific stocks that we are following include GPT, TCL and SYD.

The ALGO engine triggered buy signals in these three names at yesterday’s close.

Given the sharp sell off that these names have seen over the last few weeks, we feel the upside potential is an reasonable trade.

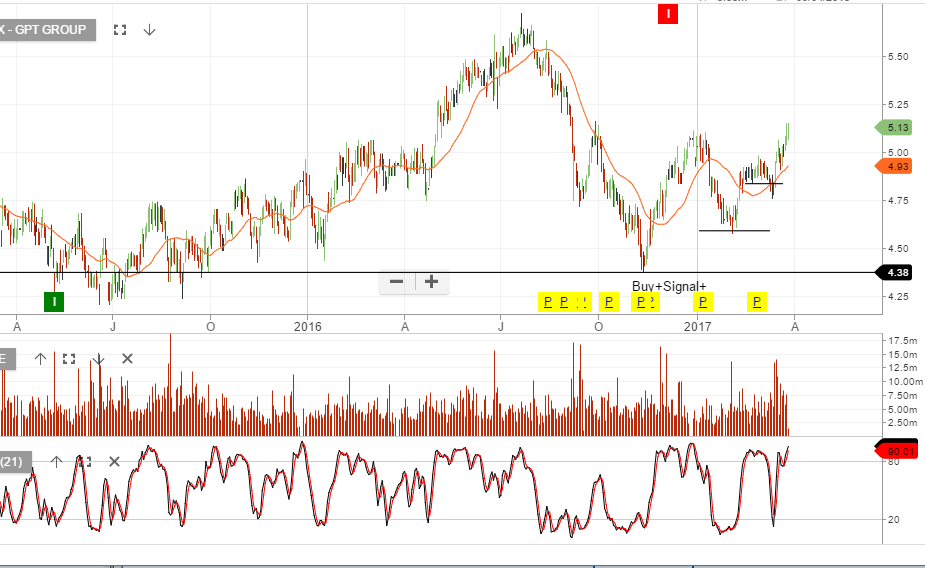

GPT

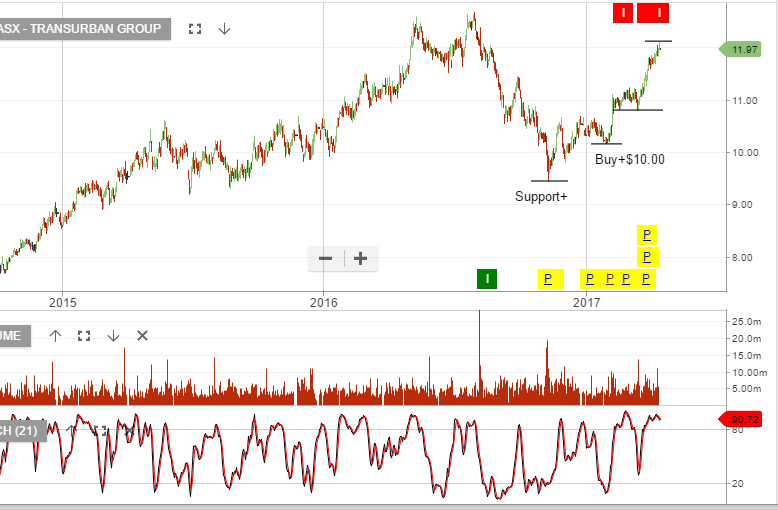

TCL

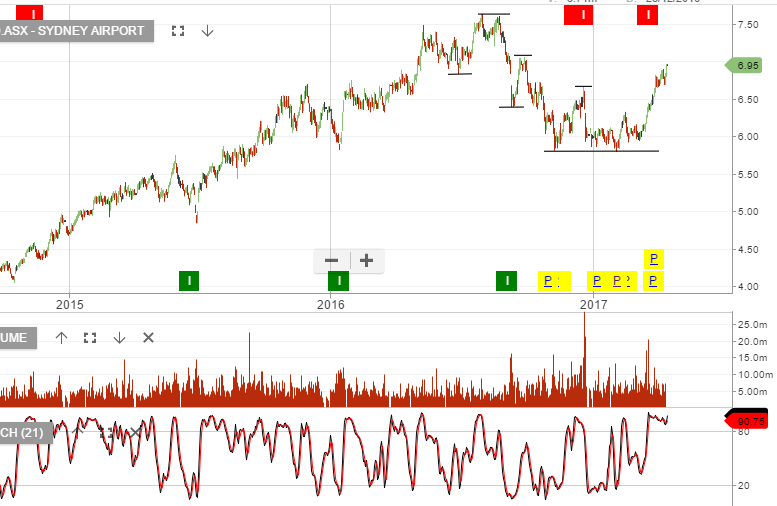

SYD