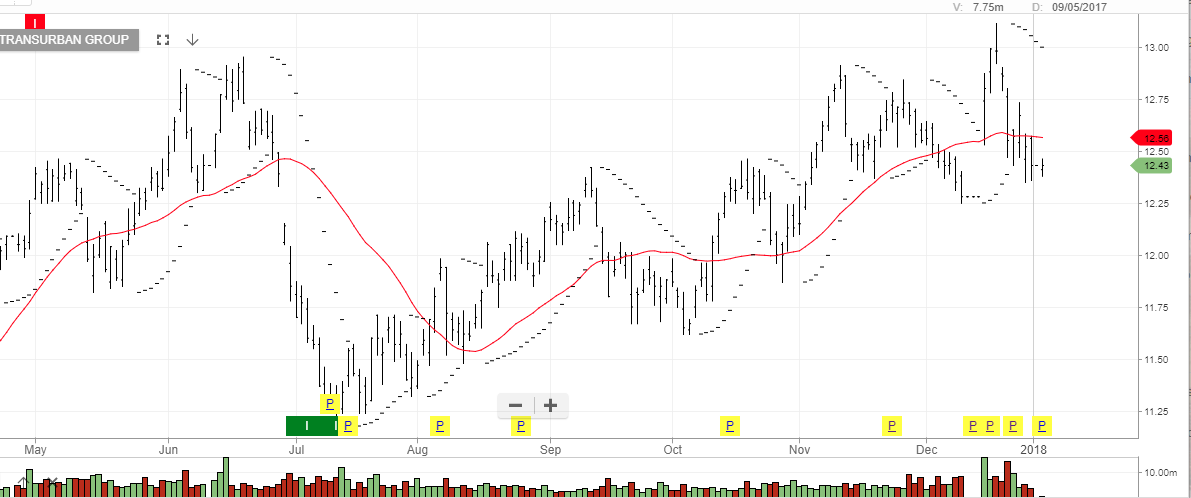

ALGO UPDATE: Stay Long Transurban

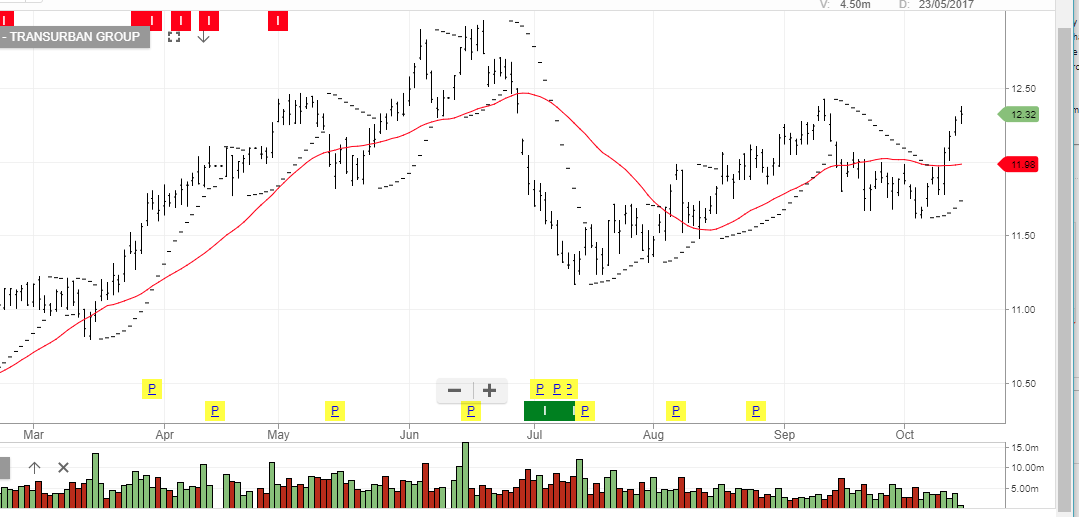

We added TCL to the model portfolio on July 3rd at $11.70 and our ALGO engine triggered a buy signal on July 12th at $11.20.

With its $9 billion pipeline of road projects over the next 7 years, the stock should be well supported with increased longer-term cash-flow numbers.

For the six-month period ending December 31st, TCL will pay 28.5 cents per share and a total of 56 cents per share over fiscal 2018.

This equates to 4.5% with the share price at $12.40 (plus some limited franking credits.)

We see the next resistance level at the December 19th high of $13.15.

Transurban