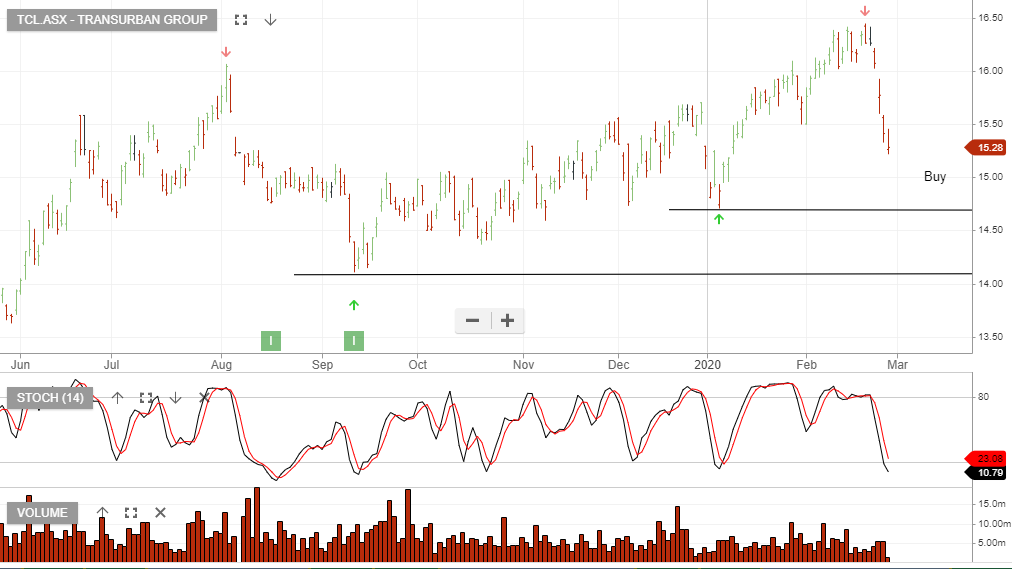

Transurban – Buy

Transurban switched to Algo Engine buy conditions on 30 October at $13.10. The stock has since rallied to $15.60 and has now retraced back 50% to find support at the current price of $14.30.

Investors should watch the short-term momentum indicators as we’re likely to see a pick up in buying interest, supported by an attractive defensive dividend yield.

This could be a short-term trade for the nimble, or a solid entry-level for long-term buy and hold investors. Investors may also consider adding the covered call option to enhance the yield.

For more detail on the option strategy , please call our office on 1300 614 002.

2020

2020