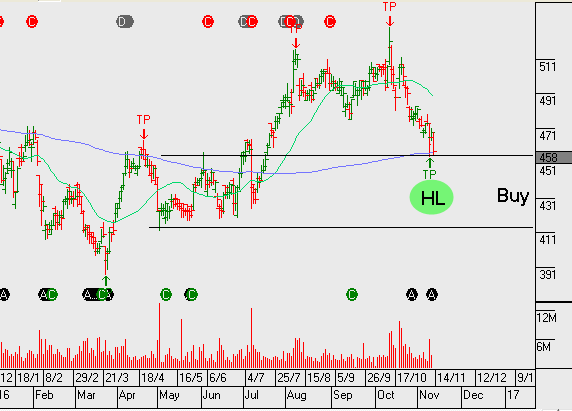

Tabcorp – Value Emerging

Tabcorp is a relatively defensive income opportunity for portfolios, with earnings supported by potential synergy savings after the Tatts integration.

The company continues to progress the merger proposal with Tatts and the ACCC is scheduled to release its statement of issues on the 23rd of February.

By applying a covered call option, we’re able to allow 5 – 10% capital growth from the current price, whilst still generating 10%+ in annualised cash flow from the dividend and call option income.

We expect modest earnings growth into FY18, which will place the stock on a forward yield of 5%. TAH goes ex-div on the 7th of Feb paying out $0.125

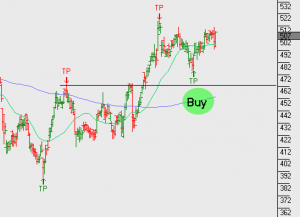

Our buy range for Tabcorp is between $4.20 & $4.50.