ASX Property Fund

SPDR S&P/ASX 200 Listed Property remains a safe play for a diversified exposure to ASX listed top 200 REITS. Add Lendlease to your portfolio for additional uplift. Patience will be required, as both opportunities are counter-cyclical and out of favor. However, in 12 – 24 months’ time, it will be a different story.

SPDR Property Fund: Up 31%

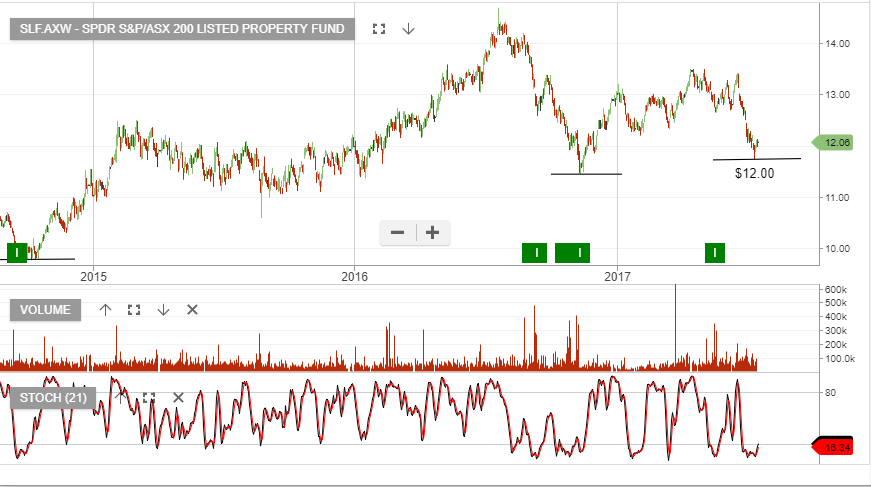

SPDR S&P/ASX 200 Listed Property in under Algo Engine buy conditions since February at $11.30 and In July we’ve seen a further buy signal at $12.50.

SLF provides a basket trade with diversification across the REIT sector. SLF and GMG remain our preferred property allocations.

13/12 Update: The SLF continues to push higher and the ETF is now up 31% since being added to the All ETF model portfolio.

SPDR Property Fund

SPDR S&P/ASX 200 Listed Property in under Algo Engine buy conditions since February at $11.30 and In July we’ve seen a further buy signal at $12.50.

SLF provides a basket trade with diversification across the REIT sector. SLF and GMG remain our preferred property allocations.

SPDR Property Fund

SPDR S&P/ASX 200 Listed Property in under Algo Engine buy conditions since February at $11.30. This week we’ve seen a further buy signal on the recent pullback to $12.50.

The SLF provides a basket trade with diversification across the REIT sector. SLF and GMG remain our preferred property allocations.

ETf Watch – ASX Listed Property Fund

Our Algo Engine recently triggered a buy signal in a number of ASX listed REIT’s as well as the SPDR Property Fund ETF.

Looking at the buying interest in US REITs across the last few trading sessions, we anticipate similar support for the sector on our local market.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.