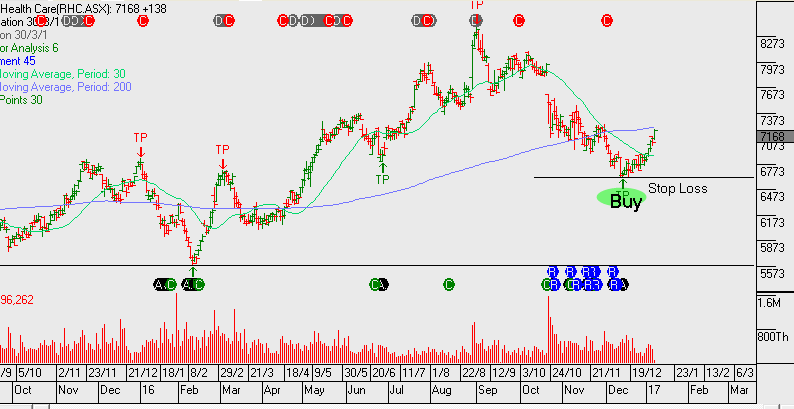

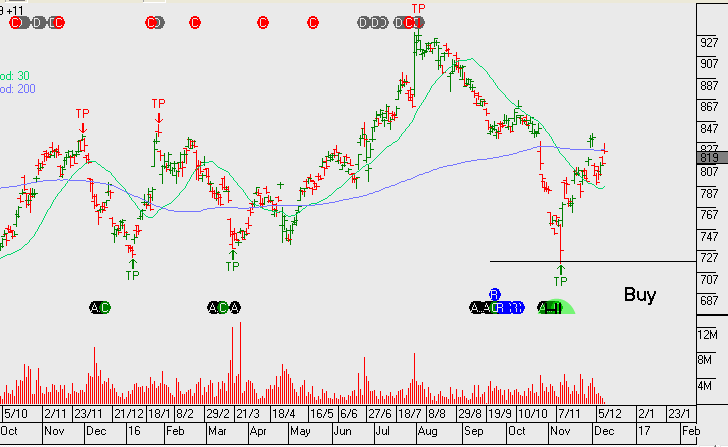

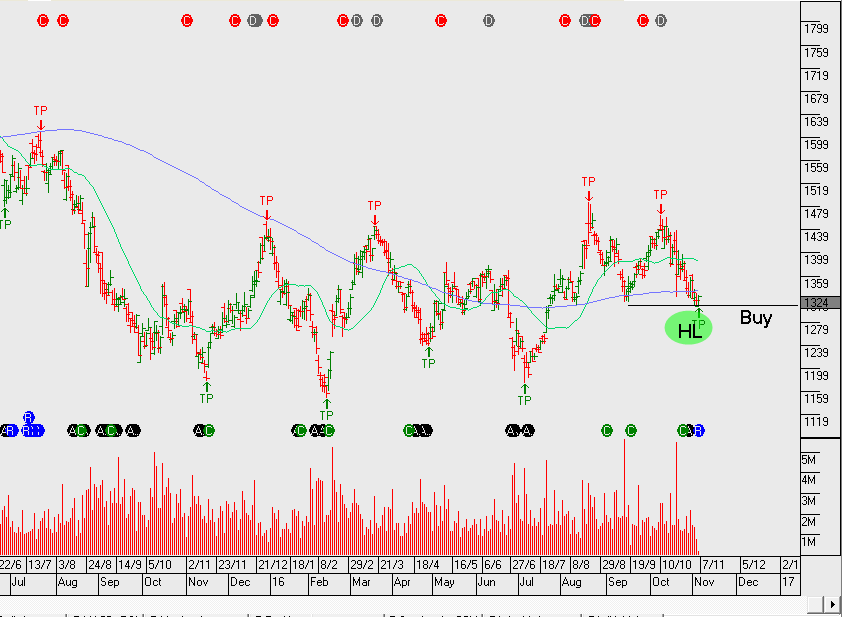

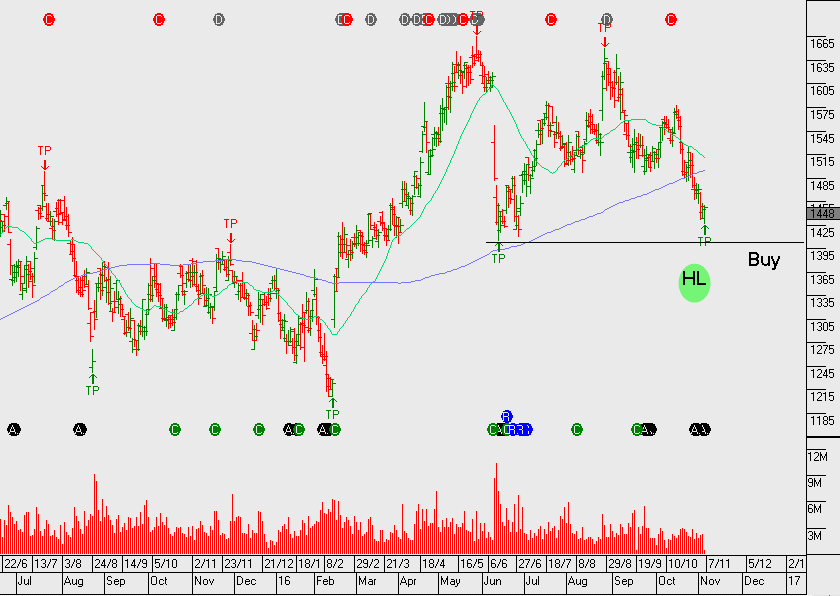

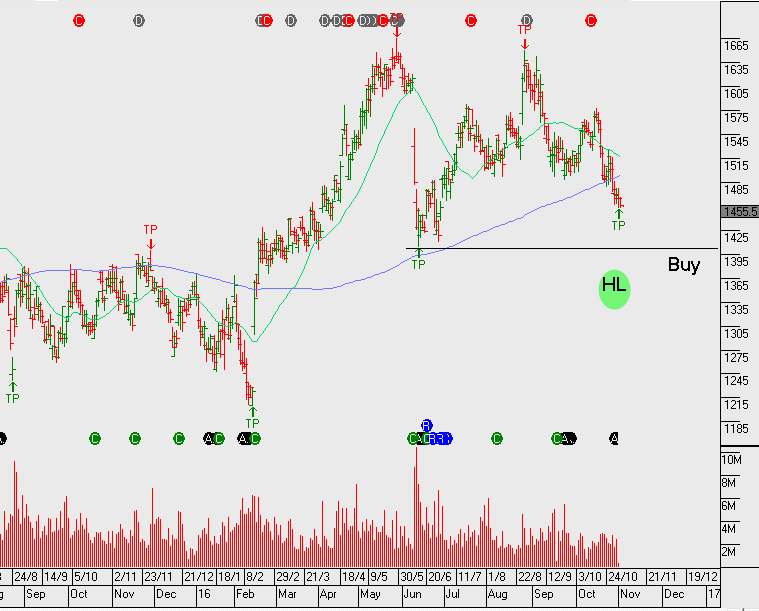

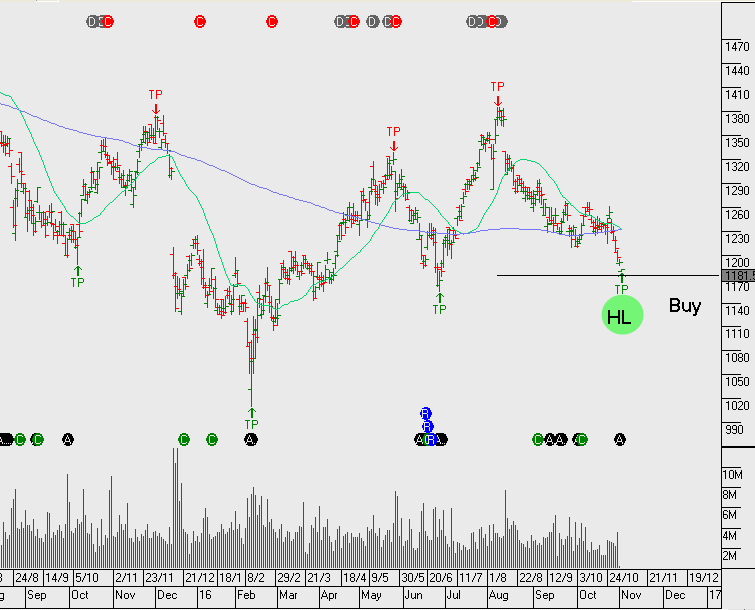

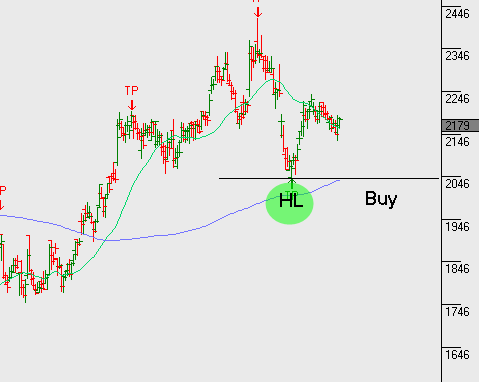

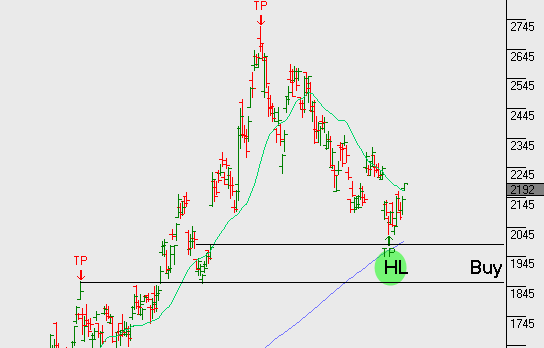

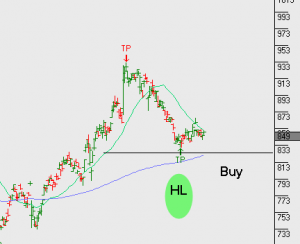

The following group of stocks are in either established uptrends or, in recent months they’ve broken downtrends to begin building the early stages of a bullish “higher low” formation.

Many of these names have been mentioned previously in the blog and/or the monthly strategy video report. It’s worth loading these codes into your watch list and considering rebalancing your portfolio to include allocations towards some, or all of these names:

JHX, LLC, MQG, SHL, TWE, ANN, ANZ, ASX, CCL, CIM, COH, QUB, TAH, WOW & WPL.

With the lower growth names within the above basket, such as WOW & CCL, we compliment the position now with tight covered calls to enhance the yield to 10%+ per annum. With some of the other names, we give a little more breathing space as we expect 5 to 10% price appreciation before selling the call option overlay.