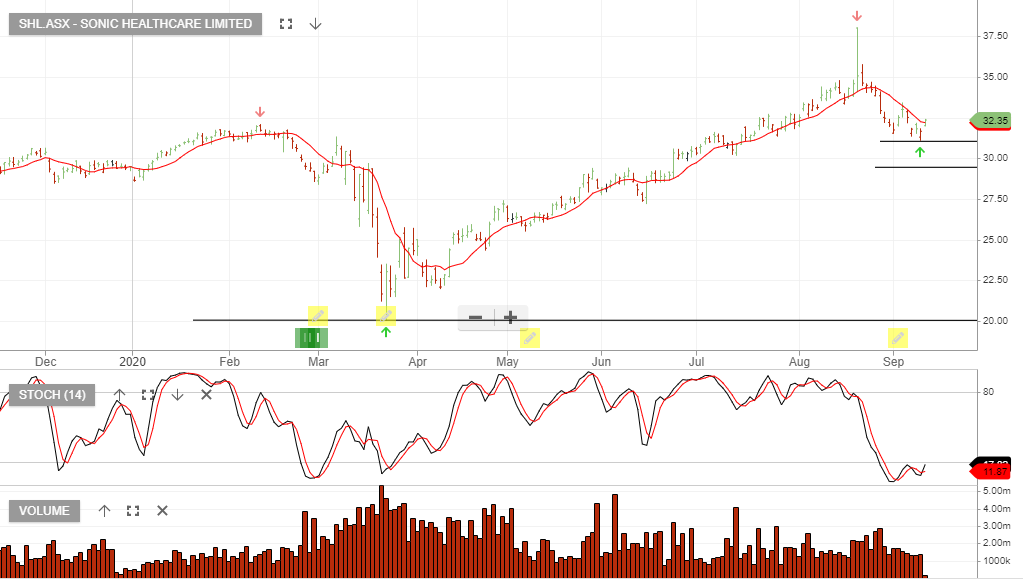

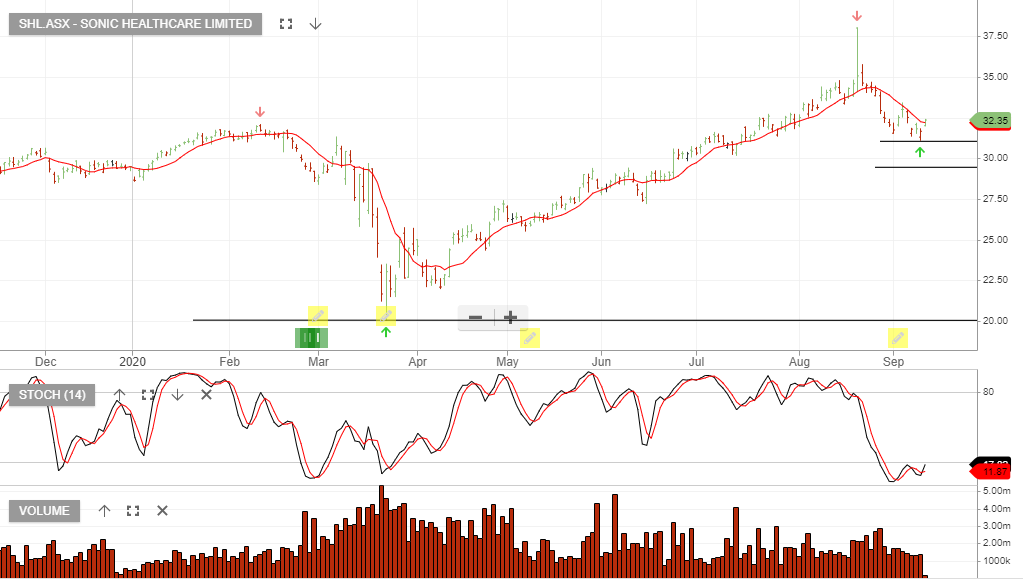

Sonic Healthcare

Sonic Healthcare has found buying support at the top of our entry range. Adding a $32.50 October call option generates $0.95 of income.

Sonic Healthcare has found buying support at the top of our entry range. Adding a $32.50 October call option generates $0.95 of income.

Sonic Healthcare FY21 revenue +5% to $7.4bn and EBIT growth of 5%+ supports a forward yield of 3%.

FY21 EBITDA estimates, range from $1.5bn – $1.75bn.

Buy Sonic within the $30 – $32 price range, as indicated below.

Sonic Healthcare is now trading below $26.00 and we suggest investors begin accumulating the stock within the $25 – $26 price range.

Sonic Healthcare rallied 10% higher from today’s open price.

Although Sonic has withdrawn its FY20 earnings guidance, (EBITDA

growth 6-8% cc) due to COVID-19, the company has a strong balance sheet with $1bn of cash and committed credit facilities available with no debt facilities maturing until 2021.

Sonic Healthcare is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

We see value emerging and upgrade SHL to accumulate.

Sonic Healthcare is under Algo Engine sell conditions, however, we take the time to look at the financial outlook of the business, following yesterday’s FY19 result.

FY19 sales revenue was up 11.6% and EBIT growth increased by 10%.

Excluding any FX benefit, we expect Sonic to grow FY20 EBITDA at 6 – 8%, which will support a forward yield of 3.2%.

The stock is trading on FY20 PE of 23x earnings and we will look to buy SHL on the next Algo Engine buy signal.

Sonic Healthcare reported a 1H19 result that was in line with consensus expectations. Moderate single digit earnings continue to flow through from Australia, US and Germany.

FY20 forecasts are for 3 – 4% EPS growth. We consider the stock slightly expensive and look to buy on a the next pullback.

At $22.50 Sonic Healthcare is looking like good value.

Whilst earnings growth is only in the 3 – 4 % range, owning it at the current price and selling out of the money call options makes sense.

SHL goes ex-dividend for 32 cents on the 6th of March.

When combined with the call option income, the strategy is generating 10% p/a cash flow.

Sonic Healthcare

Sonic Healthcare is one of our preferred opportunities in the current market.

We suggest accumulating the stock and looking to sell covered call options to enhance the return.

SHL has re-affirmed FY19 earnings and guidance was lifted slightly, the new earnings growth range now sits between 6- 8%.

Based on FY19 earnings, we have SHL now trading on a forward yield of 4%.

Sonic Healthcare

Sonic Healthcare

Sonic Healthcare is looking oversold and we believe buying support will build within the $21.50 – $22.50 price range.

SHL has a large percentage of their diagnostic equipment revenue based in US Dollars. As such, the company will benefit from the lower Aussie Dollar.

Or start a free thirty day trial for our full service, which includes our ASX Research.