Property Trusts & Infrastructure

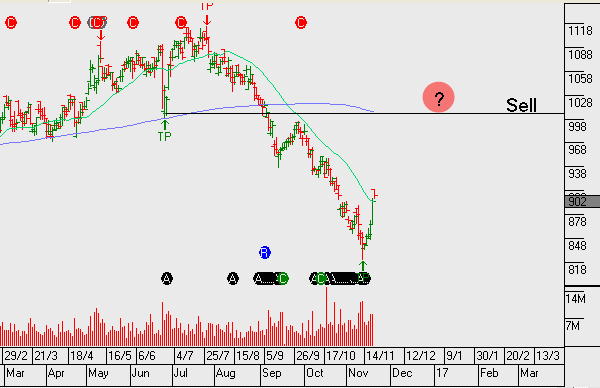

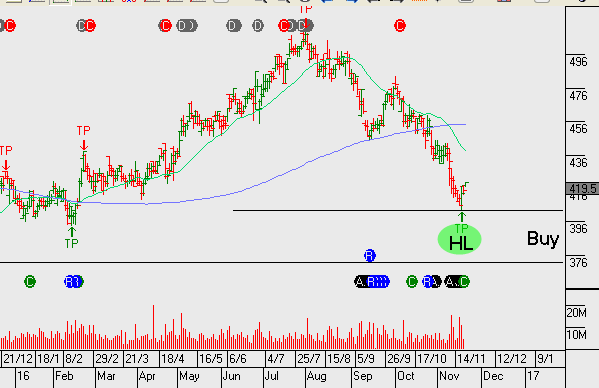

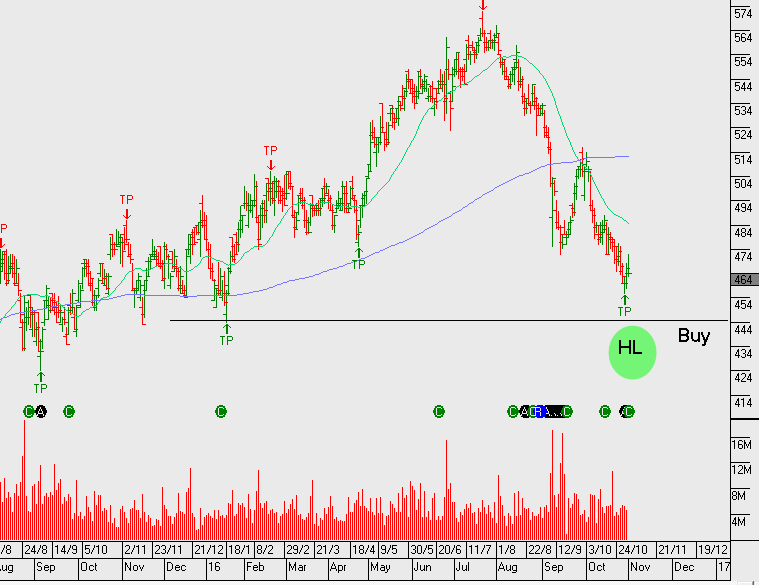

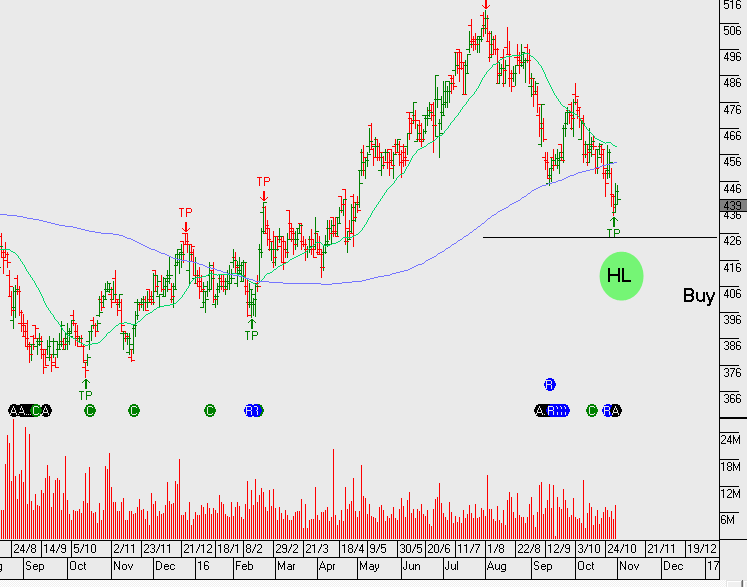

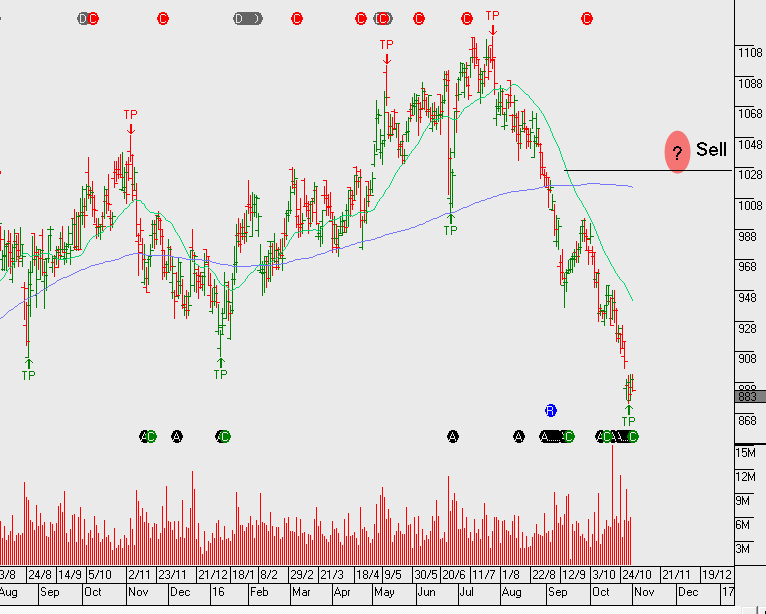

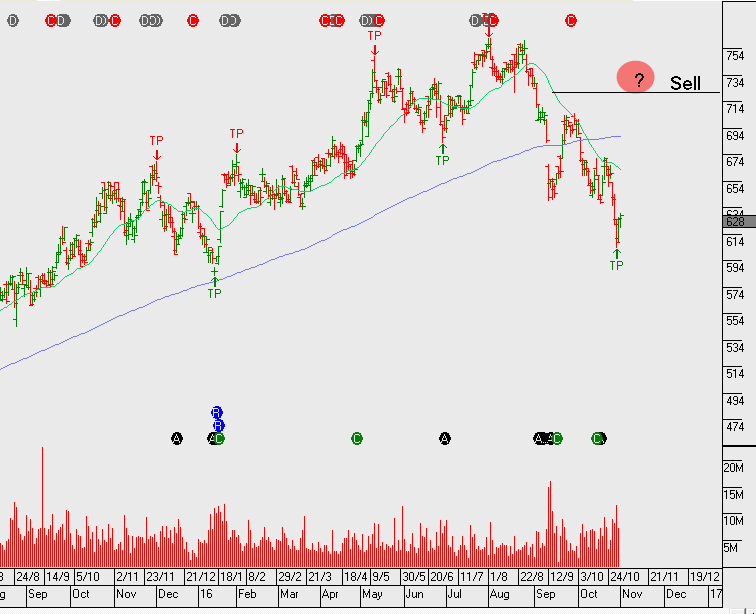

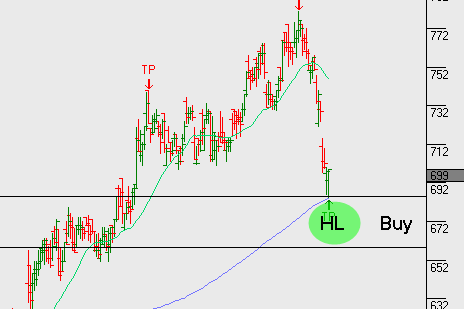

The sell-off in property trusts and infrastructure names has been substantial, 15 to 20% since early September.

The REIT sector has underperformed as bond yields have rallied. The repricing has seen the dividend yield of REIT’s back above 5%.

Historically, the correlation between Australian yield names and US 10-year yields has been inverse; as US yields fall, Australian property trusts and infrastructure stocks rise.

US 10-year bond yields have risen by 79 basis points, or over 50%, since early October. We see this pace as unsustainable and expect the local yield names to trade higher as the US Treasury yields drift lower.

We continue to track WFD, GPT, SGP, SYD and TCL versus the US10 year bond yields.