Oil and Metals

Copper prices jumped today as Chinese inflation data picked up last month, sending a reassuring signal about demand from the world’s largest consumer of industrial metals. China’s Producer Price Index rose 5.5% last month, which was better than the market expectation of 3.3%

The forward month red metal was up 2.9% at $2.60 per pound, posting its largest one-day gain in two months on the COMEX exchange in New York. A reduction in copper stocks at the LME will add short-term support to the upside for prices.

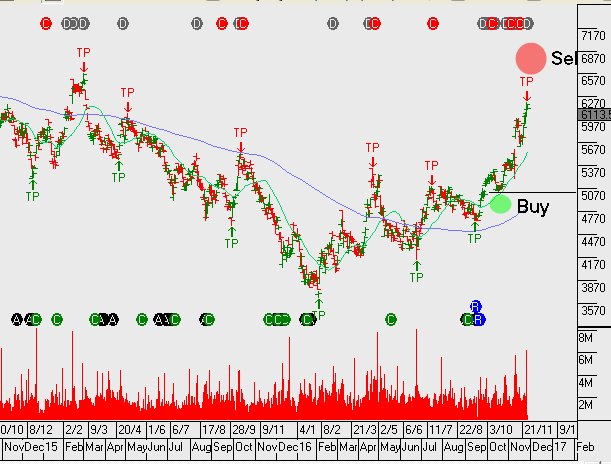

We expect to see firm resistance in the $2.74 area, which represents a “double top” chart pattern dating back to November.

A surprise jump in US inventory data extended the recent down move in crude oil prices. We now see solid support around the $50.00 level.

We still like the long side of oil names but feel investors should be adding covered call options to WPL and OSH to enhance the yield.

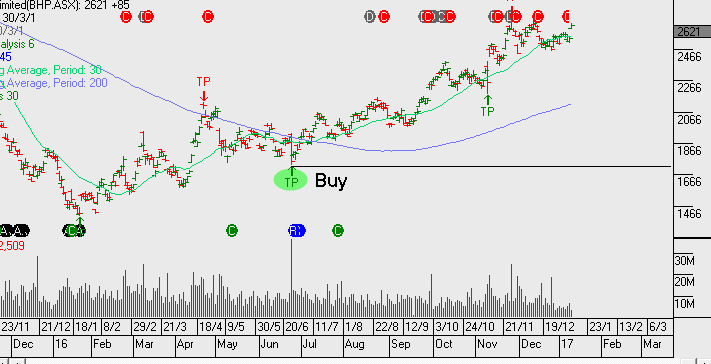

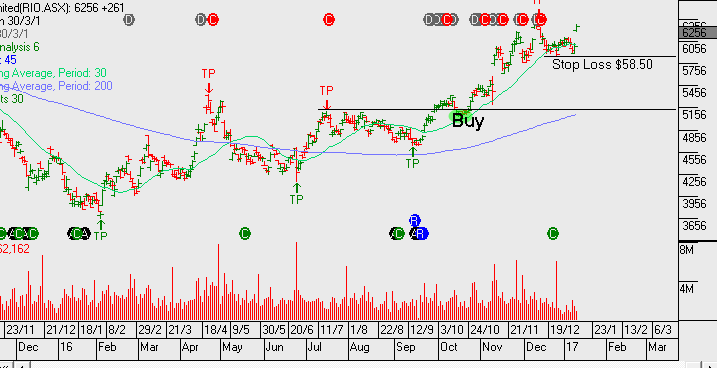

We’ve allowed upside to $27 in BHP and upside in RIO to $63 before capping out our short term gains.