RIO’s CEO Flags A Chinese Slowdown

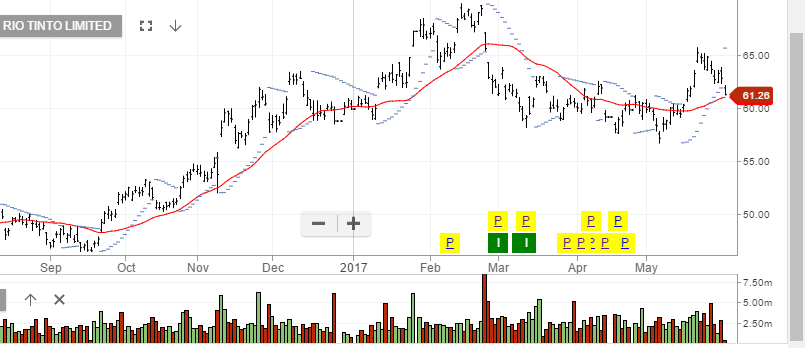

Shares of mining giant RIO Tinto are over 1% lower at $71.25 as company CEO, Jean-Sebastian Jacques expressed a negative view on the Chinese economy over the near-term.

While addressing investors in Sydney yesterday, Mr Jacques predicted a slowdown in construction, infrastructure growth and automotive demand from China over the next six months.

The company also announced that they would close some Iron Ore mines over the Christmas break as part of their “value over volume” strategy. Even with high-grade Iron Ore price firming over the last 6-weeks, we consider the CEO’s message a negative signal for RIO shares.

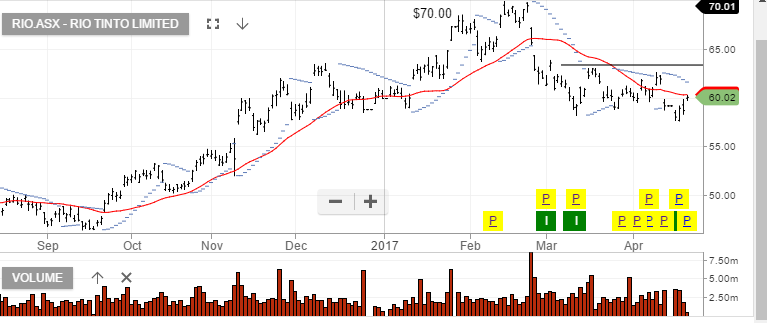

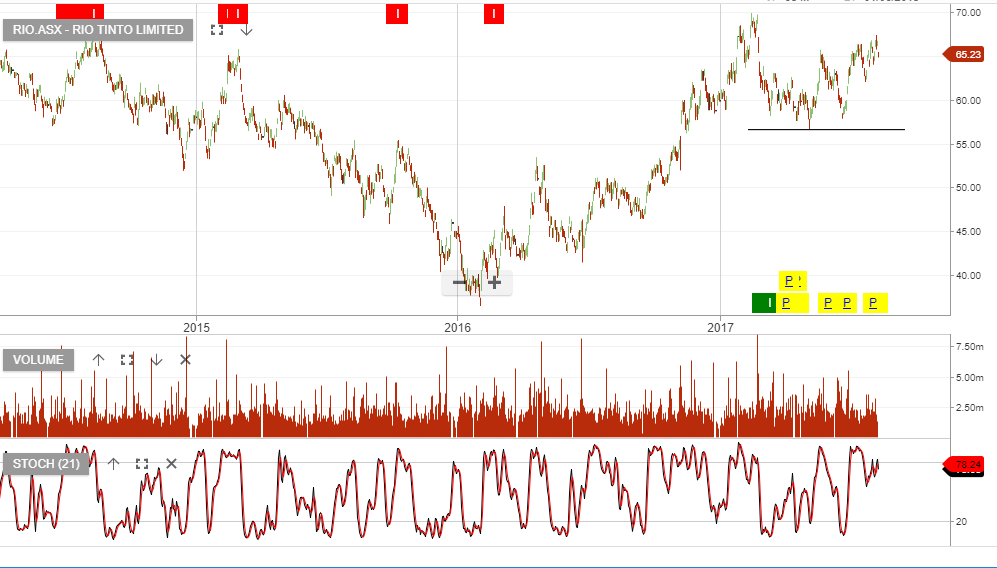

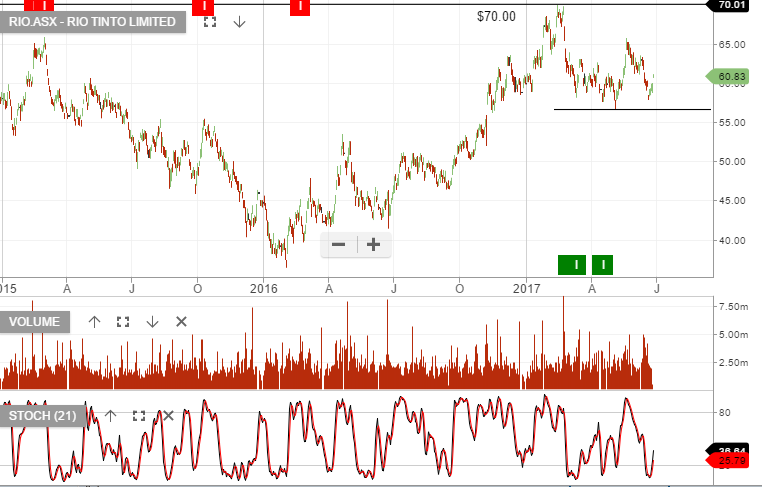

Our ALGO engine triggered a buy signal in RIO back in April at $61.40. Even though the ALGO engine has not triggered a sell signal, we suggest investors can take profits on long RIO exposure, sell a covered call to enhance cash flow, or go short the RIO CFD on our SAXO Go Platform

The next significant level on the daily charts is near the October low of $68.50.

RIO Tinto

ASX XJO Index

ASX XJO Index

Rio Tinto

Rio Tinto BHP

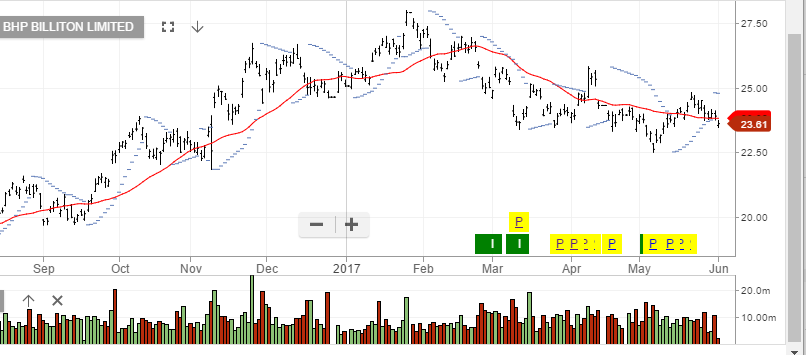

BHP