Rio – Algo Buy Conditions

Rio Tinto is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We expect to see buying interest pick up near the current $93 price level.

Rio Tinto is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We expect to see buying interest pick up near the current $93 price level.

Rio Tinto is now showing an Algo Engine buy signal and has been added into our ASX 100 model portfolio.

We see value emerging and consider the $82 – $87 price range as a good entry-level.

Rio Tinto reported their June quarter production which was in line with market consensus.

If we assume a slight softening in Iron Ore prices next year, (back below US$100 per tonne), RIO will produce $45bn in FY20 revenue and generate EBITDA of $20bn. Underlying reported FY20 profit will be $10bn, which will sustain a 5.5% yield based on dividends per share of $4.50.

Within the resource space, we continue to prefer BHP over RIO and within the energy complex WPL and ORG.

We also like the look of Oz Minerals.

Spot iron ore prices have rallied in the past days on the news of a second catastrophic tailings dam failure at a Vale-owned mine in Brazil.

Exceptions of reduced supply impacting the market, has driven up short term spot prices. Although, Iron Ores prices have been on a steady climb since the November low.

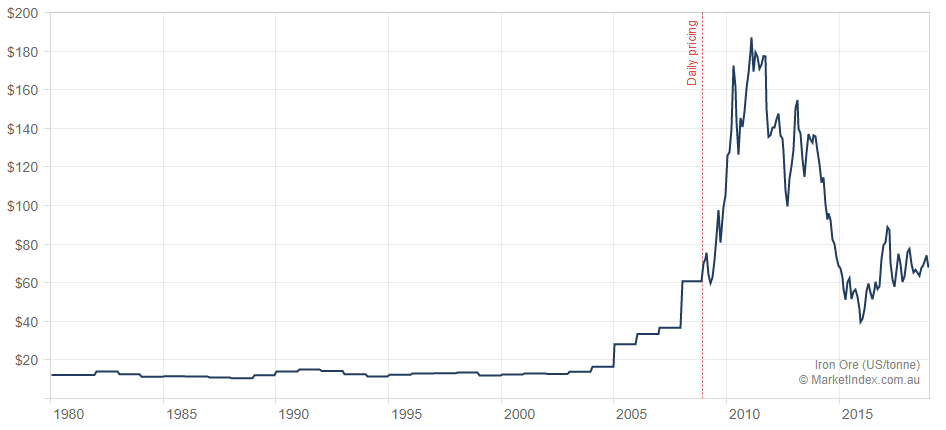

Long-term Iron Ore price chart.

We remain cautious of a potential pullback in RIO, BHP and FMG following the run up in prices and Algo Engine sell conditions.

Our preference continues to be in the energy names with OSH and WPL our core exposures.

Our ALGO engine triggered a sell signal for RIO Tinto into yesterday’s ASX close at $79.50.

This “lower high” pattern is referenced to the intra-day high of $82.20 posted on August 1st.

RIO has also been removed from our ASX Top 100 model portfolio after achieving a 29.50% gain (and over $5.00 in dividends) over the last 569 days.

Since trading as low as $69.40 on September 6th, RIO’s share price has rallied over 15% in less than two weeks reaching a high of $80.00 on Friday.

We believe two of the reasons for the recent investor interest are the stabilization of the raw materials market and the announcement of RIO’s massive share buy back scheme.

According to a company release, RIO plans off-market purchases of up to 41 million of its ASX listed shares as well as on-market purchases of its UK listed shares.

In total, the plan could equal over $4.5 billion in capital returned to share holders.

As such, we feel the strong fundamentals driving the recent surge in the stock price will result in a near-term consolidation, as opposed to a change in trend to the downside.

Rio Tinto

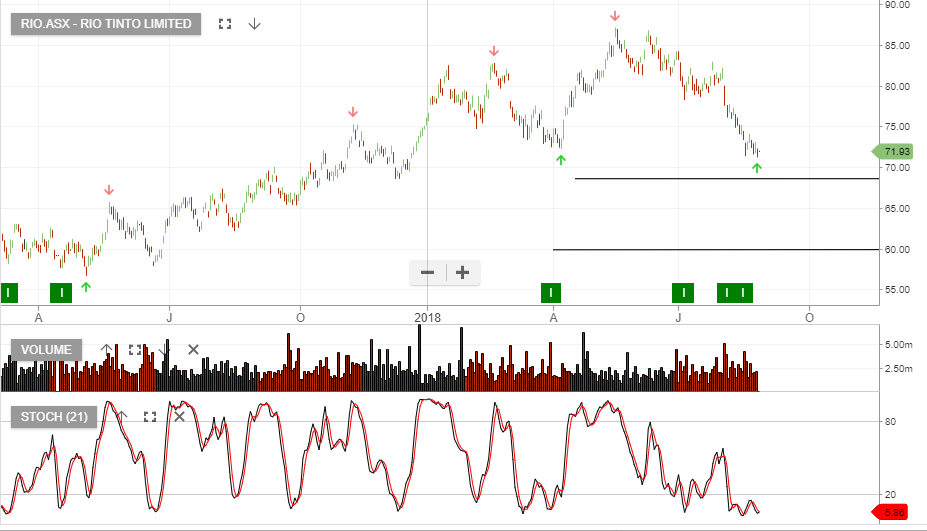

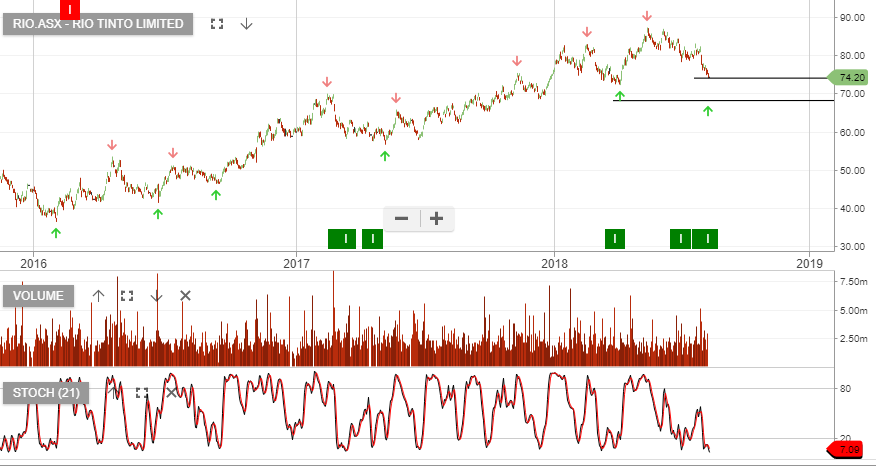

Our Algo Engine generated a buy signal recently in RIO following the “higher low” formation at $71.00

RIO will soon complete US$11 billion + in asset disposals and further realization of their portfolio is likely. With net debt now at historically low levels, we expect the bulk of this cash to be returned to shareholders via buy-backs and dividends.

Iron Ore prices appear to be steady at around US$63 p/t. We recommend accumulating RIO shares within the $65 – $73 range.

RIO

Our Algo Engine generated a buy signal in RIO and the chart below highlights the indicated “buy zone”.

Investors can look to accumulate within $68 – $74 range.

Rio Tinto

Our ALGO engine triggered a buy signal for RIO Tinto into the ASX close yesterday at $76.50.

This “higher low” chart pattern is referenced to the intra-day low of $72.30 posted on April 9th.

Despite the announced expansion of their share buyback program, RIO’s share price slid more than 5% last week to hit a 3-month low of $76.15.

We calculate that the stock is currently on a 4.5% yield and will go ex-dividend for US $1.70 on Thursday the 9th of August.

From a technical perspective, we see solid support in the $73.25 area.

Rio Tinto

RIO’s 1H 2018 earnings result was slightly below the consensus forecast with underlying EBITDA of US$9.2 billion.

If we assume flat earnings and dividend growth over the next 12 months, it places RIO on forward yield of 4.5%.

Returning cash to share holders through an increased share buy back program, (largely proceeds from asset sales), will help to underpin RIO’s current share price.

We recommend investors add a covered call option to enhance the income returns.

RIO goes ex-dividend US$1.70 on the 9th August.

Rio Tinto

Our Algo Engine triggered a buy signal recently in RIO at $79.00.

We retain our “buy” bias on RIO heading into the 1H earnings result on the 1st of August. Half year forecast net profit after tax is estimated at $4.6b

The result will likely be ahead of analysts forecasts and the company should also announce an increase to their share buy-back program.

RIO goes ex-div $1.40 on the 10th August.

Rio Tinto

Rio Tinto

Or start a free thirty day trial for our full service, which includes our ASX Research.