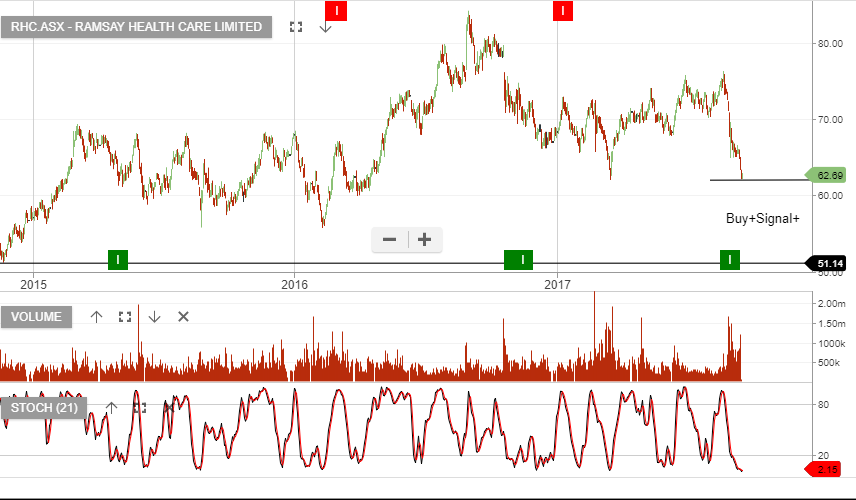

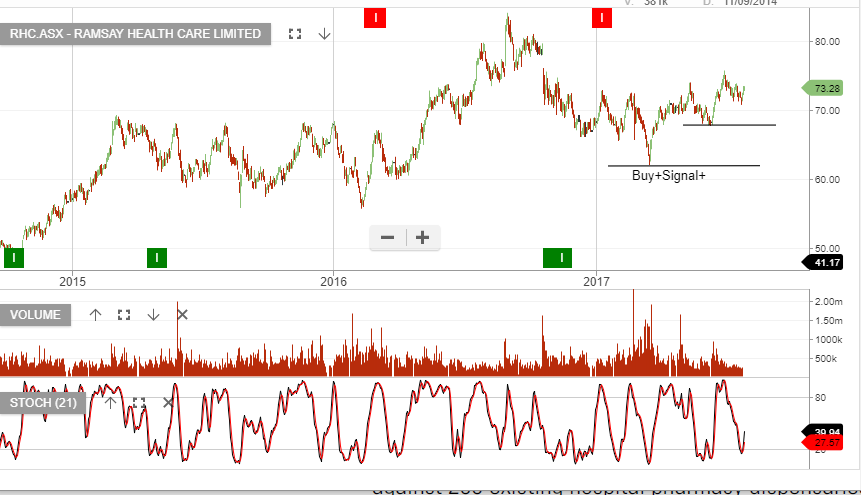

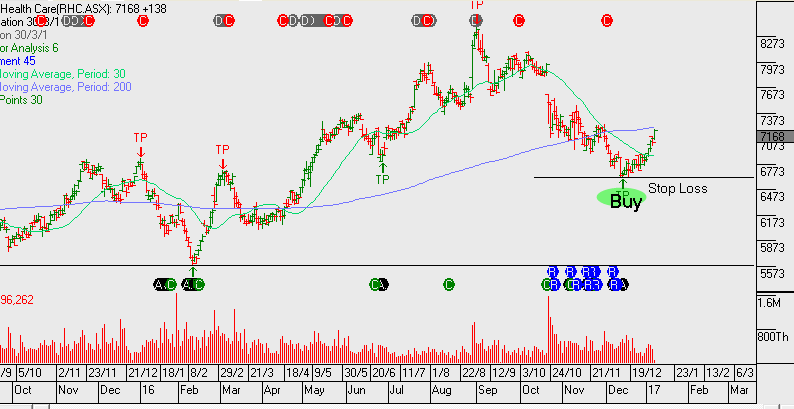

After posting a 6-month low of $61.05, shares of RHC rebounded Friday afternoon to close the week at $61.85.

RHC shares traded as high $76.15 on August 22nd and have dropped almost 20% over the last month.

While there’s no guarantee that the $61.00 level is the medium-term turning point, we believe that value investors will do very well to start scaling into long positions at the current share price.

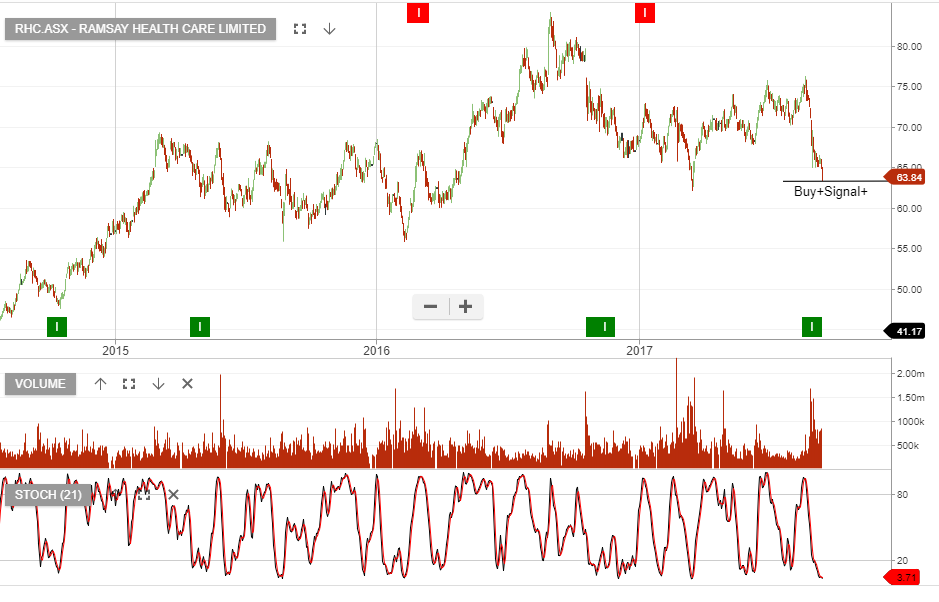

Core earnings per share are expected to grow by 8% to 10% in FY 2018, and the company’s global footprint now extends to 25,000 hospital beds and 1,150 operating theatres across its 221 hospitals and 13 health care and treatment facilities.

Further, as the company generates over 40% of its revenue outside of Australia, when the AUD/USD resumes its down trend, RHC is well placed to benefit from favorable currency movements.

Ramsay Health Care

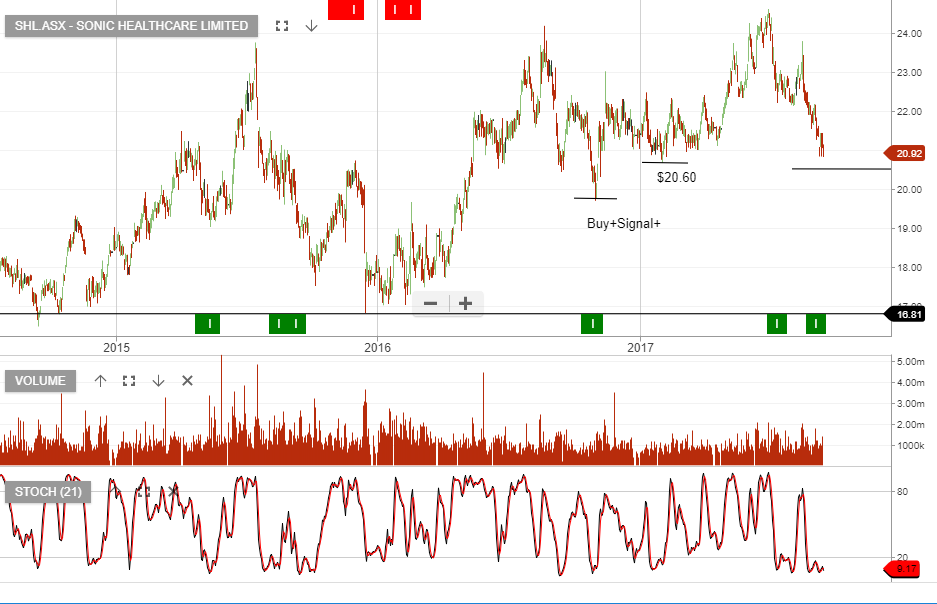

Ramsay Health Care

Ramsay Health Care

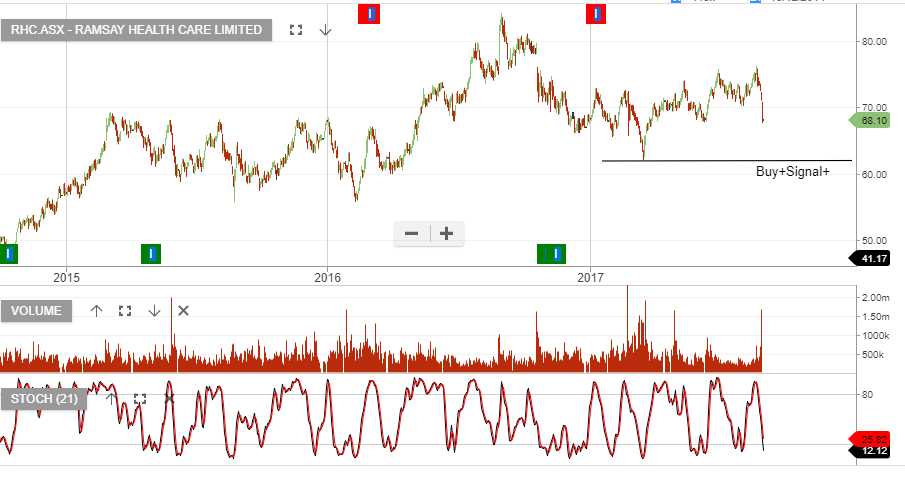

Ramsay Health Care