Ramsay Healthcare – Buy

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

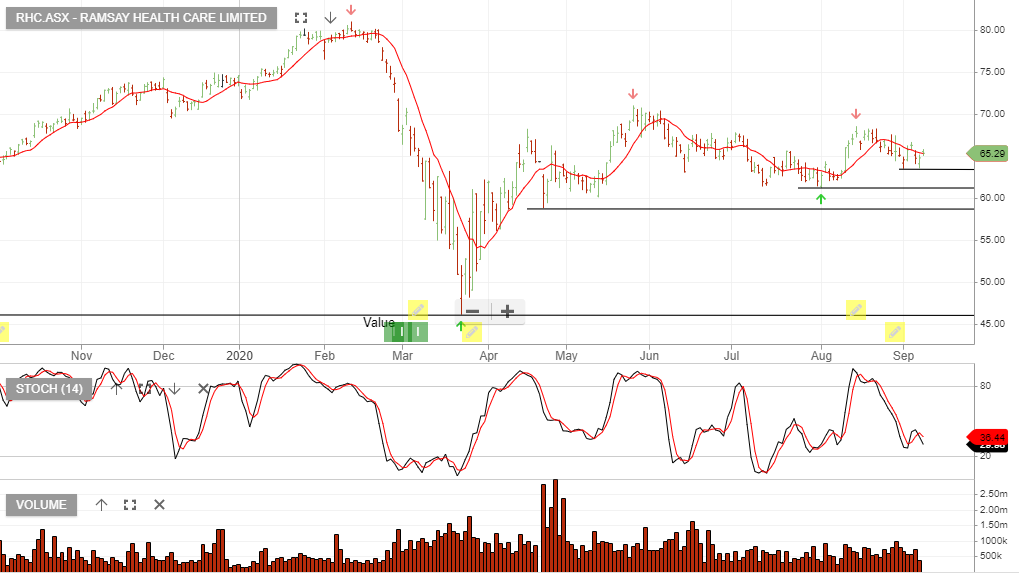

Valuation support within the $61 – $65 range.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Valuation support within the $61 – $65 range.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Valuation support within the $61 – $63 range.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Valuation support within the $61 – $63 range.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Valuation support within the $61 – $63 range.

Ramsay Health Care is under Algo Engine buy conditions and is a current holding in our model portfolio.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

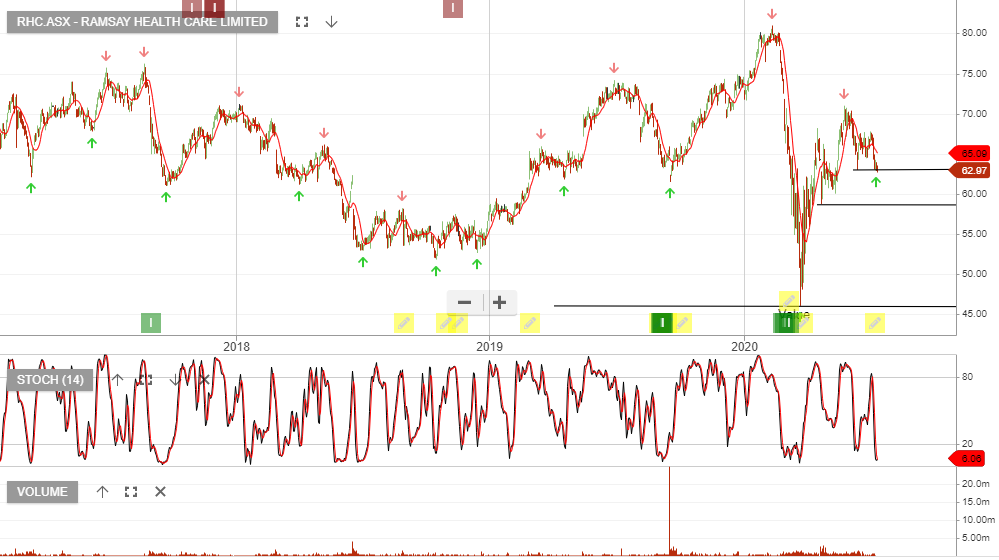

RHC delivered 8% revenue growth in FY20, with a strong 1H more than offsetting the 4% decline experienced in 2H.

Australia suffered the greatest contraction in 2H, down 8% on the same time last year. UK revenue growth remained solid, up almost 5%.

Based on normalization in FY22 earnings, we have the stock trading on a forward yield of 2.2%.

Buy Ramsay Health Care within the $61 – $65 price range.

Ramsay Health Care is faced with flat earnings in 2020 and only moderate growth FY21. For patient long-term investors, there’s an income opportunity with defensive low levels of growth.

We see buying support increasing near the $60 level.

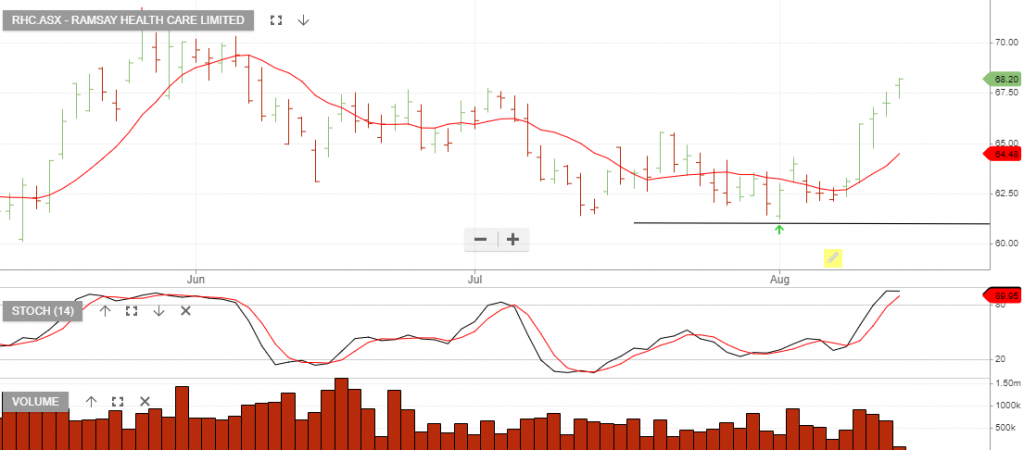

The above post is from early August when RHC was trading in the $60 – $62 price range. The stock is now approaching $70 and short-term traders can consider taking profit between $68 – $70.

Or start a free thirty day trial for our full service, which includes our ASX Research.