Pro Medicus

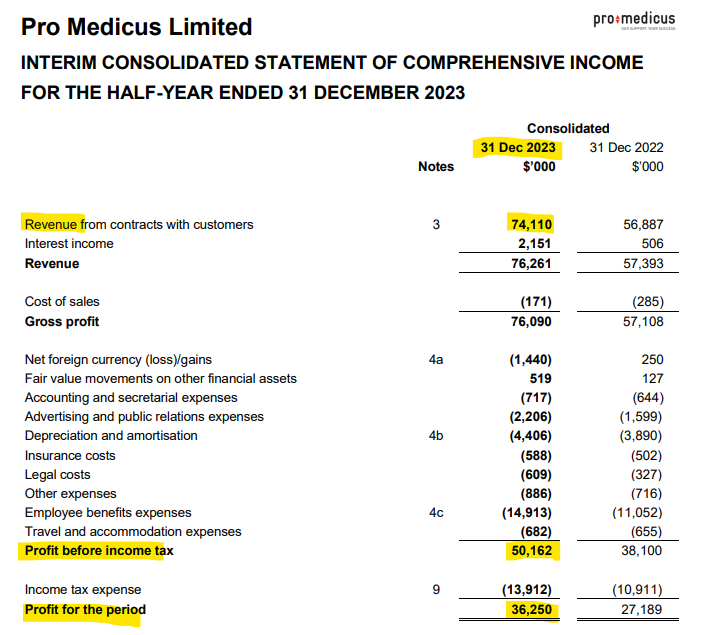

Pro Medicus’ profit jumped 42.7 per cent in the half-year to December after the company won and renewed several key contracts.

Profit rose to a record $51.7 million, while revenue rose by almost one-third to a record $97.2 million.

Pro Medicus’ profit jumped 42.7 per cent in the half-year to December after the company won and renewed several key contracts.

Profit rose to a record $51.7 million, while revenue rose by almost one-third to a record $97.2 million.

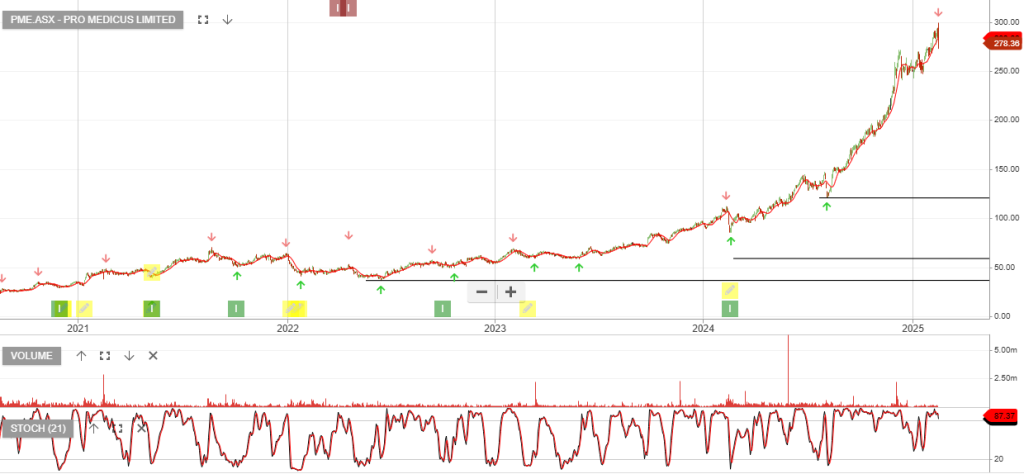

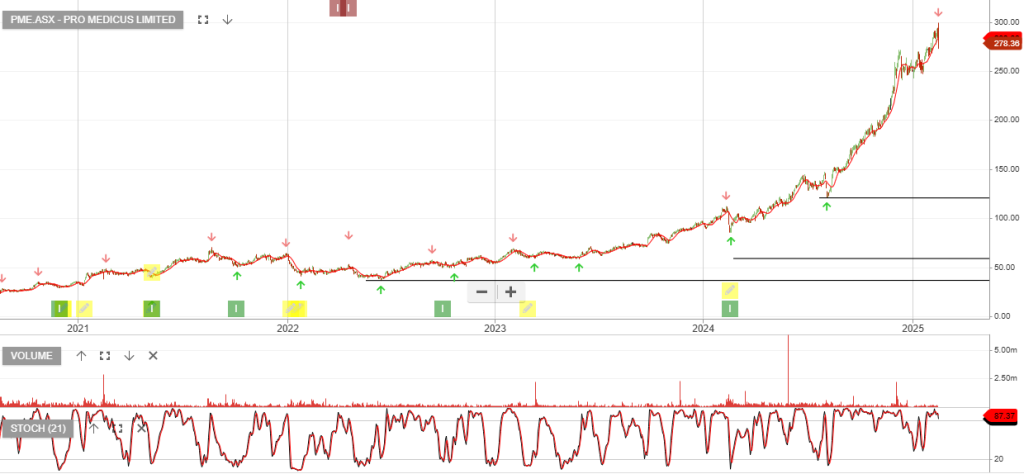

Pro Medicus is among the best growth companies on the ASX.

Revenue from contracts with customers for the 6-month period increased from $56.89m to $74.11m, an increase of 30.3%.

The Company reported a first-half after-tax profit of $36.25m, an increase of $9.06m (up 33.3%) compared to the same period last year

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Pro Medicus is up 100% since the buy signal back in July 2020.

While the stock trades on a very high multiple 100x FY22 earnings, the 40%+ revenue and profit growth is supported by long-term contract wins. Watch for buying interest to build within the range indicated.

Pro Medicus is up 100% since the buy signal back in July 2020.

While the stock trades on a very high multiple 100x FY22 earnings, the 40%+ revenue and profit growth is supported by long-term contract wins. Watch for buying interest to build within the range indicated.

Pro Medicus is up 100% since the buy signal back in July 2020.

While the stock trades on a very high multiple 120x FY22 earnings, the 40%+ revenue, and profit growth is supported by long-term contract wins. Watch for another Algo Engine buy signal on the current price retracement.

Pro Medicus remains under algo engine buy conditions after rallying from the November entry level at $30.

The current retracement from $50 to $39 means investors should now be watching the short-term momentum indicators for a turn higher. We continue to like the long-term growth profile of Pro Medicus.

For more detail on the strategy, please call our office on 1300 614 002.

Pro Medicus remains under algo engine buy conditions after rallying from the November entry level at $30.

The current retracement from $50 to $41 means investors should now be watching the short-term momentum indicators for a turn higher. We continue to like the long-term growth profile of Pro Medicus.

For more detail on the strategy, please call our office on 1300 614 002.

Pro Medicus is under algo engine buy signals and has created a recent higher low from the $31 support level.

The company trades on a high PE but offers an attractive technology play into global healthcare.

Pro Medicus is now under algo engine buy signals after rallying 40% from the original buy signal back in July.

The current retracement from $35 to $29 means investors should be watching the short-term momentum indicators for a turn higher and apply a stop loss on a break below support or a turn lower in the momentum indicators.

For more detail on the strategy, please call our office on 1300 614 002.

Or start a free thirty day trial for our full service, which includes our ASX Research.