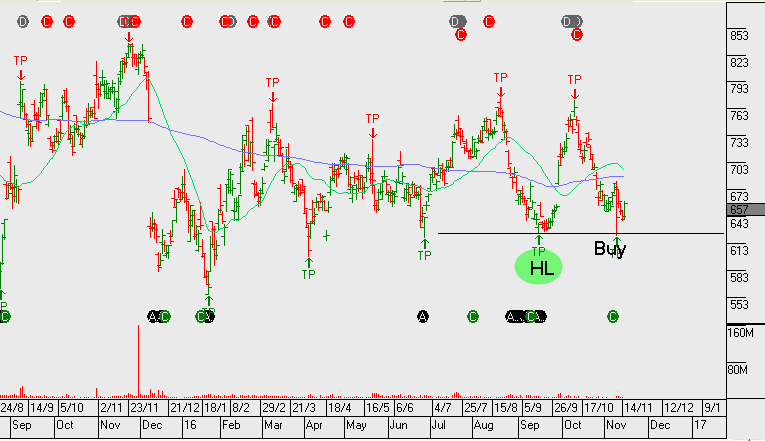

ETF Watch – OOO.AXW BetaShares Oil ETF

Oil prices surged overnight as investors speculate that OPEC members will push toward securing a deal to cut output. West Texas Intermediate Crude oil rose 5.8%.

As an introduction to our ETF Watch commentary, we’re looking at the BetaShares Oil ETF listed on the ASX under the code OOO.AXW. The ETF provides investors with a “pure play” to take a view on oil prices. It aims to track the performance of an index (before fees and expenses), that provides exposure directly to crude oil futures.

In addition, as oil is priced in USD the fund hedges its USD exposure back to AUD, which reduces currency risk for Australian investors.

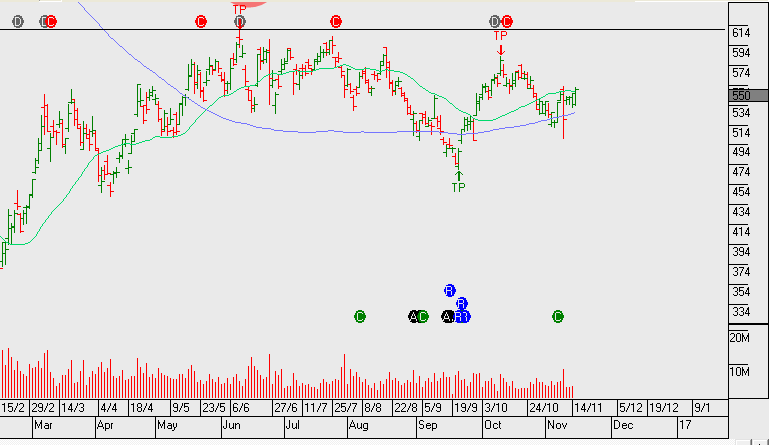

At a company specific level, we continue to like OSH, ORG and note the recent positive momentum in STO following China’s Hony Capital increasing its share holding.