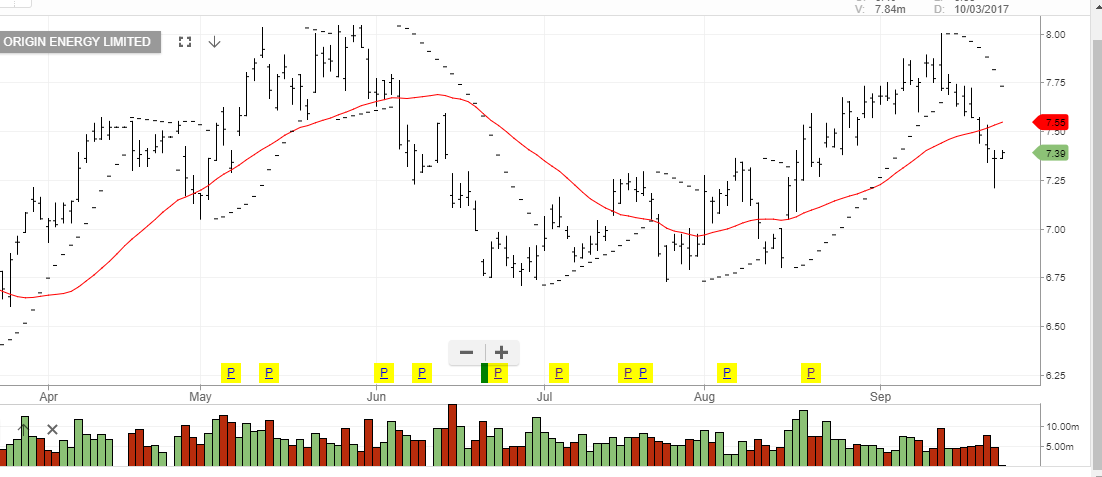

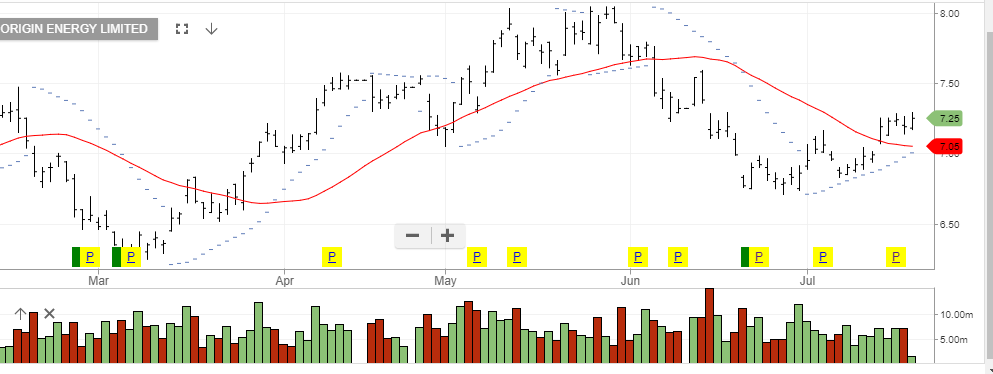

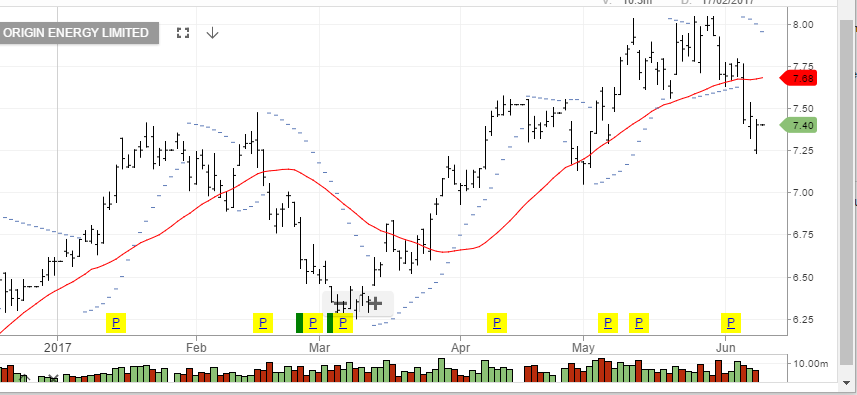

Origin – Reaffirmed FY18 Guidance

ORG indicated it’s targeting a Crude Oil price of US$40 per barrel distribution break-even for FY20.

ORG hosted its 2017 investor day, this week, at which time they reaffirmed their FY18 guidance with respect to capital expenditure, debt management and APLNG.

The market is encouraged by the potential for up-to $500m in cost savings, ($110m OPEX and $400m CAPEX), over the next 2 – 3 years.

ORG will likely reinstate dividend distributions, building to $0.40 per share in FY19 and $0.50 in FY20.

These targets have ORG trading on a FY19 forward yield of 5%.

We continue to see ORG as a buy on the dip opportunity and look to keep exposure to the name in portfolios over the next 3 to 5 years.

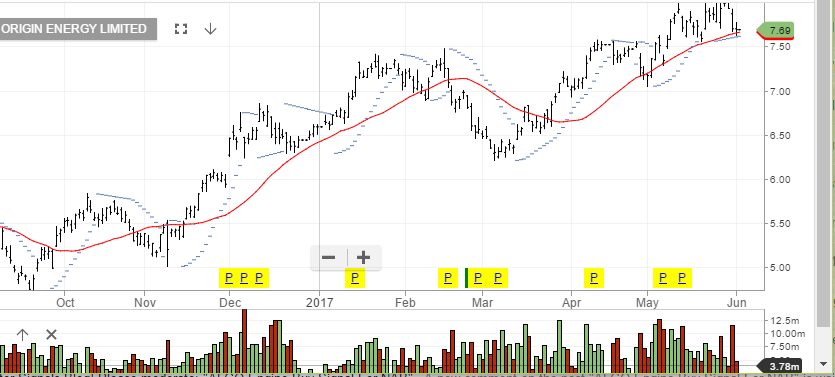

Origin Energy