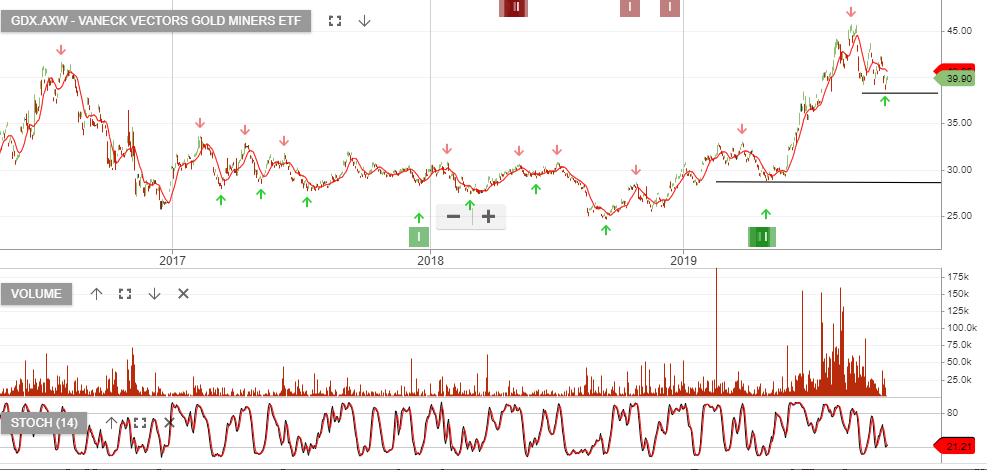

GDX – Gold ETF

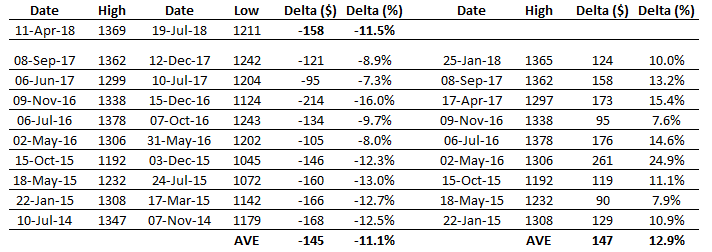

The below post is a copy of a publication on the 18th of October. Since making the post, gold stocks have performed well and we now look to trim the gains and rotate into oversold industrial & REIT names.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions following the entry condition earlier this year at $30. It is a current holding in our ALL ASX ETF model portfolio.

GDX ETF has corrected from $45 to $38 over the past 8 weeks. We feel buying support will now begin to increase.

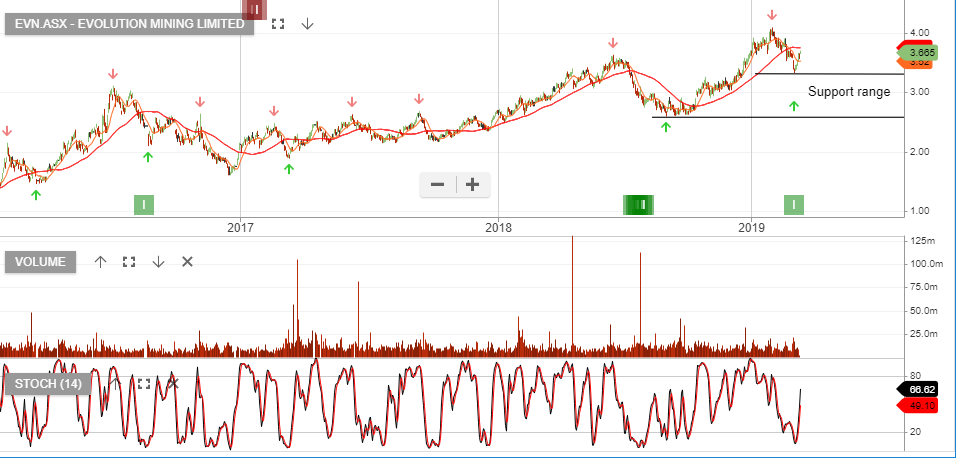

Individual names are also now appearing on the radar, such as Newcrest Mining Northern Star Resources, Evolution Mining, OceanaGold and Gold Road Resources.

–

–

Northern Star

Northern Star Evolution Mining

Evolution Mining

Northern Star

Northern Star