NIB Holdings

NIB Holdings is in the ASX200 Trade Table.

NIB Holdings is in the ASX200 Trade Table.

NIB Holdings has downgraded FY20 earnings by $30m, owing to claims inflation across the business.

Based on the updated FY20 earnings outlook we now have NHF trading on a forward yield of 3%.

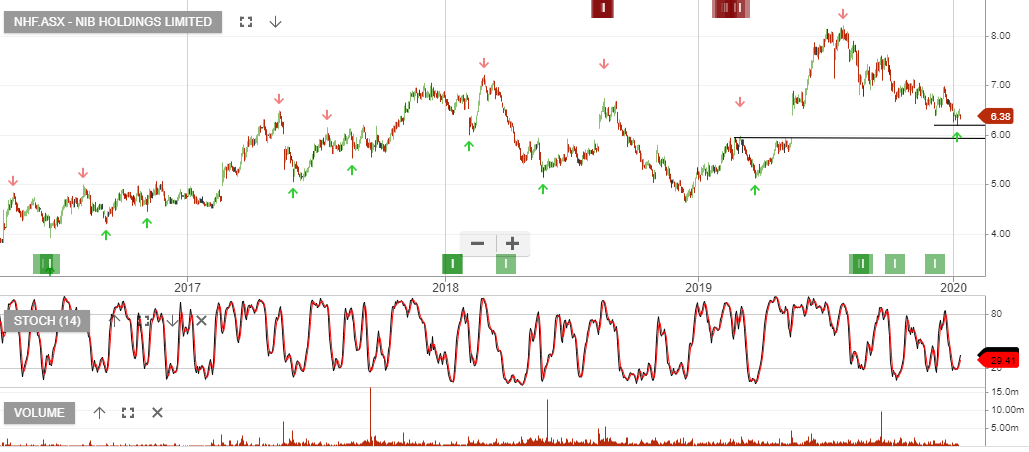

NIB Holdings is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

With the stock now trading at $6.35, we see value emerging heading into the February earnings result. The company has guided towards 6% EPS growth and now trades on a 4% dividend yield.

Note: We’re mindful of the price gap back to $6.00, but we’re assuming this may not get filled at this stage.

NIB Holdings is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

The share price is supported by a 4%+ dividend yield and mid-single-digit earnings growth.

Buy $6.50

Our call for NIB Holdings to find support and trade higher into the February earnings result is now gaining traction.

The price action found support at $6.60 and we expect to soon see a test of the $7.00 – $7.50 range.

Or start a free thirty day trial for our full service, which includes our ASX Research.