Newcrest vs Evolution & Northstar

Newcrest Mining will pay US$807m to Canadian listed Imperial Metals for the proposed acquisition of 70% of the Red Chris mine.

The opportunity provides for operational improvements and possible long-term exploration upside.

We continue to view Newcrest as expensive and prefer Evolution Mining, OceanaGold and Northern Star Resources as our gold exposure.

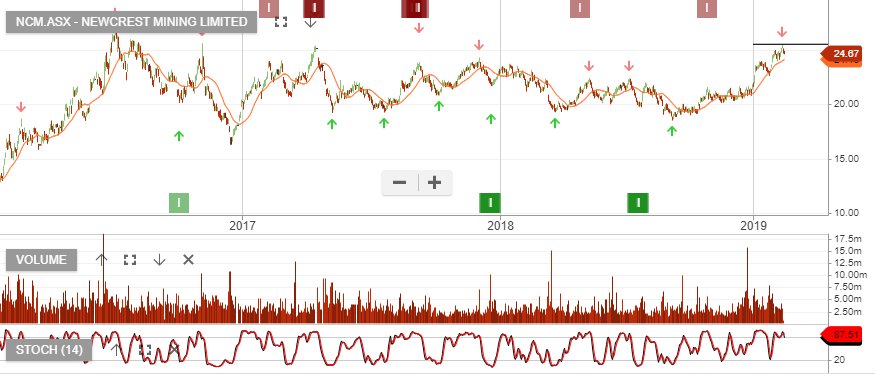

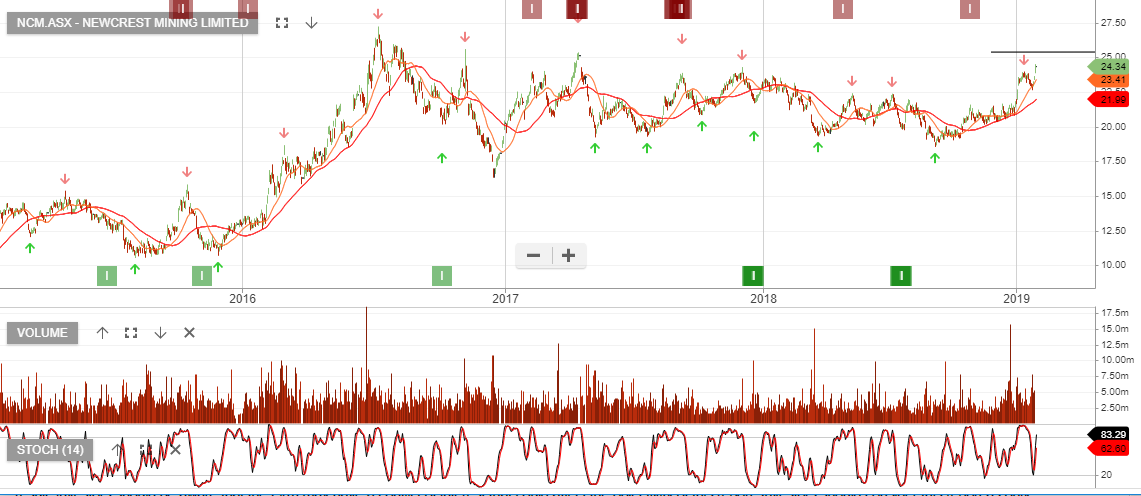

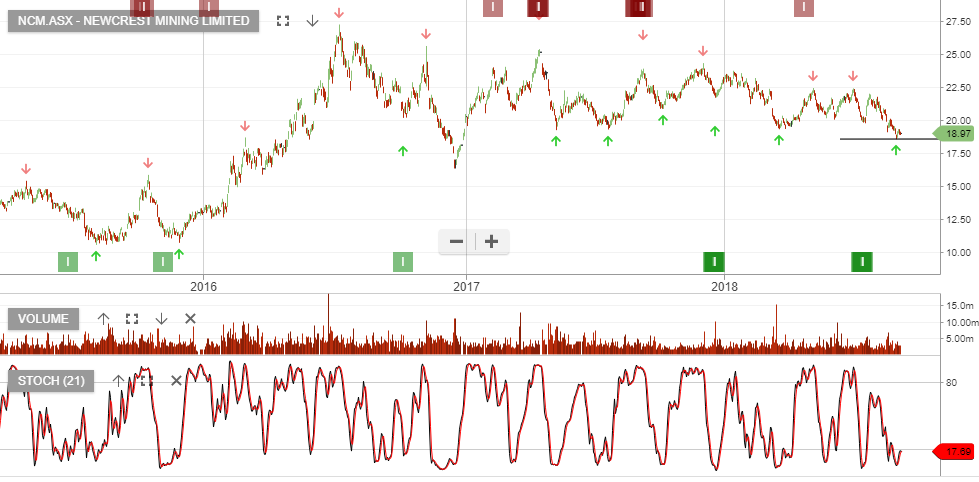

Newcrest Mining

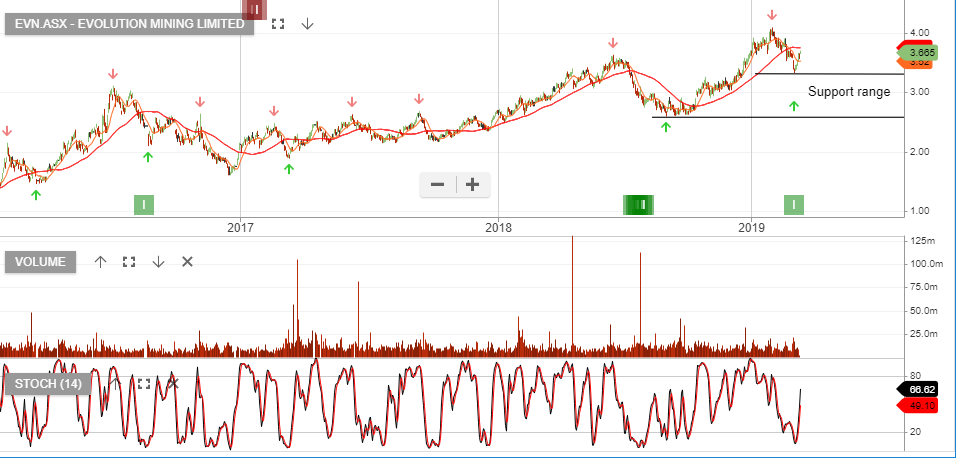

Newcrest Mining Evolution Mining

Evolution Mining