Newcrest

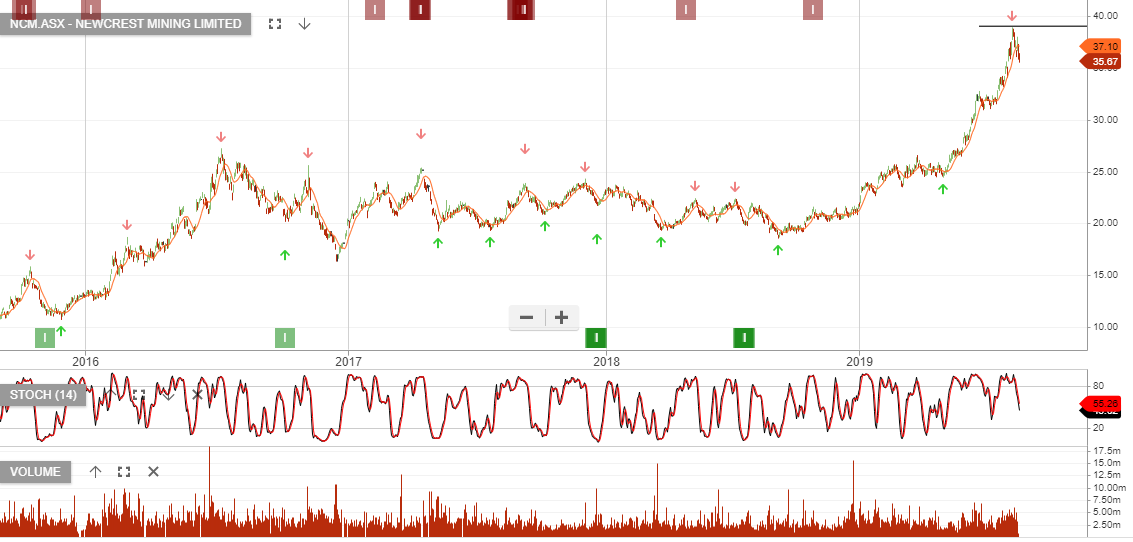

Newcrest Mining remains under Algo Engine buy conditions and we recommend investors accumulate between $32 – $34.

Newcrest Mining remains under Algo Engine buy conditions and we recommend investors accumulate between $32 – $34.

Newcrest Mining is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Newcrest remains our preferred large cap exposure to the strong gold price.

Newcrest Mining has moved to bolster their balance after raising $1.1bn which will be used for growth.

Newcrest’s balance sheet is in good shape with over $1.5bn in cash and about the same in undrawn facilities. Gearing remains low at 15%.

NCM has now rallied to $30+ and we will consider taking profit within the $31 – $32 price range.

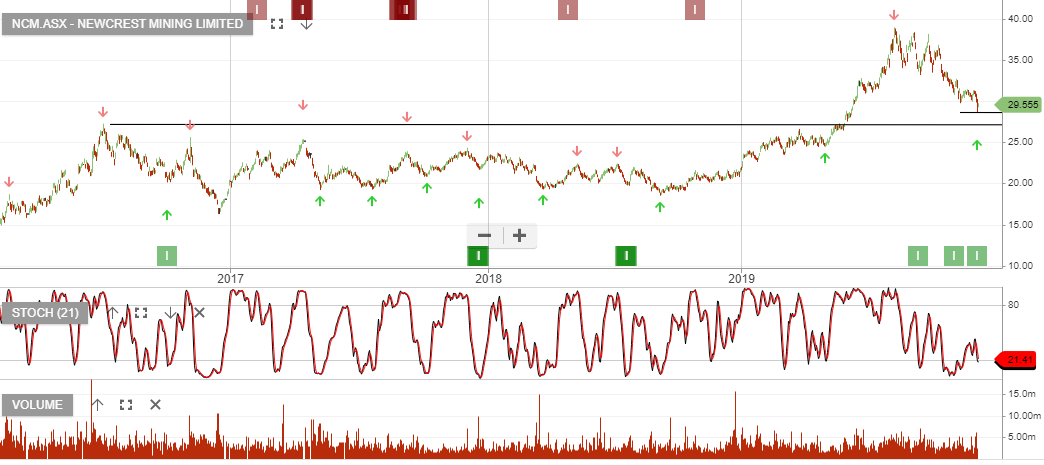

After flagging NCM as a buy last month at $22 we again take another look at the stock as it pulls back from the $29.73 high.

Accumulate NCM at market.

Newcrest Mining is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see value emerging in NCM and suggest investors continue to accumulate at the current price level.

Newcrest Mining is under Algo Engine buy conditions and is a current holding in ASX 100 model portfolio.

We see upside potential to $32.00.

The below post is a copy of a publication on the 18th of October. Since making the post, gold stocks have performed well and we now look to trim the gains and rotate into oversold industrial & REIT names.

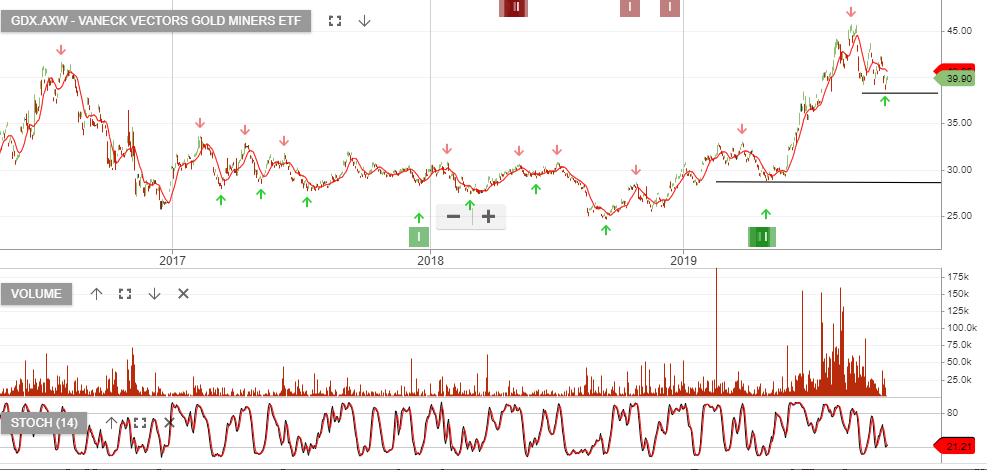

Vaneck Vectors Gold Miners is under Algo Engine buy conditions following the entry condition earlier this year at $30. It is a current holding in our ALL ASX ETF model portfolio.

GDX ETF has corrected from $45 to $38 over the past 8 weeks. We feel buying support will now begin to increase.

Individual names are also now appearing on the radar, such as Newcrest Mining Northern Star Resources, Evolution Mining, OceanaGold and Gold Road Resources.

Newcrest Mining is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see buying support building at the current price level of around $29.50

As the gold price finds buying support our basket of preferred names, Northern Star Resources, Evolution Mining, Newcrest Mining and Vaneck Vectors Gold Miners are among the best percentage performers today.

We continue to like Northern Star Resources as our main gold play.

Newcrest Mining is under Algo Engine sell conditions. Our preferred gold names have been EVN and NST, which remain in our ASX 100 model portfolio.

Whilst there’s upside risk to NCM, if the gold price continues

higher, we remain cautious following the latest earnings update.

FY19 EBITDA of US$1,670m was close to market consensus and FY20 production guidance is similar to FY19, with 2.35-2.5 million ounces.

Our base case is FY20 earnings are unlikely to top FY19 and with the stock trading on an FY20 forward dividend yield of 1.6%, we see better opportunities elsewhere.

We’ll continue to monitor NCM and will review further following the next Algo Engine buy signal.

Or start a free thirty day trial for our full service, which includes our ASX Research.