Gold Continues To Climb

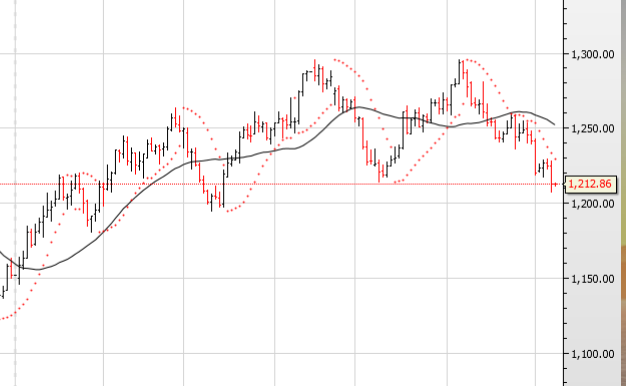

Gold posted a low of $1204.50 on July 10th. Since then, the yellow metal has rallied over 5% and hit an intra-day high of $1270.70 in last night’s New York trade.

This marks the 3rd straight week of higher prices and internal momentum indicators are now pointing to the June high of $1295.75.

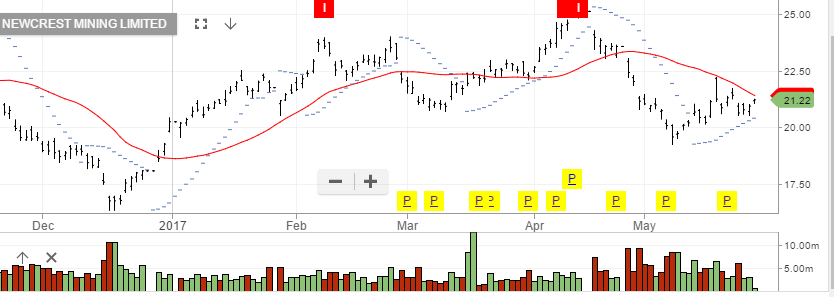

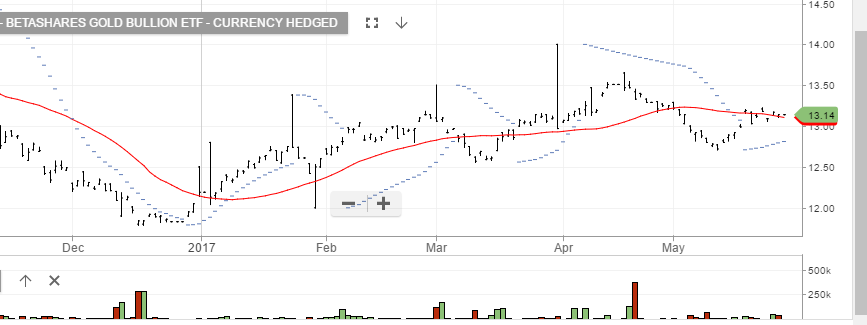

However, share prices of local gold miners NCM and EVN have not reflected this stronger trade in the spot Gold price.

Both NCM and EVN announced positive quarterly production numbers last week, and we expect both names will break out their recent ranges on the topside.

Over the medium-term, we have price targets of $22.10 for NCM and $2.60 for EVN. Gold

Gold

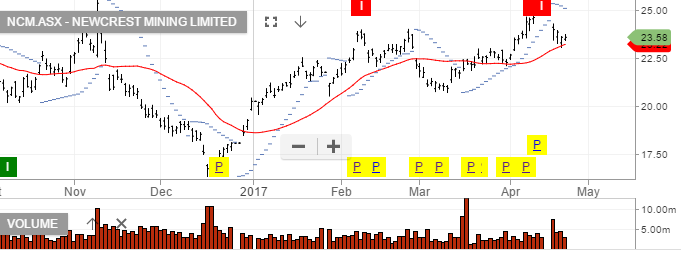

Newcrest.

Newcrest.

Evolution Mining

Evolution Mining

Newcrest Mining

Newcrest Mining

Newcrest

Newcrest