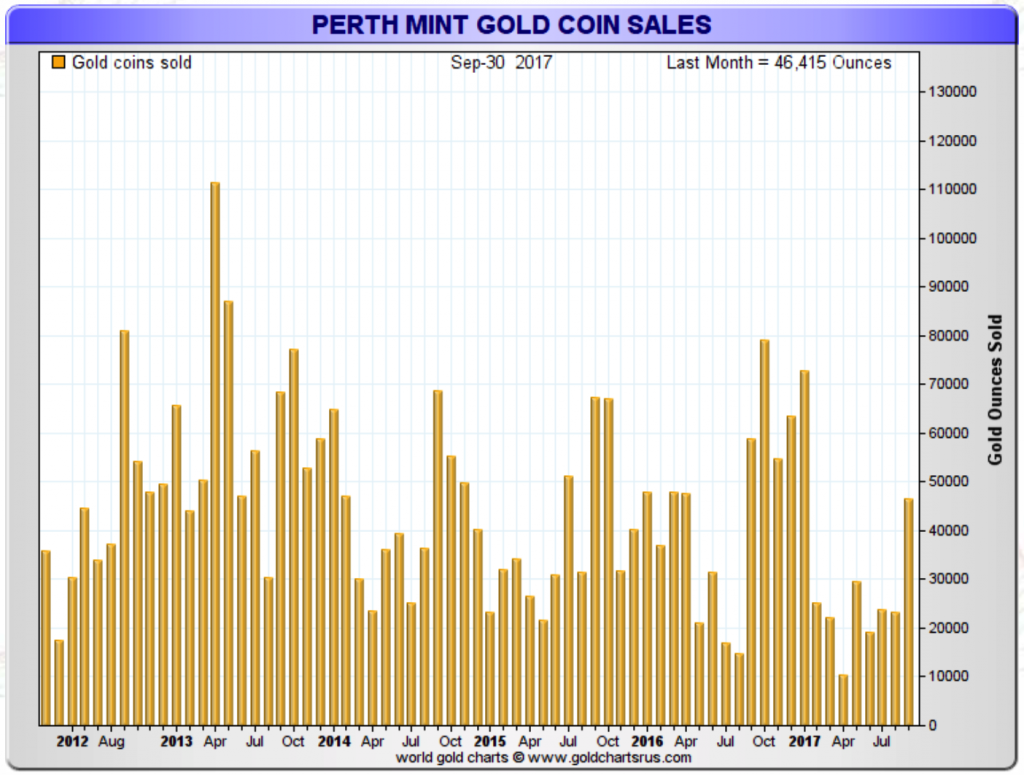

Perth Mint Gold Sales Double In September

The Perth Mint reported sales of 46,415 ounces of Gold during the month of September. This is more than double the 23,130 ounces sold in August.

The Perth mint refines over 90% of newly-mined Gold in Australia and ships to investors world-wide.

As illustrated in the chart below, this trend in higher demand could indicate higher Spot Gold prices in coming months.

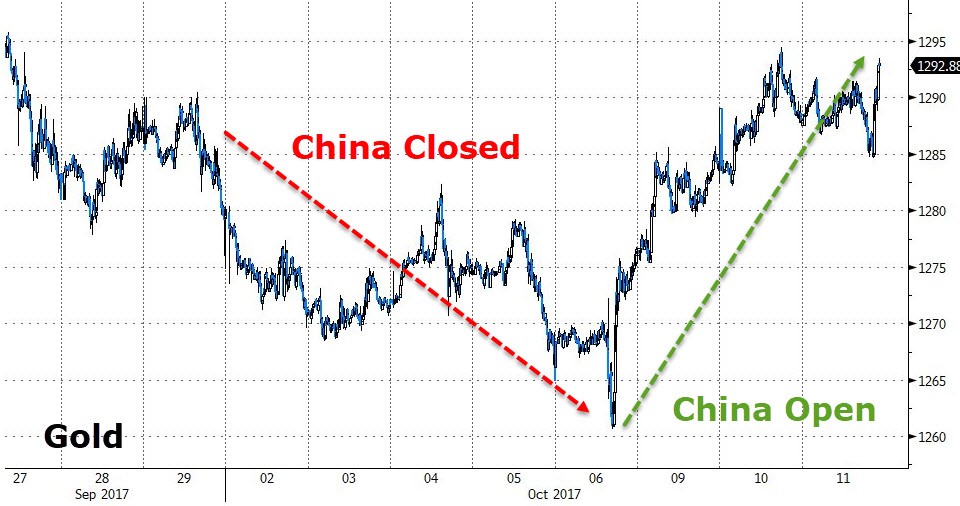

As mentioned in a previous blog post, Gold has rallied after the Chinese Golden week for the last four years.

This year, the yellow metal has traded $25.00 higher since the Chinese market has been back online and is now over $1300.00 per ounce.

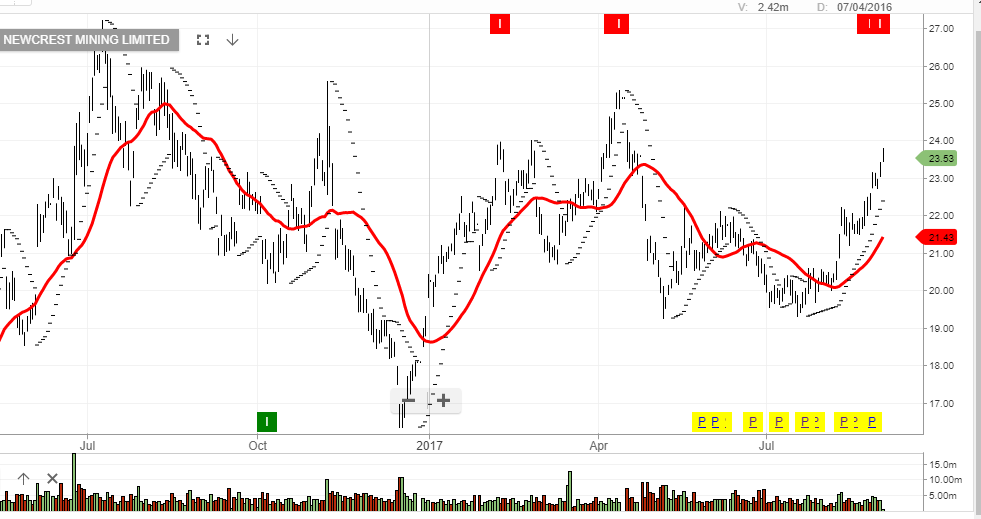

At this point the local Gold mining names haven’t rallied in the same percentage terms as spot Gold. However, we consider this price lag to be temporary and to see higher share prices in the near-term.

Perth Mint Gold Coin Sales

Perth Mint Gold Coin Sales

Newcrest Mining

Newcrest Mining

Newcrest

Newcrest Evolution Mining

Evolution Mining Spot Gold

Spot Gold Newcrest Mining

Newcrest Mining Evolution Mining

Evolution Mining Spot Gold

Spot Gold Newcrest Mining

Newcrest Mining Evolution Mining

Evolution Mining