NAB 2H16 Earnings Result

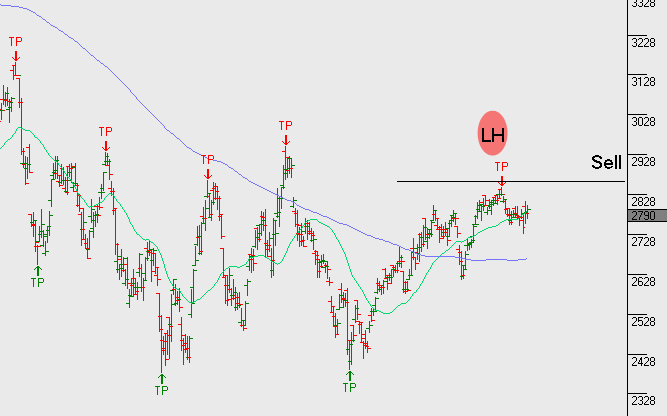

Shares of the National Australia Bank (NAB) are pushing back toward the $28.00 level after announcing that its final dividend will be unchanged at 99 cents per share as full-year cash earnings rose 4.2% to $6.48 billion.

Forward guidance suggests a drop in FY17 dividend to 85 cents as bad and doubtful debt charges rose 7.0% to $800 million, expenses rose 2.2% and net interest fell to 1.88%. Based on these figures, the FY17 growth forecast of -1% is the lowest in the sector, which is likely to limit further out performance to peer banks in the near-term.

The forward guidance equates to NAB trading on a P/E multiple of 12x , which is a 6% discount to peers, and a forward yield of 6.2%