NAB – Algo Buy Signal

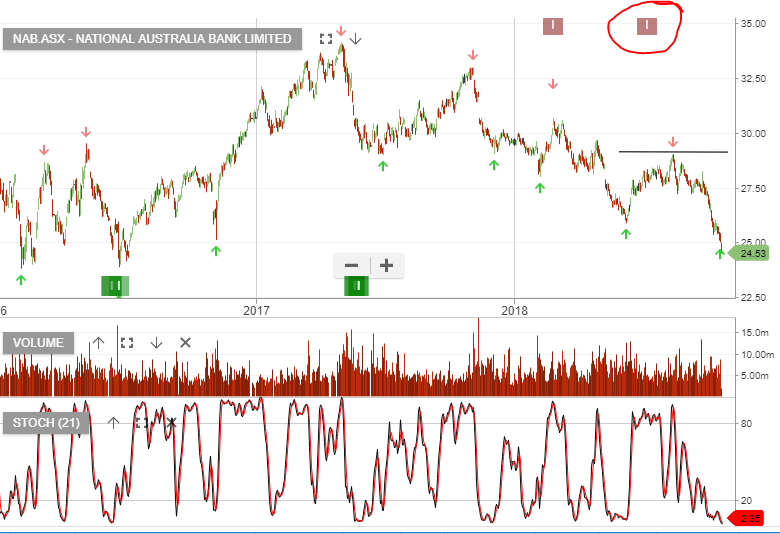

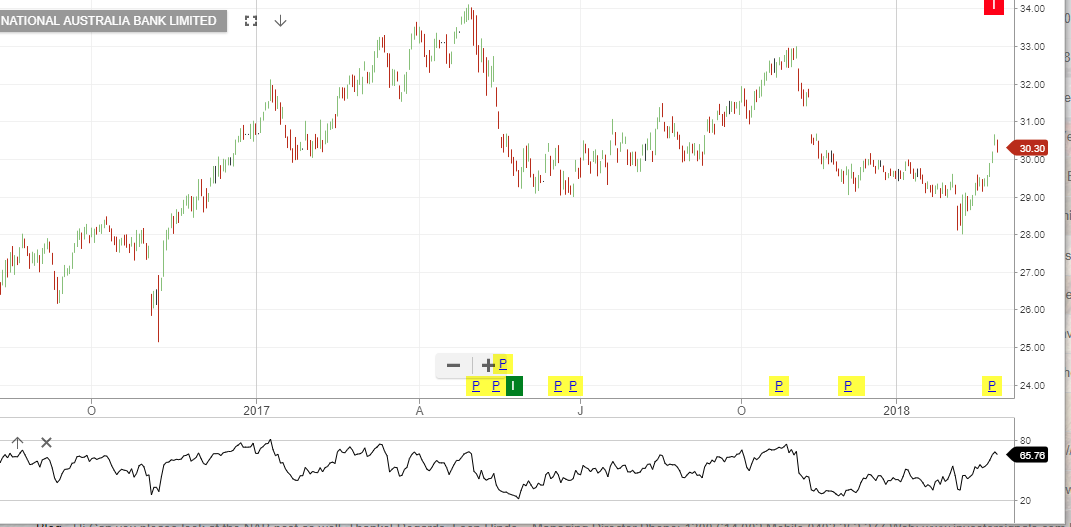

National Australia Bank is under Algo Engine buy conditions and was added to the ASX 100 model portfolio on Friday.

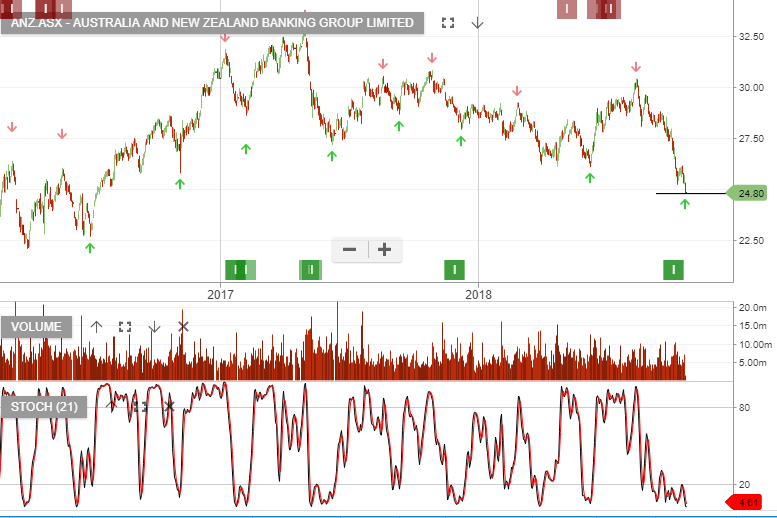

We now have ANZ, NAB and MQG under buy conditions.

National Australia Bank is under Algo Engine buy conditions and was added to the ASX 100 model portfolio on Friday.

We now have ANZ, NAB and MQG under buy conditions.

National Australia Bank is under Algo Engine sell conditions following the lower high formation at $25.50 in early March.

ANZ & MQG are the only banks under buy conditions.

The chart below shows the price action of the Betashares Global Banks ETF.

JP Morgan reports earnings Friday in the US.

ANZ is expected to report its FY18 result on 31 October.

The share price has now broken the June low support area and looks vulnerable to more downside pressure.

NAB is scheduled to report its FY18 result on the 1st of November. The next downside target is near the $24.00 area.

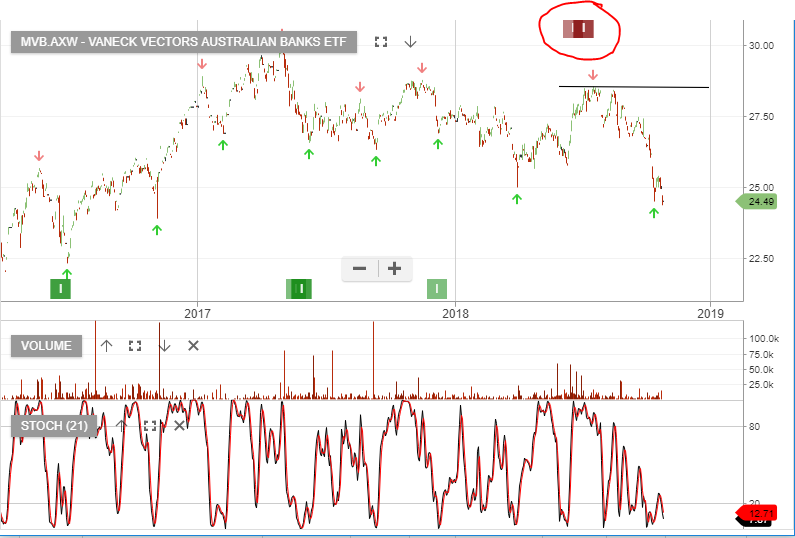

Vaneck Vestors Australian Bank ETF has been under ALGO Engine sell conditions since early July. The sell-off so far represents a 20% correction.

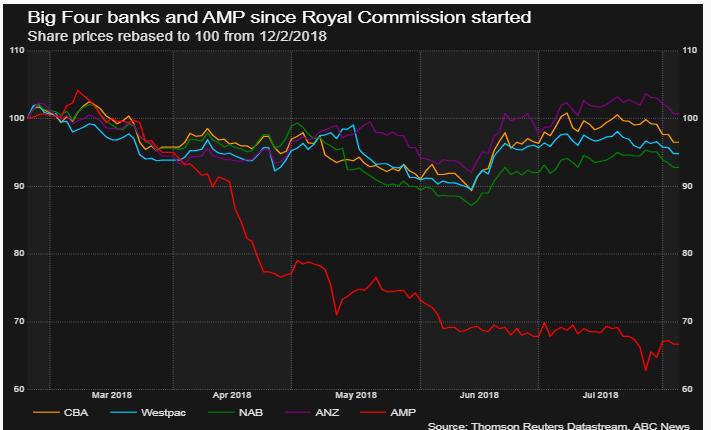

The Big four banks will be in the spotlight this week as the Banking Royal Commission commences round five today in Sydney.

The main topic for this round of examination will be the fees, charges and weak performance of bank-managed superannuation funds.

One Melbourne-based think tank has estimated that excessive fees and poor performance can cost superannuation investors up to $12 billion per year.

Australia’s largest superannuation provider, AMP, felt the wrath of the Royal commission during the last round of testimony, which saw their share price drop over 30% and the sacking of its chairman, CEO and three other directors.

The chart below illustrates the performance of AMP’s share price relative to the other Big 4 banks.

We don’t have ALGO buy signals for any of the domestic banks and we’re not holding any banking names in our ASX Top 100 portfolio. However, we will look for signals as the share prices approach the June lows.

The NAB result was subdued with revenue growth deteriorating. 1H18 NPAT $2.75bn down 17%, EPS 99cps and Div 99cps.

“looks like a dividend cut is imminent”

1H18 revenue rose just 0.7%, whilst Net Interest Income fell and loan growth was anemic at +1%.

In both the ANZ and NAB results, we’ve seen early signs of bad and doubtful debts, (for 90 days+), beginning to rise from very low historical levels.

Lower loan growth, no revenue growth, increased costs associated with restructuring, competition from technology disruptions, increasing bad debts, wafer-thin bad loan provisioning are reasons to “sell the rally” in the banking shares.

6100 – 6200 on the XJO Index should be a level to review bank holdings.

NAB

Shares of NAB are down over 1.5% in early trade as the bank reported a 16% drop in half-year cash profit as it booked a restructuring-linked costs related to workforce reduction.

The bank posted cash earnings, that excludes one-offs and non-cash accounting items, of $2.76 billion for the six months ended March 31, compared with $3.29 billion last year.

NAB bank maintained its interim dividend at 99 cents per share, which puts it on 13.2 times earnings.

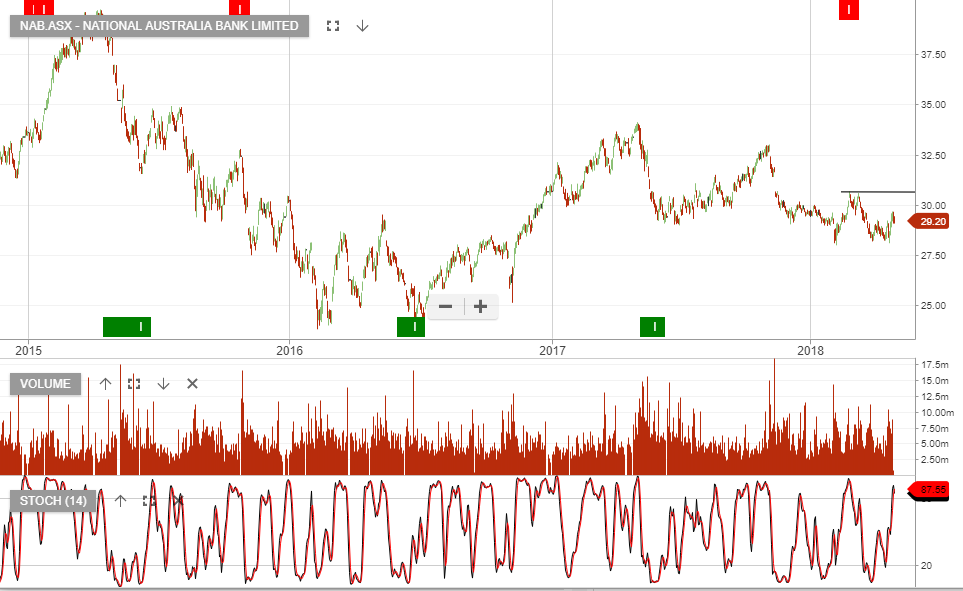

Our ALGO engine triggered a sell signal for NAB on February 27th at $30.40.

The technical picture is fairly neutral, and with NAB going ex-dividend on May 16th, we see initial support in the $28.50 area.

NAB

Local banking stocks have found a slight bid in early trade today. However, we expect more downside price pressure as the Bank Royal Commission proceeds.

So far, we’ve seen evidence of appalling behaviour by Australia’s major banks and financial planners from the past decade, including bribes, forged documents and repeated conflict of interest in insurance products.

It seems that the banks discovered long ago it was highly profitable to sell their customers financial advice and financial products.

If they could charge customers for financial advice, and if that “advice” consisted of purchasing their financial products, then they would enjoy a profitable feedback loop.

This model was called ‘vertical integration”, which is inherently a conflict of interest.

With earning season approaching, we believe there will be some buying interest from longer-term investors.

We will keep a close watch on banking shares and advise which names have met our ALGO price criteria to hold in investor portfolios.

CBA

Westpac

NAB

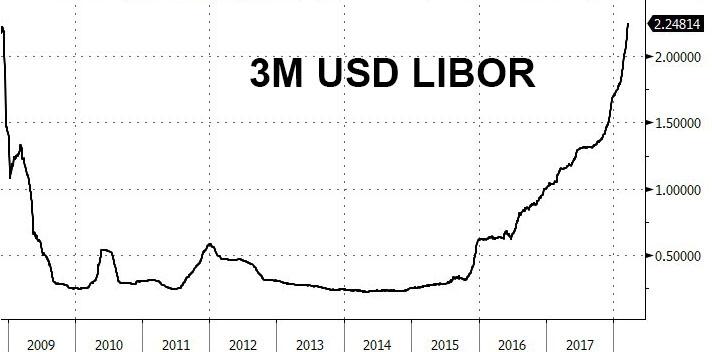

Local banking stocks will be facing higher funding costs as LIBOR rates have surged higher over the last few weeks.

Considering the negative combination of the Royal Commission and lower margins on Mortgage lending, we have been urging caution to investors looking to buy the recent dips in the Big 5 banking names.

As illustrated in the chart below, the cost of local bank funding has posted the sharpest monthly rise in over 8 years.

As such, we don’t believe the local bank shares have found sustainable price support levels yet.

Phone in for more details on trading the local banking stocks on a cash basis and on the SAXO Go CFD platform

LIBOR

NAB was removed from our ASX 50 model portfolio following the Algo Engine sell signal on 27th February at $30.64.

The chart below perfectly illustrates the negative price action following the recent sell signal.

Our ALGO engine triggered a sell signal for NAB into yesterday’s ASX close at $30.40.

This “lower high” pattern is relative to the November 8th high of $31.85.

NAB posted an 18-month low of $28.05 on February 8th. The banking sector, in general, has had a respectable recovery over the last three weeks.

However, the internal momentum indicators now suggest that the local banking names will trade lower over the near-term, taking out the February lows.

NAB

Or start a free thirty day trial for our full service, which includes our ASX Research.