Bank Shares Roiled On Royal Commission Announcement

Shares of the “big-4” banks are trading sharply lower as the Government announced a $75 million Banking Royal Commission before the ASX open today.

When making the announcement, PM Turnbull said it was a regrettable but necessary action.

The terms of the inquiry are wider than the market expected and will include the entire financial services sector. The final report will be due in February 2019.

We have been giving the banks a wide berth recently due to likely headwinds from slower loan growth and falling profit guidance. We’ll continue to watch the ALGO engine for trade updates and future levels to enter the market.

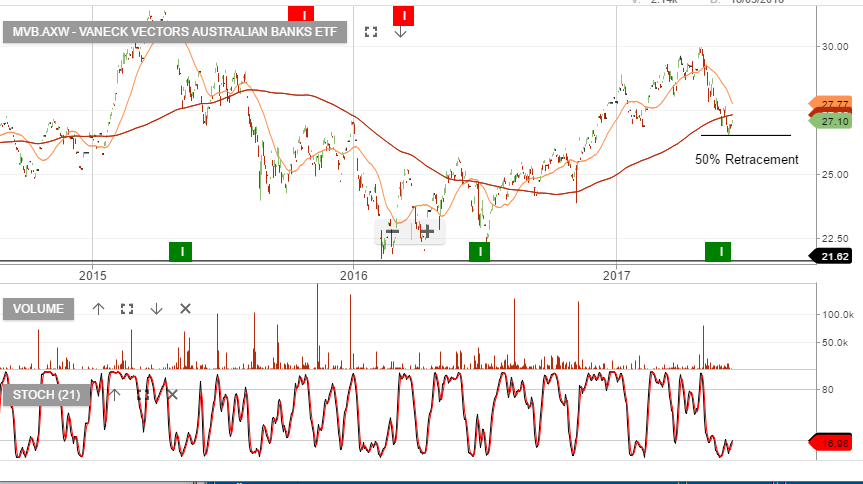

MVB Aussie Banking ETF