ALS Limited is up 15.4% in 35 days…

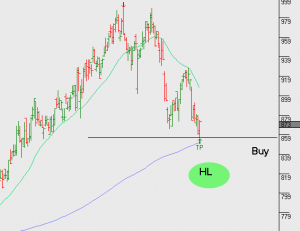

ALS has been an open trade for 35 days and is up 15.4%. We’re likely only days away from seeing the sell conditions met on this one.

For more detail and up-to-date instructions, see the ASX 200 Trade Table.

ALS has been an open trade for 35 days and is up 15.4%. We’re likely only days away from seeing the sell conditions met on this one.

For more detail and up-to-date instructions, see the ASX 200 Trade Table.

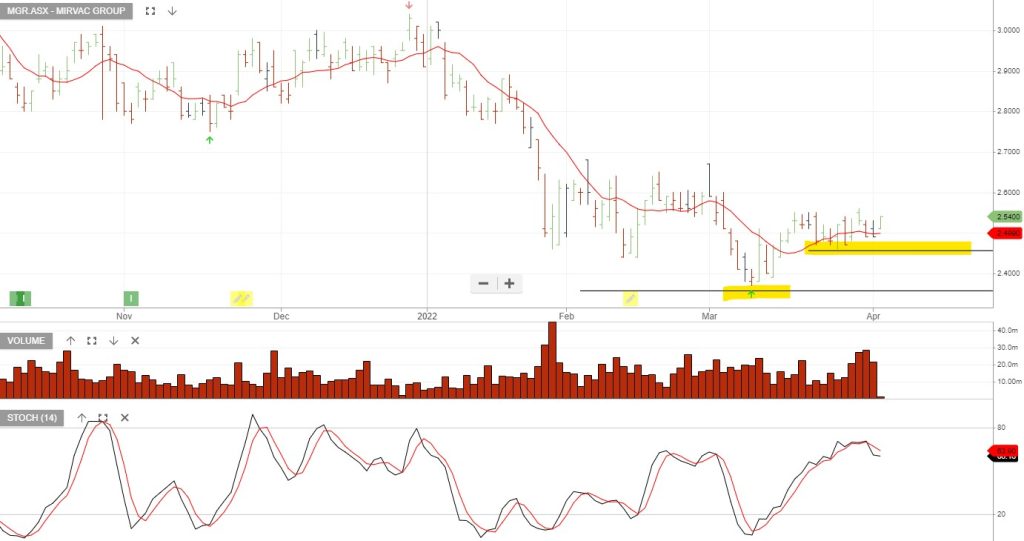

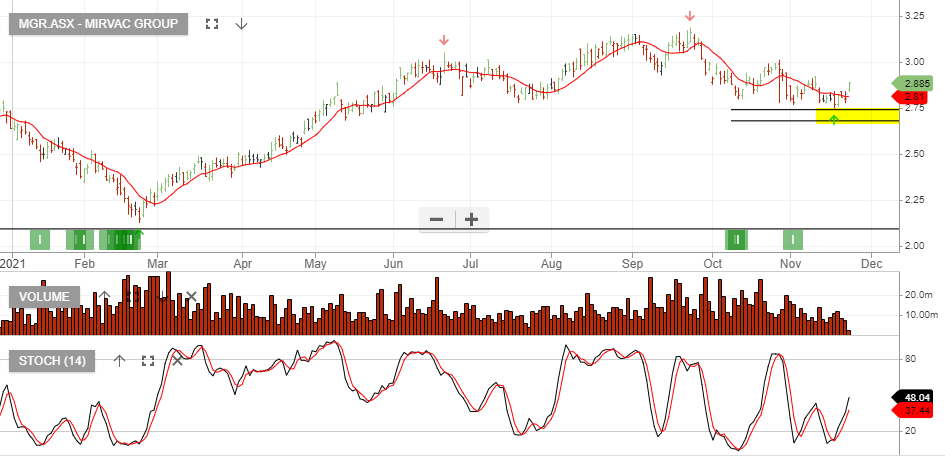

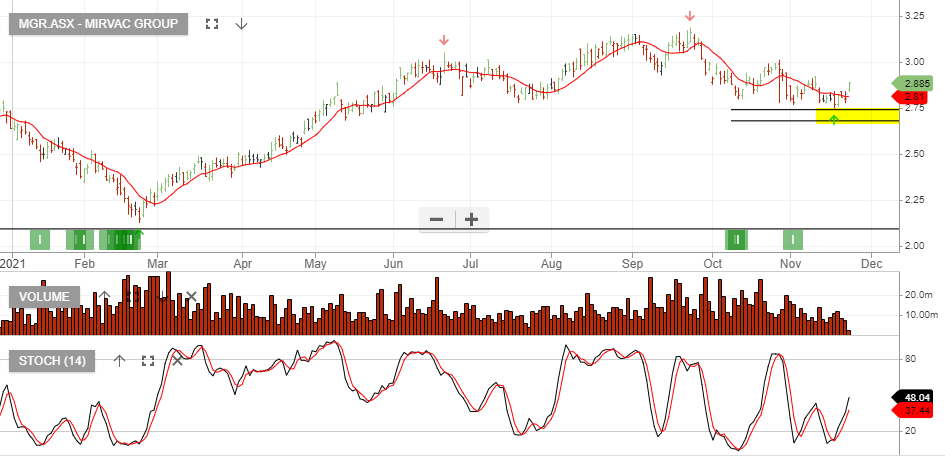

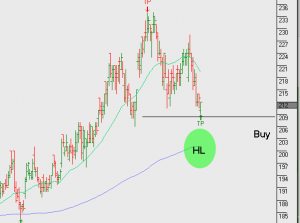

Mirvac has been an open trade for 28 days and is up 14.2%. Our Algo Engine will continue tracking the momentum and we may soon see a sell alert when the price action rolls over.

For more detail and up-to-date instructions, see the ASX 200 Trade Table.

Mirvac reported 1H22 operating EPS of $0.075. FY22 guidance was reaffirmed at $0.15, aided by higher commercial development profits.

We continue to view the apartment and commercial pipeline as a key driver of growth following a softer-than anticipated 1H22 update.

MGR is now trading on a forward yield of 4%.

Mirvac reported 1H22 operating EPS of $0.075. FY22 guidance was reaffirmed at $0.15, aided by higher commercial development profits.

We continue to view the apartment and commercial pipeline as a key driver of growth following a softer-than anticipated 1H22 update.

MGR is now trading on a forward yield of 4%.

Mirvac is under Algo Engine buy conditions.

Buy MGR at market.

Sell on stop at $2.75 (break below recent pivot low).

Hold the trade open, as long as the price action remains above the 10-day average.

Mirvac is under Algo Engine buy conditions.

Buy MGR at market.

Sell on stop at $2.75 (break below recent pivot low).

Hold the trade open, as long as the price action remains above the 10-day average.

A number of REITs announced their 3Q19 operational updates yesterday.

Dexus forecast 5% underlying earnings growth. reaffirmed its FY19 guidance for 5% growth.

Mirvac indicated their FY19 guidance will be in the 3 – 4% growth range with DPS growth at 5%.

Across the sector it is likely residential and retail remain the weak spots, whilst office and industrial will continue to provide strong growth. Softening of the retail sector was evident in GPT’s March quarter business update.

Despite GPT’s exposure to retail, the office exposure along with the groups strategy to expand the footprint in logistics, makes the stock one of our preferred opportunities within the REIT sector.

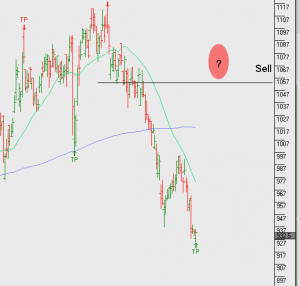

Our Algo Engine triggered a sell signal in Mirvac at the recent “lower high” formation.

We note the difficulties residential REITs are likely to face in a falling house price environment. Tighter credit conditions will impact Mirvac’s core customer, the investor.

Resistance within the $2.30 – $2.45 range.

The recent market rotation towards growth assets and in particular, materials and financials, has resulted in selling utilities and property trusts. In many cases, these names have seen 10 to 20% correction.

The following post takes a quick look at some of the relevant chart patterns.

SCG.ASX (forward yield 4.9%)

SGP.ASX (forward yield 5.5%)

WFD.ASX (forward yield 3.5%)

DXS.ASX (forward yield 5.2%)

GMG.ASX (forward yield 3.7%)

GPT.ASX (forward yield 5%)

MGR.ASX

On the utilities, we think that both Sydney Airports and Transurban should be back on the radar and maybe looking oversold.

SYD.ASX (forward yield 5%)

TCL.ASX (forward yield 4.8%)

Or start a free thirty day trial for our full service, which includes our ASX Research.