Keeping an Eye on Key Support

Watch LLC, SHL, ASX and AMC as stocks that are trading on support.

Watch LLC, SHL, ASX and AMC as stocks that are trading on support.

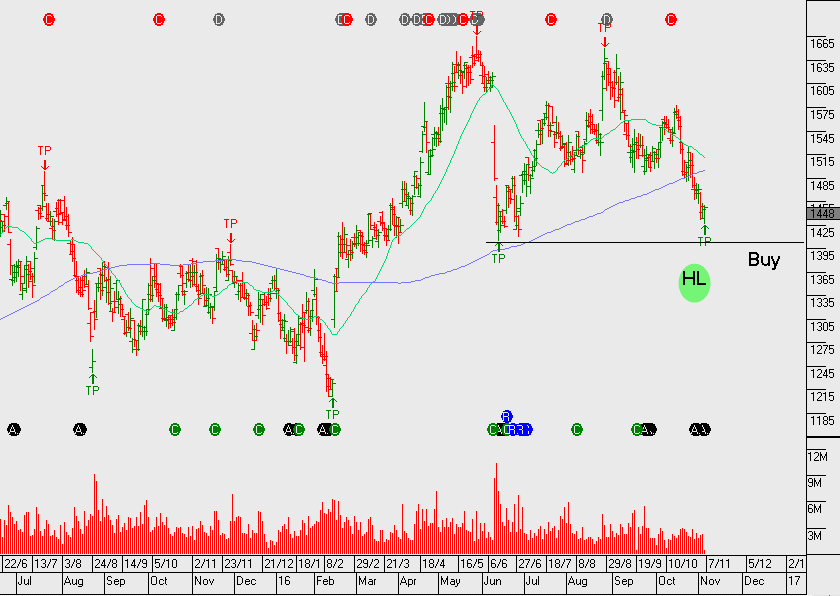

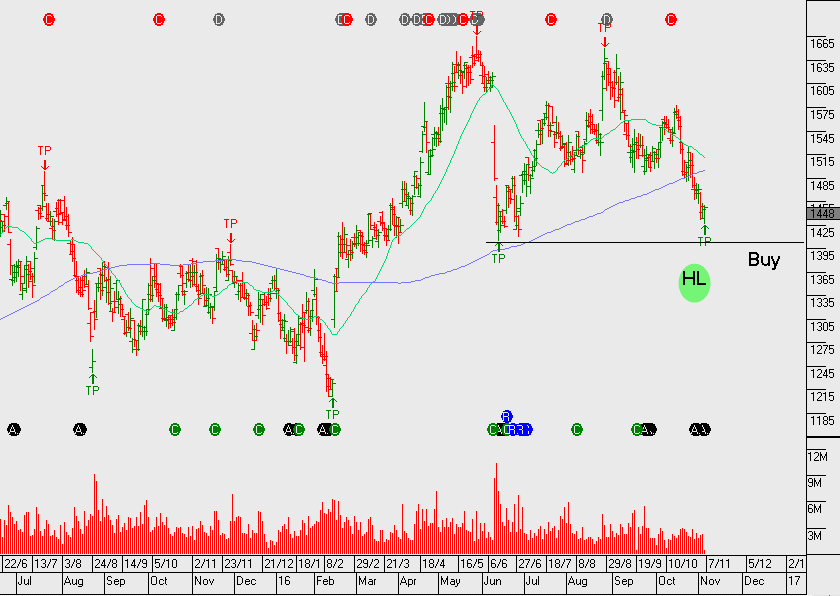

Most property stocks have broken their long term uptrends and are displaying the early signs of a “rollover” type pattern. We’ll most likely see a bounce from the current oversold level, driven from an outcome on the December Fed rate hike. However, the probability of a bearish lower high in the next 3 to 6 months will mean the counter trend trade from the current lows will be short and explosive but the real opportunity to watch will be the short side trade in 2017.

The above picture applies to most property trusts and property development companies. The exception appears to be SGP and LLC. Out of the two names, my preference remains Lend lease.

FY17 should deliver EBITDA of $1.2b, EPS of $1.30 and DPS of $0.68 placing the stock on a forward yield of 4.9%

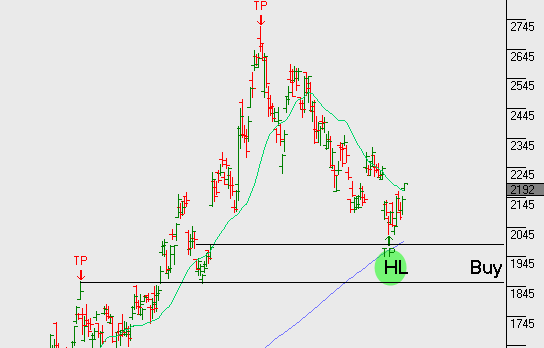

Sonic Healthcare (SHL.ASX)

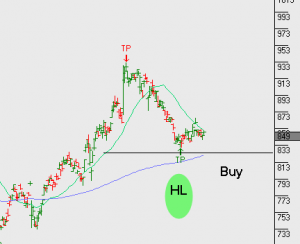

Amcor (AMC.ASX)

James Hardie (JHX.ASX)

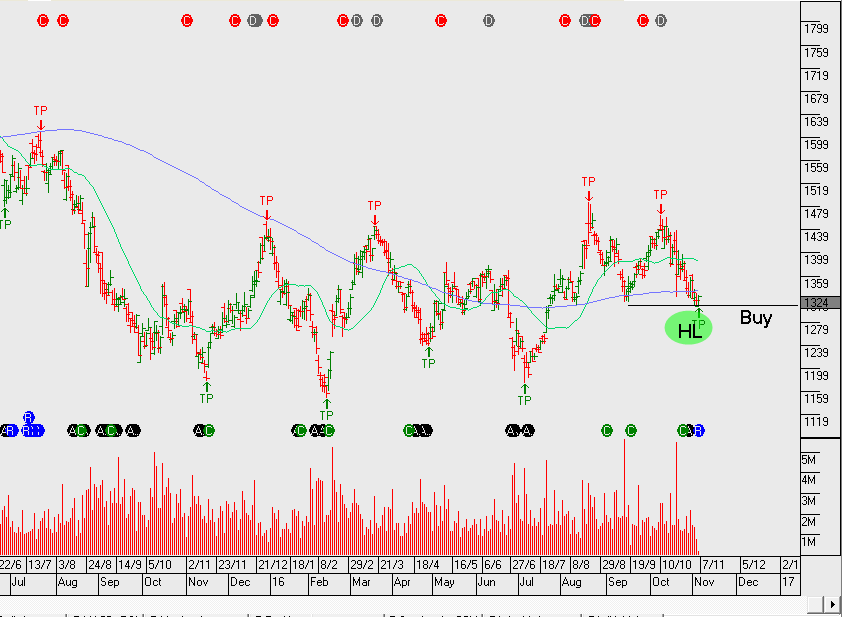

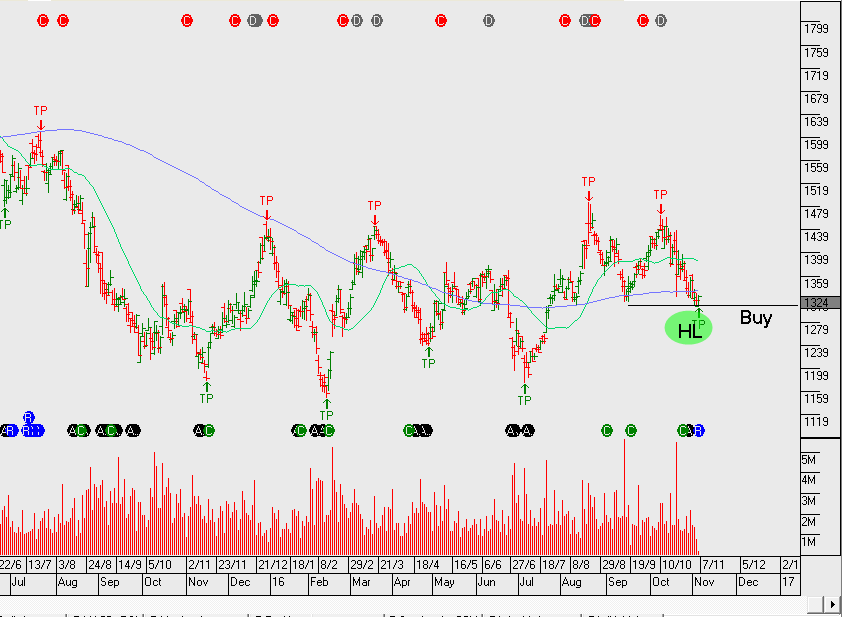

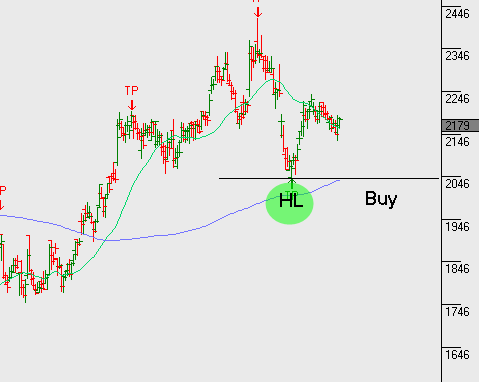

Lend Lease (LLC.ASX)

Newcrest (NCM.ASX)

Resmed (RMD.ASX)

For more analysis on our recent buy recommendations and market stratagey, please keep an eye out for tomorrow’s mid-week market update video report. It will be sent out tomorrow morning as a blog post.

LLC delivered FY16 NPAT earnings increase up 13% to $700m. The share price has underperformed in the early stages of 2016 reflecting fears of significant apartment defaults which could derail an otherwise strong cash flow profile. The announced FY16 earnings result puts some of these fears at ease and on 11x forward earnings and FY17 EPS growth of 6 – 8%, we see okay value on a relative basis.

FY17 revenue forecast of $15b, EBIT of 1.1b and DPS $0.66, placing the stock on a forward yield of almost 5%.

We own LLC and have left the stock uncovered coming into the earnings result. Our view, (as expressed in the monthly strategy recording), on LLC was the market had become too negative and we are now seeing the re-rating of the stock back to our initial target price of $14.50. With the stock now back at fair value, we’ll look to set the covered call position into the December period.

Or start a free thirty day trial for our full service, which includes our ASX Research.