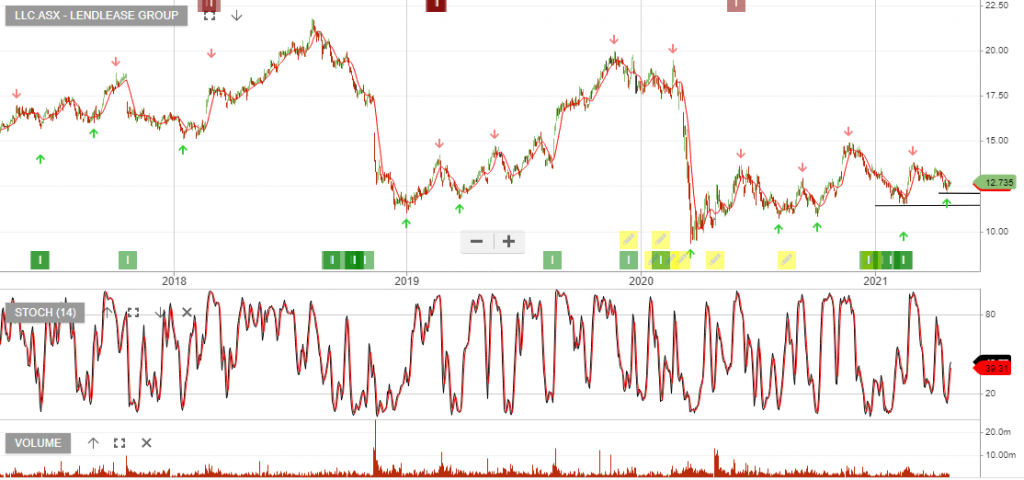

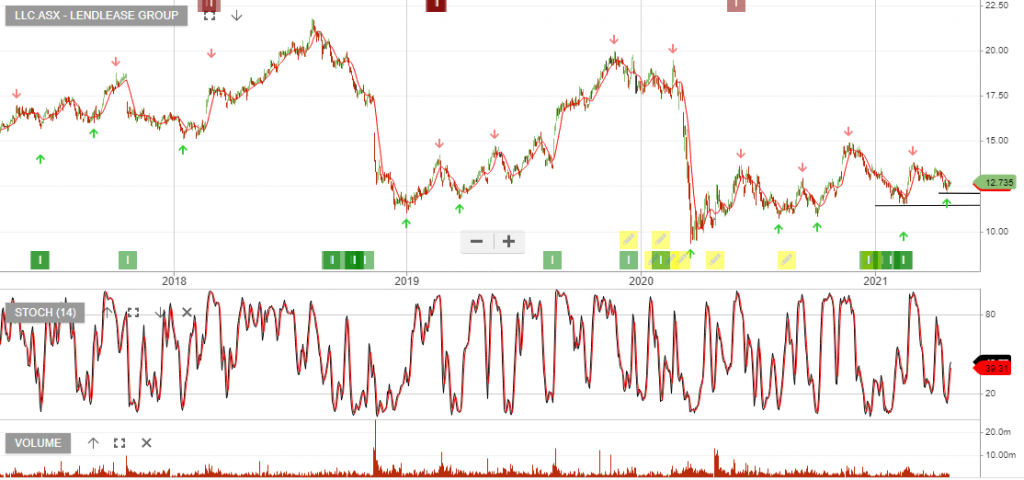

Lendlease: Buy + Stop Loss

Lendlease provides a great way to play a recovery in the oversold property names. Buying momentum is increasing but a stop loss is required at the $6.09 pivot low.

Lendlease provides a great way to play a recovery in the oversold property names. Buying momentum is increasing but a stop loss is required at the $6.09 pivot low.

Lendlease is now under Algo Engine buy conditions.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Lendlease is under Algo Engine buy conditions.

Last week’s profit warning could be the first stage of the

new CEO’s company reset. A review, covering the restructuring of operations and impact of market uncertainties will likely lead to further divestment of less-core businesses and re-prioritization of the existing 23 urbanization projects.

FY22 NPAT is forecast to increase, although still remind 20% below pre-pandemic levels. LLC will provide the FY21 results on 16 August.

Our preference is to own LLC via long call options. For further details please call 1300 614 002.

Lendlease has switched to Algo Engine buy conditions and has now been added to our ASX 100 model portfolio.

Watch for renewed buying interest above the recent $11.50 support level.

Option traders: We’re buying the $12 Dec call options.

Lendlease has switched to Algo Engine buy conditions and has now been added to our ASX 100 model portfolio.

Watch for renewed buying interest above the recent $11.50 support level.

Option traders: We’re buying the $12 Dec call options at $0.85.

Lendlease has switched to Algo Engine buy conditions and has now been added to our ASX 100 model portfolio.

Watch for renewed buying interest above the recent $12 support level.

Lendlease has switched to Algo Engine buy conditions and has now been added to our ASX 100 model portfolio.

Or start a free thirty day trial for our full service, which includes our ASX Research.