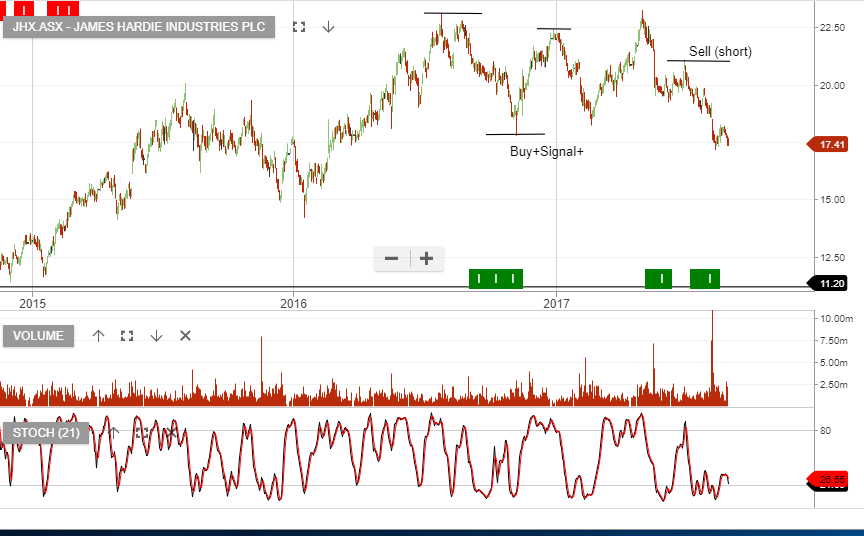

Algo Update – James Hardie

Our Algo Engine recently generated a buy signal in James Hardie Industries and the stock was added to the ASX50 model.

While the Australian housing cycle is turning, JHX continues to grow above market through a combination of plant efficiencies and new new products.

We remain “long” JHX whilst the share price holds above the $21.50 price level.

JHX goes ex-div $0.30 on the 12th of December. Adding a November $24 call option will enhance the income by a further $0.60 per share.

James Hardie

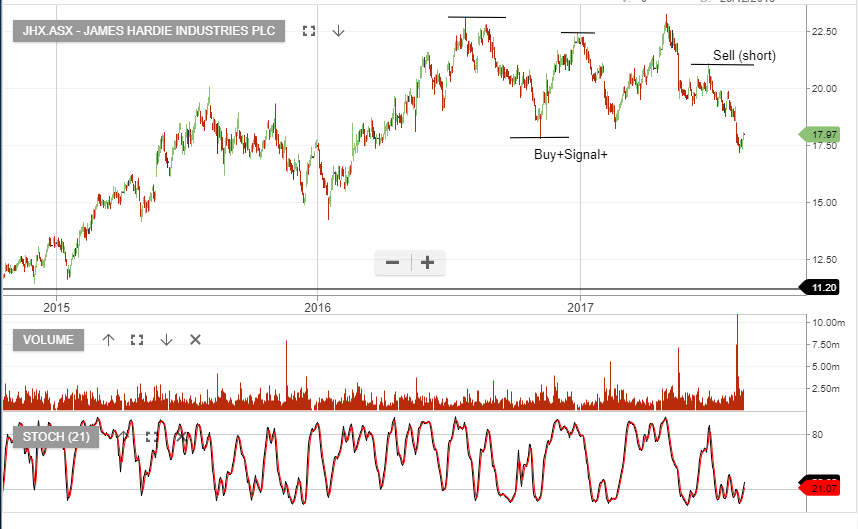

James Hardie

James Hardie

James Hardie

James Hardie