IAG – Bounces Off Support

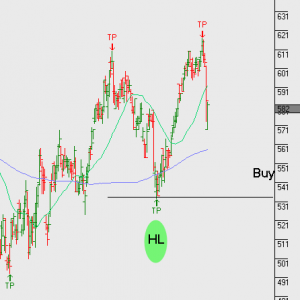

We highlighted in this month’s video report that IAG would likely find support at $5.50. The stock has since traded down and tested the $5.50 range and buyers have pushed the stock back to $5.80.

We see a place for IAG in portfolios based on FY17 earnings of $900m, EPS $0.36 and DPS of $0.32 which places the stock on a forward yield of 5.5%. We compliment this with a tight covered call option to increase the cash flow to 12% on an annualised basis.

$6.00 remains resistance and we don’t see the stock trading above this level in the short term.

Note: IAG has implemented an optimisation program that will reduce gross operating costs by an annual run rate of at least 10%, or $250m by the end of FY19.